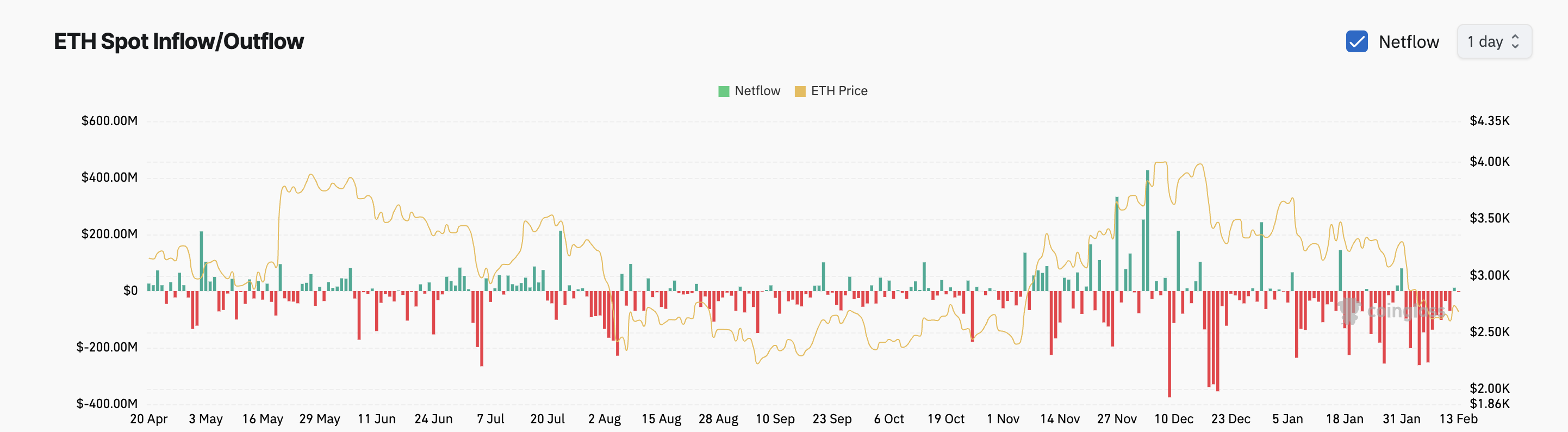

For the primary time this month, Ethereum (ETH) has recorded a sequence of spot inflows, signaling renewed investor curiosity within the main altcoin.

This comes because the Chicago Board Choices Change (CBOE) filed an software for a spot-staked Ethereum exchange-traded fund (ETF) on behalf of 21Shares. With a rising bullish bias towards the main altcoin, it may be poised to start an uptrend.

CBOE Recordsdata for 21Shares Spot-Staked Ethereum ETF

In a February 12 submitting, CBOE submitted an software to the US Securities and Change Fee (SEC) on behalf of asset supervisor 21Shares to listing a spot-staked Ethereum ETF.

The proposed fund goals to allow the staking of 21Shares’ Ethereum ETF holdings, providing its buyers a approach to earn passive earnings whereas holding the asset.

Staking normally entails locking up ETH cash to assist safe the Ethereum community whereas producing rewards. In comparison with customary ETH ETFs, a staked model will present buyers with further yield alternatives.

In a put up on X, Bloomberg ETF analyst James Seyffart famous that the applying’s approval is probably going. Nonetheless, he stays cautious, acknowledging the uncertainty surrounding regulatory choices.

“Assuming that is acknowledged by the SEC (I’d most likely make that assumption proper now however you by no means know). The ultimate deadline on this submitting will probably be someplace across the finish of October. Like October Thirtieth-ish.,” the analyst wrote.

ETH Reacts Positively

Following the information, ETH costs gained 12%. On Wednesday, the main altcoin climbed to an intraday peak of $2,790 from a low of $2,565 as spot inflows soared. Based on Coinglass, this totaled $11.87 million and marked the coin’s first spot inflows because the starting of February.

