Hedera (HBAR) worth has dropped 5% within the final 24 hours, with an total 22% correction prior to now 30 days. Its market cap is now at $8.5 billion. Technical indicators counsel that bearish momentum continues to be dominant, although indicators of a possible shift are rising.

The ADX reveals that the continued downtrend is dropping power, whereas the Ichimoku Cloud confirms that sellers stay in management for now. If HBAR can maintain its restoration and break key resistance ranges, a stronger uptrend might develop, however failure to take action could result in additional declines.

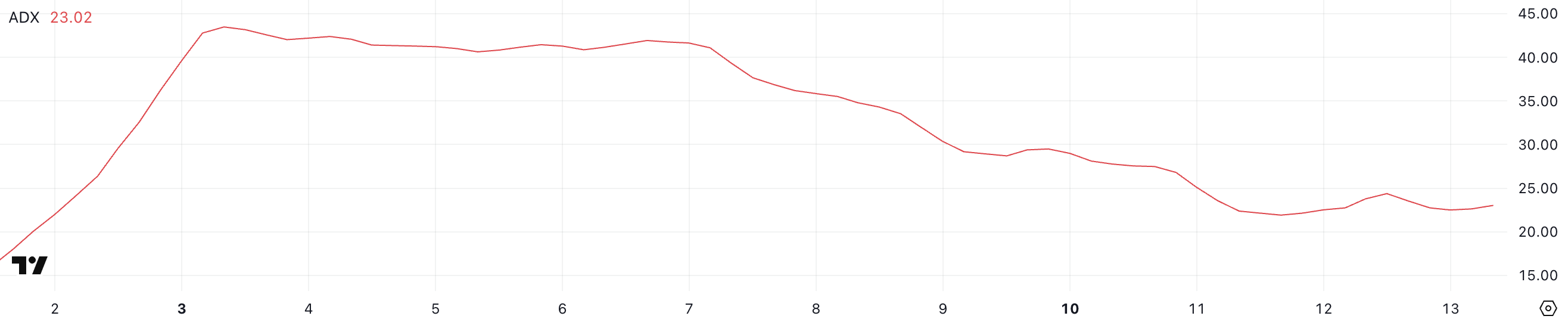

HBAR ADX Exhibits The Downtrend Is Secure and Not As Sturdy As Earlier than

Hedera ADX is at the moment at 23, down from 28.9 three days in the past, and has remained under 25. This decline means that the power of the continued development is weakening, with sellers dropping some momentum.

Since ADX measures development power reasonably than path, a falling ADX in a downtrend signifies that bearish strain is slowing, although not but reversing.

ADX values under 20 sign weak developments, whereas these above 25 counsel sturdy, established motion. With HBAR’s ADX at 23, the downtrend continues to be current however dropping depth.

If ADX continues to say no, worth motion might shift towards consolidation reasonably than additional draw back acceleration. Nonetheless, with out stronger HBAR shopping for strain, a transparent development reversal stays unsure.

