B3 worth surged roughly 50% on February 12, making it one of many fastest-growing tokens launched on Base in current months. As a gaming-focused mission based by former Base group members, B3 has additionally turn into one of the talked-about gaming cash this cycle.

Regardless of its sturdy rally, technical indicators recommend that development momentum is easing, and promoting strain has began to extend. Whether or not B3 can maintain its bullish momentum or face a deeper correction will rely on key assist and resistance ranges within the coming periods.

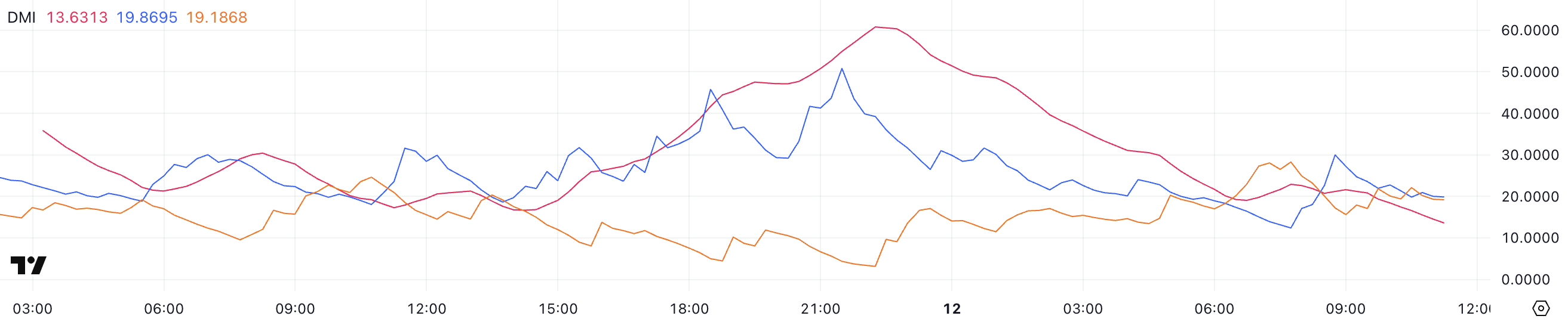

DMI Chart Exhibits B3 Development Is Easing

B3 – which defines itself as an “Open Gaming Layer-3” – DMI chart reveals a pointy decline in its ADX, dropping from 60.8 to 13.6 within the final 12 hours, signaling a fast lack of development power.

The ADX (Common Directional Index) measures the power of a development, with values above 25 indicating a powerful development and values beneath 20 suggesting weak point or consolidation.

Whereas a excessive ADX confirms a powerful development, a sudden drop like this usually factors to fading momentum or a possible shift in market course.

Regardless of this decline in development power, B3 remains to be in an uptrend, as indicated by the +DI at 19.8, although it has fallen from 30. In the meantime, the -DI has risen from 15.6 to 19.1, displaying rising promoting strain for the gaming coin.

Because the +DI and -DI stay shut, the market is at a crucial level the place a decisive transfer may outline the subsequent development.

If +DI regains power, the uptrend may resume, but when -DI continues rising, B3 might enter a consolidation part or perhaps a downtrend. Since yesterday, B3 has surged, changing into the ninth greatest asset on Base by way of market cap, forward of well-known tokens like AIXBT.

With its current surge, it grew to become the most important gaming coin on Base ecosystem.

B3 CMF Is At present Unfavourable, After Staying Constructive Between Yesterday and In the present day

B3’s CMF is presently at -0.08 after remaining optimistic for a number of consecutive hours between yesterday and in the present day. The Chaikin Cash Stream (CMF) measures the shopping for and promoting strain primarily based on quantity and worth motion, with values above zero indicating accumulation and values beneath zero signaling distribution.

A rising CMF suggests stronger shopping for curiosity, whereas a declining or destructive CMF factors to rising promoting strain. Earlier, B3’s CMF dropped to a destructive peak of -0.22, displaying a short interval of heavy outflows earlier than making an attempt to recuperate.

Though B3’s CMF has rebounded from its lowest ranges, its remaining destructive at -0.08 means that promoting strain remains to be current. This might point out a weakening of bullish momentum, making it tougher for the value to maintain an uptrend.

If CMF continues to recuperate and turns optimistic once more, it will sign renewed accumulation, doubtlessly supporting a worth rebound. Nevertheless, if it declines additional, it could affirm rising sell-side strain, resulting in additional draw back or extended consolidation.

B3 Worth Prediction: Will B3 Rise Extra 42%?

B3’s EMA strains nonetheless point out bullish momentum, as short-term EMAs stay above long-term ones. Nevertheless, the narrowing hole between them suggests that purchasing strain could also be weakening.

The worth is presently close to a key assist degree at $0.01259, which can be essential in figuring out the subsequent transfer. If this assist is examined and fails, B3 may see a big drop, doubtlessly falling to $0.0068 and even $0.0053, marking a steep 61% correction, as gaming cash nonetheless attempt to carry out nicely this cycle.

Alternatively, if the uptrend strengthens, B3 may push towards the $0.016 resistance degree.

A breakout above this degree may sign renewed bullish momentum, resulting in a transfer towards $0.0195, representing a 42% upside, doubtlessly making it one of the related new cryptos within the Base ecosystem.

Disclaimer

In step with the Belief Venture tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.