When an asset data spot inflows, it implies that the quantity of the asset being purchased and held in its spot market has elevated, typically indicating rising investor demand. This displays a shift in direction of shopping for the asset immediately fairly than utilizing derivatives or futures contracts.

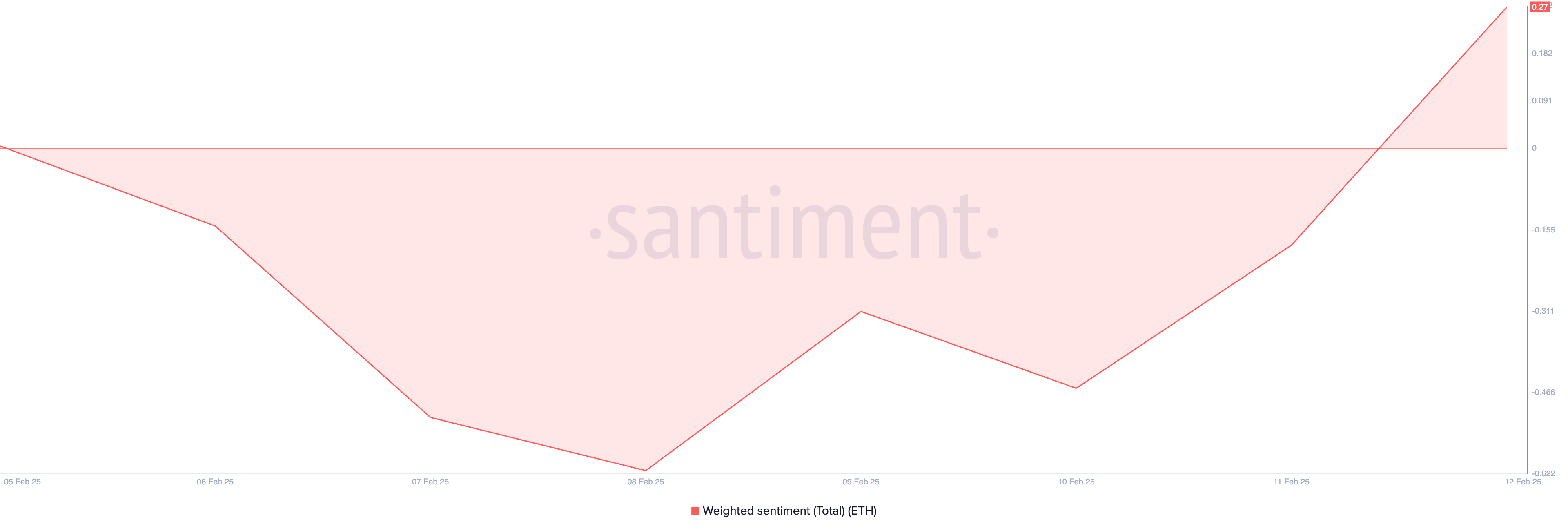

Notably, there was a turnaround within the bias trailing the altcoin. Based on Santiment, ETH’s weighted sentiment metric has returned a constructive worth for the primary time since February 5, reflecting the altering angle in direction of the coin. At press time, that is at 0.27.

An asset’s weighted sentiment measures its general constructive or unfavorable bias, contemplating each the amount of social media mentions and the sentiment expressed in these mentions.

When constructive like this, it’s a bullish sign as buyers change into more and more optimistic in regards to the token’s near-term outlook. This prompts them to commerce extra, driving up the asset’s worth.

ETH Worth Prediction: Merchants Eye $2,811 and Past

A gradual resurgence in ETH’s demand may trigger it to increase its present rally. The coin trades at $2,681 at press time, noting a 4% hike previously 24 hours.

Amid rising spot inflows and sustained constructive sentiment amongst merchants, ETH’s value may rise towards $2,811. Ought to it break this stage, a rally towards $3,321 may comply with.

Alternatively, if ETH holders resume profit-taking, the coin’s worth may slip under $2,500.

Disclaimer

In step with the Belief Challenge pointers, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.