- World Liberty Monetary launched Macro Technique, a token reserve targeted on Bitcoin, Ethereum, and digital finance.

- WLFI’s holdings dropped from $360 million to $38 million after transferring most belongings to exchanges.

- The agency is in talks with establishments to contribute tokenized belongings and develop its crypto publicity.

World Liberty Monetary (WLFI), a DeFi platform backed by U.S. President Donald Trump, is taking a daring step into crypto. On Tuesday, the undertaking introduced the formation of a strategic token reserve geared toward strengthening its place in digital belongings. Dubbed Macro Technique, the reserve will concentrate on supporting main cryptocurrencies like Bitcoin and Ethereum—initiatives that WLFI says are “reshaping international finance.”

Past simply accumulating belongings, the reserve can be meant to assist WLFI diversify its holdings and hedge towards market dangers. “The Macro Technique will function a strong monetary spine for WLFI,” the corporate said in a put up on X.

Unclear Funding, Institutional Talks Underway

Final week, WLFI co-founder Chase Herro hinted on the concept of making a token reserve, however the particulars remained obscure. Even with Tuesday’s announcement, one key query stays unanswered—the place precisely will the funds for the reserve come from?

Whereas WLFI hasn’t offered specifics, it did reveal that it’s in talks with monetary establishments. The purpose? Discovering organizations prepared to contribute tokenized belongings to the reserve.

“Contributed belongings might be held in WLFI’s publicly accessible pockets, offering establishments with clear publicity to the crypto neighborhood,” the platform defined.

A Large Drawdown in Holdings

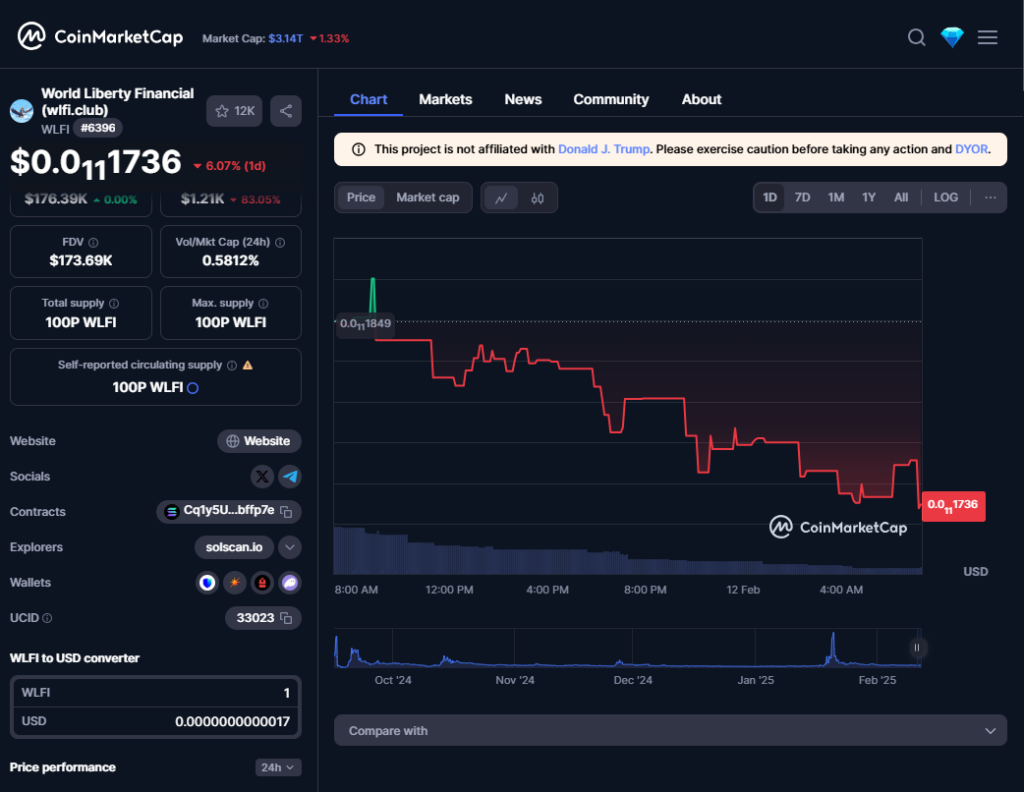

At present, WLFI holds round $38 million in numerous tokens—a steep decline from the greater than $360 million it managed simply final week. The sharp drop comes after nearly all of its belongings have been transferred to exchanges, although the corporate hasn’t elaborated on the explanations behind the transfer.

In the meantime, WLFI can be teaming up with Ondo Finance. The 2 companies introduced plans to collaborate on advancing tokenized real-world belongings (RWAs) and integrating conventional finance into the on-chain ecosystem.

With the launch of Macro Technique and rising institutional curiosity in tokenized belongings, WLFI is positioning itself as a key participant within the evolving DeFi panorama. However with its holdings shrinking and funding particulars nonetheless murky, all eyes are on whether or not this reserve can really ship on its formidable objectives.