Solana (SOL) worth is trying to recuperate the $200 degree after just lately dipping beneath $190. This rebound comes as its market cap nears $97 billion, reflecting renewed investor curiosity.

Technical indicators recommend that SOL may acquire additional momentum if a golden cross kinds, doubtlessly pushing the value towards $209 and past. Nonetheless, if shopping for strain weakens, SOL may face one other pullback, with key help ranges at $187 and $175.8.

Solana Whales Are Trying to Get well

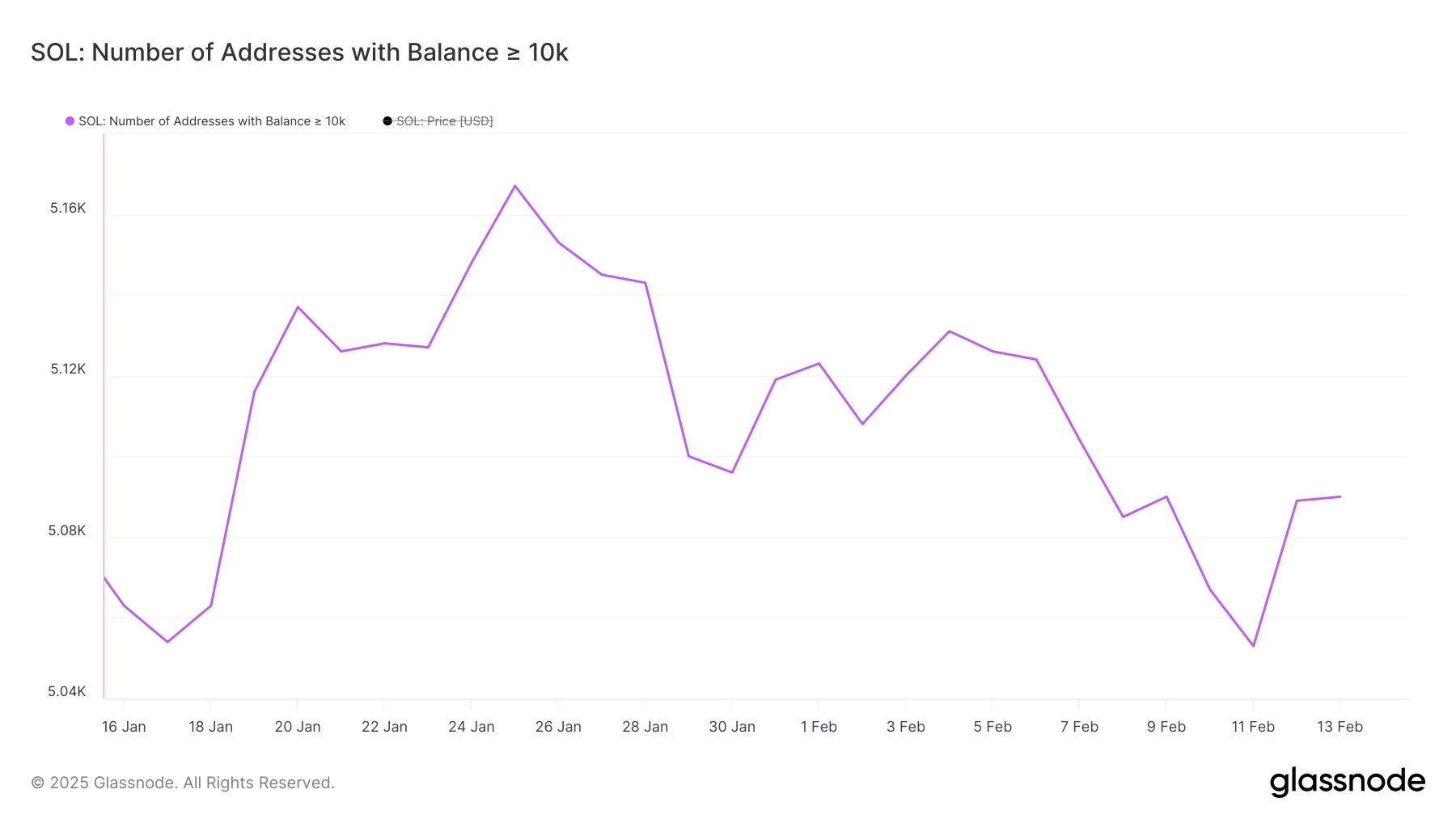

The variety of SOL whales – wallets holding at the very least 10,000 SOL – has seen a major decline in current days, dropping from 5,131 on February 4 to five,053 on February 11.