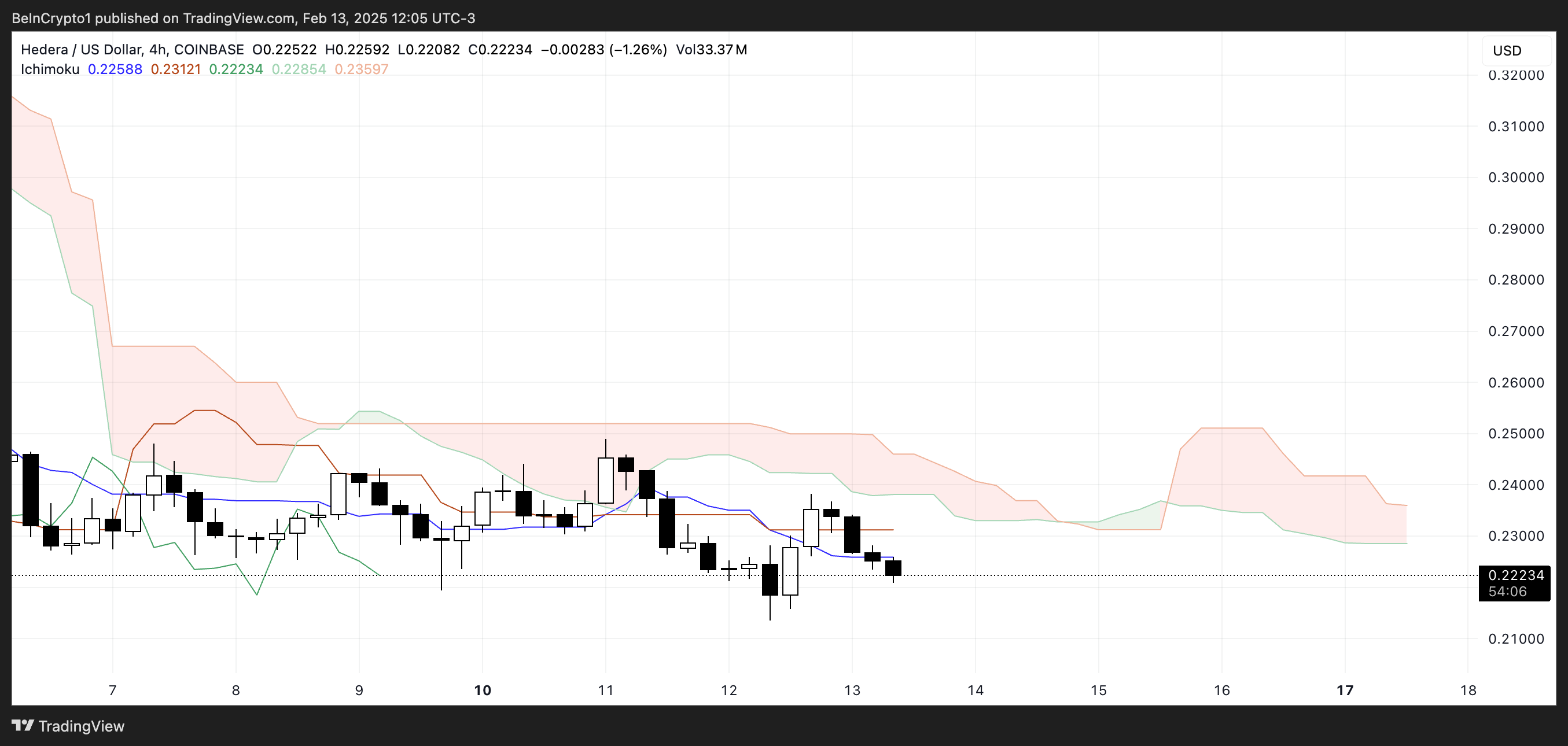

HBAR Ichimoku Cloud Exhibits a Bearish Setup, However This May Change Quickly

HBAR Ichimoku Cloud chart is displaying a bearish setup, with worth motion remaining under the cloud.

The purple cloud means that bearish momentum has dominated, and a number of makes an attempt to maneuver above it have been rejected. The Tenkan-sen (blue line) is positioned under the Kijun-sen (purple line), reinforcing the continued weak spot.

The projected cloud stays bearish, with the Senkou Span A (inexperienced line) under the Senkou Span B (purple line), signaling continued downward strain, although the gap between then is narrowing.

The Chikou Span (inexperienced lagging line) can be under the previous worth motion, confirming that the market construction nonetheless favors sellers. Except HBAR consumers step in with stronger momentum, the development stays intact, and bearish continuation is probably going.

HBAR Value Prediction: Can Hedera Reclaim $30 In February?

Hedera EMA traces present that short-term developments stay under long-term ones, reinforcing the present bearish setup. This alignment means that sellers are nonetheless in management, protecting downward strain on worth motion.

If this bearish development strengthens once more, HBAR worth might drop additional, doubtlessly testing the assist at $0.179, which might characterize a 19% decline from present ranges.

Nonetheless, if HBAR worth can reverse this development and achieve bullish momentum, it might problem the resistance at $0.248.

A breakout above this degree might result in a stronger restoration, pushing the worth towards $0.32, marking a 46% upside. To verify a shift in development, consumers would want to maintain momentum and set up worth motion above key resistance zones.

Disclaimer

Consistent with the Belief Mission pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.