Intently adopted crypto analyst Benjamin Cowen says {that a} shift in financial coverage will most certainly be what lastly triggers an “altseason,” or a interval the place altcoins vastly outperform Bitcoin (BTC).

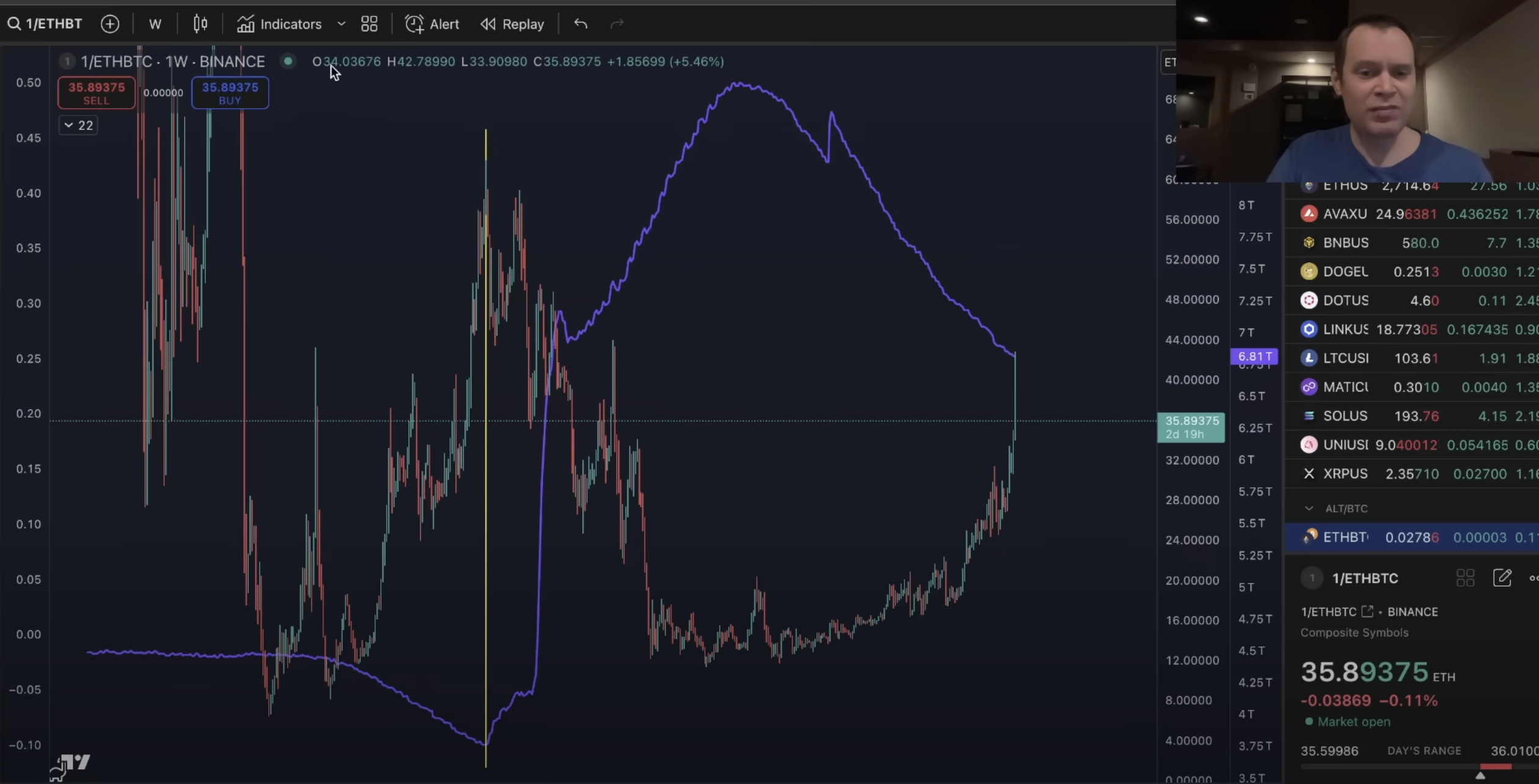

In a brand new technique session, Cowen overlays the Fed steadiness sheet with Ethereum (ETH) versus Bitcoin (ETH/BTC) and notes that in earlier market cycles, altseasons didn’t kick off till the Fed ended quantitative tightening (QT) and elevated the belongings on its steadiness sheet.

“What allowed for [the forecast] was simply the understanding of tighter financial coverage, and figuring out that final cycle we didn’t see ETH/BTC backside or the inverse of that prime, we didn’t see the BTC/ETH valuation prime till the Fed ended quantitative tightening…

And so, you may see that the Fed has been doing the identical actual factor this cycle and all through this course of identical to final cycle, ETH has misplaced worth to Bitcoin. Now the identical may very well be stated about a whole lot of altcoins…

And actually, in the event you take a look at a basket of alts, you may see that the truth is, they’ve put in new lows this week, and my argument has at all times been, that they may seemingly finally go to the vary low earlier than there’s actually an amazing hope of any altseason having the ability to happen. You would additionally take a look at OTHERS/BTC, and see that it has simply dropped since 2022 started.

There’s lots of people who name this the ‘memecoin supercycle’ they usually attempt to get you pumped up for alteason and saying that these memecoins are going to outperform, however on the finish of the day they simply maintain bleeding out to Bitcoin.”

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Examine Worth Motion

Comply with us on X, Fb and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl are usually not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual threat, and any losses chances are you’ll incur are your duty. The Each day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Each day Hodl an funding advisor. Please observe that The Each day Hodl participates in internet affiliate marketing.

Featured Picture: Shutterstock/Tithi Luadthong/Natalia Siiatovskaia