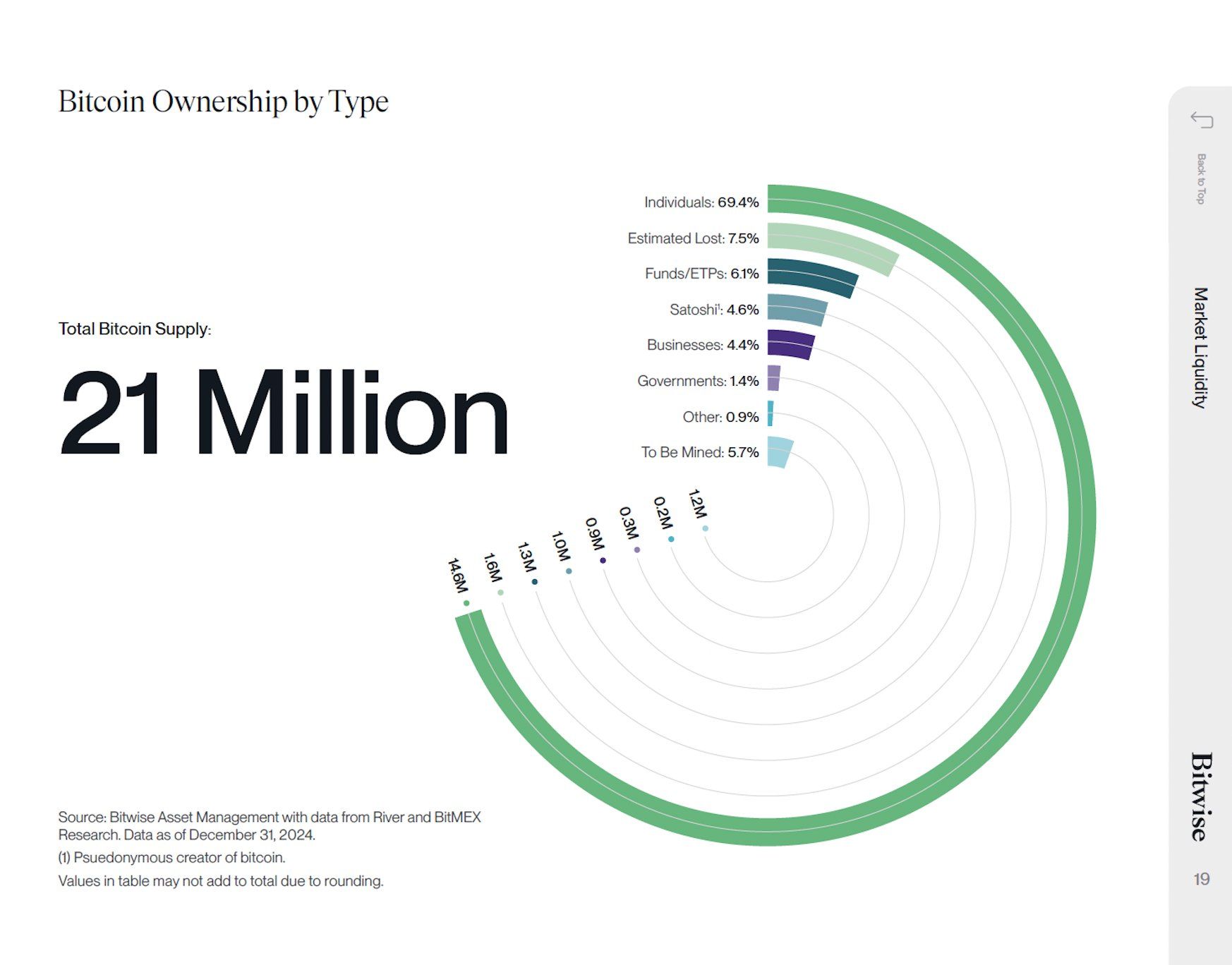

In keeping with Bitwise Asset Administration, particular person holders management most of Bitcoin’s (BTC) whole provide. 69.4% of the 21 million BTC in circulation belong to personal buyers.

Given this focus of possession amongst people, massive establishments and governments in search of to amass Bitcoin could face challenges.

Establishments Face Shortage as Bitcoin Provide Declines

In a current X put up, Bitwise outlined Bitcoin’s whole provide distribution. Aside from particular person holders, roughly 7.5% of Bitcoin is taken into account misplaced. Funds and exchange-traded merchandise (ETPs) management 6.1%.

The pockets related to Satoshi Nakamoto, Bitcoin’s pseudonymous creator, holds 4.6%. Furthermore, governments and companies collectively personal simply 5.8% of Bitcoin.

The asset supervisor highlighted that if corporations and governments want to purchase Bitcoin, they may primarily must buy it from people prepared to promote.

“That market dynamic between consumers and sellers might get very fascinating,” the put up learn.

Hunter Horsley, CEO of Bitwise, additionally identified that regardless of constant shopping for from corporates and ETFs, Bitcoin’s value has nonetheless confronted downward strain. He additionally confused that the majority of Bitcoin’s worth stays within the palms of particular person holders.

“Each new purchaser should discover a vendor. Apparent however essential as ever,” Horsley added.

Is a Bitcoin Provide Shock Coming?

In the meantime, solely 5.7% of Bitcoin stays to be mined. As well as, OTC (Over-the-Counter) markets are working low on Bitcoin. A crypto analyst highlighted that simply 140,000 BTC stays within the OTC market.

“There’s virtually no Bitcoin left even for establishments,” he claimed.

The analyst defined ETFs collectively bought 50,000 BTC final month. But, value actions remained subdued. This advised that establishments supply Bitcoin from OTC markets slightly than exchanges to keep away from triggering value surges.

Nonetheless, this technique could not be viable with OTC provide depleting.

“Each billion {dollars} price of cash going into BTC raises its value by 3-5%. Thats why OTC drying up is so insane,” the analyst remarked.

He added that if MicroStrategy (now Technique) continues its aggressive acquisitions or ETFs preserve their January-level accumulation, OTC Bitcoin might be depleted. The same situation would unfold if the US and the states started shopping for Bitcoin as a part of their reserves.

Technique has maintained a constant Bitcoin acquisition plan. On February 10, the agency bought 7,633 BTC for roughly $742.4 million. This marked its fifth Bitcoin buy in 2025 alone. In keeping with Saylor Tracker, the agency now holds 478,740 BTC, valued at $47.12 billion.

Establishments akin to BlackRock are additionally including strain to provide. The asset supervisor reportedly acquired $1 billion price of BTC in January. In truth, it purchased 227 BTC right now, in line with Arkham Intelligence.

However, as provide tightens, establishments could quickly be compelled to purchase instantly from exchanges, probably driving Bitcoin’s value considerably increased.

This provide shock menace looms as Bitcoin adoption accelerates. In a earlier report, BlackRock famous that cryptocurrency reached 300 million customers sooner than the web and cellphones.

Brian Armstrong, CEO of Coinbase, additionally weighed in on the adoption timeline comparability.

“Bitcoin adoption ought to get to a number of billion folks by 2030 at present charges,” Armstrong predicted.

He added that the comparability is determined by how one defines the official beginning factors for Bitcoin, the web, and cellphones. Nonetheless, Armstrong acknowledged that the general development continues to be correct regardless of these variables.

Disclaimer

In adherence to the Belief Undertaking pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nonetheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.