Este artículo también está disponible en español.

Cardano has confronted vital volatility and promoting stress because the broader crypto market struggles to ascertain robust help ranges. Since early December, Cardano has dropped over 61%, with its worth motion reflecting a persistent downtrend that has shaken investor confidence. Regardless of a number of makes an attempt, the worth has but to indicate clear indicators of reversing the bearish momentum that has dominated its efficiency over the previous months.

Associated Studying

At the moment, Cardano is buying and selling at a important stage, one which should maintain to spark a possible change in its market trajectory. The significance of this stage can’t be overstated, as shedding it might result in additional declines and heightened uncertainty for ADA buyers. Nevertheless, hope stays on the horizon for Cardano bulls.

High crypto analyst Ali Martinez has shared a promising technical sign, revealing that Cardano is starting to indicate indicators of a possible rebound on the every day chart. In keeping with Martinez, key indicators are aligning to recommend {that a} restoration could possibly be within the making, providing a glimmer of optimism for merchants and long-term holders alike. The approaching days can be essential for Cardano, because it stays at a crossroads that would decide whether or not the present development continues or a much-needed rebound lastly takes form.

Cardano Might Begin A Restoration

Cardano could possibly be on the verge of a restoration rally because it finds robust demand at present ranges, with bears unable to push the worth into decrease demand zones. After months of persistent promoting stress and bearish sentiment, Cardano seems to be stabilizing, creating a possibility for bulls to regain management. Nevertheless, reclaiming key ranges above the $0.72 mark can be important to confirming the beginning of a significant restoration.

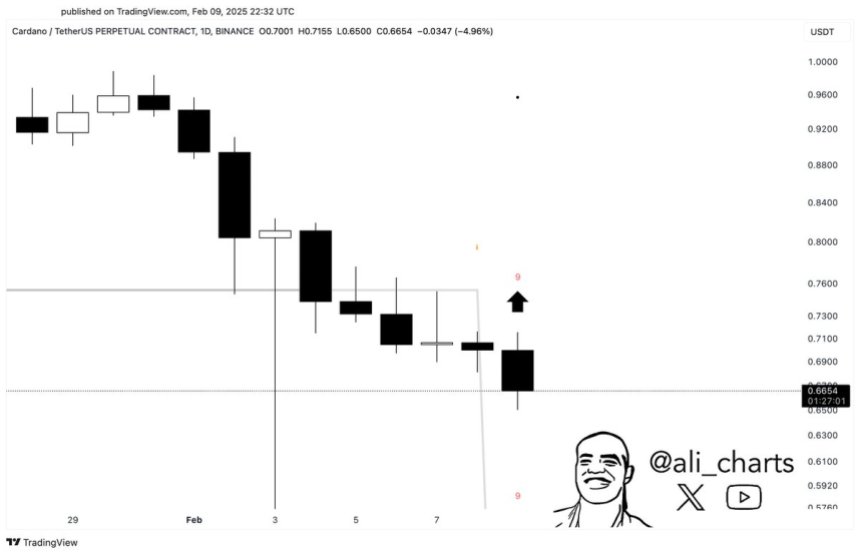

Including to this optimism, prime analyst Ali Martinez lately shared a technical sign on X, indicating that Cardano could also be poised to rebound. Martinez highlighted that the TD Sequential indicator has flashed a purchase sign on the every day chart, a improvement that has caught the eye of many ADA buyers. The TD Sequential is a extensively used technical evaluation device designed to establish potential worth reversals and factors of development exhaustion, making it a useful indicator throughout risky market situations.

This optimistic sign presents a glimmer of hope for Cardano buyers who’ve been ready for a rally, not only for ADA but additionally throughout the altcoin market. If bulls can maintain the present demand stage and push the worth above $0.72, a restoration rally might acquire momentum within the coming weeks.

Associated Studying

Breaking by means of this key stage and sustaining greater costs will probably appeal to extra patrons and gasoline bullish sentiment, doubtlessly marking the beginning of a brand new upward development. Nevertheless, failure to reclaim key ranges might lead to prolonged consolidation or additional declines, making the following few days essential for Cardano’s worth trajectory.

ADA Worth Testing Essential Demand

Cardano (ADA) is at present buying and selling at $0.69 after enduring days of promoting stress and heightened volatility. Final Monday’s dramatic 38% drop, adopted by a formidable 60% restoration, showcased the depth of the present market situations. Nevertheless, regardless of the swift rebound, ADA has struggled to reclaim the $0.85 stage, a important resistance zone that bulls should conquer to ascertain a sustainable uptrend.

For Cardano to realize momentum, it’s important for bulls to carry present worth ranges and push the worth above the 200-day exponential transferring common (EMA), which stands at $0.7225. This EMA serves as a vital indicator of long-term power, and a reclaim above it will sign renewed bullish momentum. Breaking above this stage might pave the best way for a rally, doubtlessly bringing ADA nearer to difficult the $0.85 mark once more.

Associated Studying

Failing to carry the present worth or reclaim the 200-day EMA might result in additional consolidation and even one other leg down, as market sentiment stays fragile. The approaching days can be important for ADA because it checks its capacity to take care of help and set up a bullish development. Buyers will carefully watch these key ranges, as holding and breaking above them might sign the beginning of a restoration rally.

Featured picture from Dall-E, chart from TradingView