This follows an all-time excessive of 5,167 on January 25, after which whale holdings started lowering. Such a decline means that some giant holders have been offloading their positions, doubtlessly creating promoting strain on SOL worth.

Monitoring whale exercise is essential as these giant holders play a key position in market actions. After hitting 5,053, the variety of whales has began rising once more, at present at 5,090.

This sluggish restoration may point out renewed confidence amongst large buyers, however the total pattern stays unsure. If whale accumulation continues, it may help Solana worth, whereas stagnation or one other decline might sign additional weak spot.

Solana DMI Exhibits the Consumers Are Making an attempt to Take Management

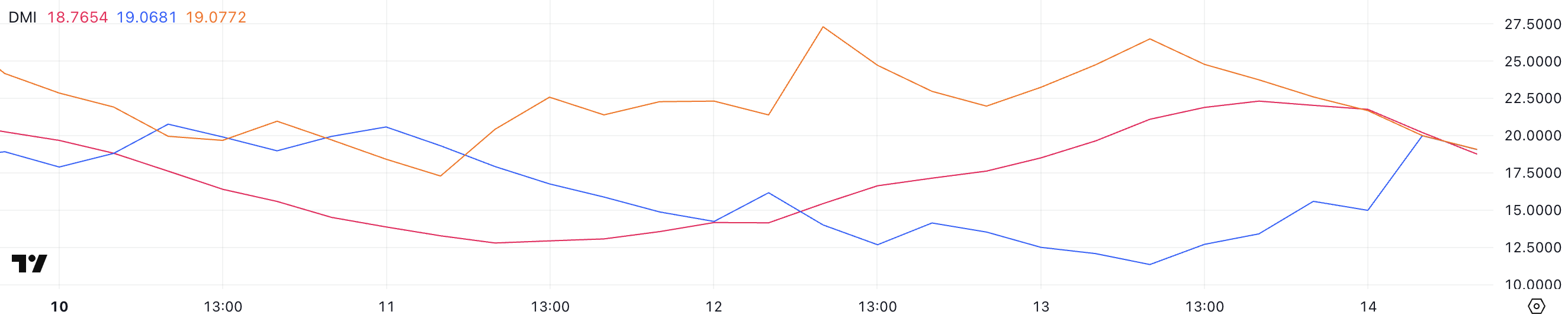

Solana Directional Motion Index (DMI) chart reveals its Common Directional Index (ADX) at 18.7, down from 22.2 yesterday. A declining ADX suggests weakening pattern energy, indicating that the earlier downtrend could also be shedding momentum.

In the meantime, the +DI has risen from 11.3 to 19, whereas the -DI has dropped from 26.4 to 19, signaling a shift in shopping for and promoting strain.

The ADX measures pattern energy on a scale from 0 to 100, with values above 25 indicating a powerful pattern and values beneath 20 suggesting weak or indecisive motion.

With ADX declining and +DI rising whereas -DI falls, Solana seems to be trying a pattern reversal. If shopping for strain continues to extend, SOL may set up a brand new uptrend, but when ADX stays low, the market might keep in consolidation earlier than a clearer course emerges.

SOL Worth Prediction: Can Solana Maintain Ranges Above $200?

Solana worth is trying to reclaim the $200 threshold after just lately dipping beneath $190. One in all its short-term shifting averages is near crossing above one other, which may result in a golden cross.

If this bullish sign materializes, SOL may rise to check $209, and a breakout above that degree might push it towards $219.9. If momentum from the earlier month returns, SOL worth may even rally to $244, marking its highest degree since late January.

Nonetheless, if SOL fails to determine an uptrend, it may face renewed promoting strain.

A drop to the $187 help degree is feasible, and if that fails to carry, SOL may decline additional to $175.8.

Disclaimer

According to the Belief Venture tips, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.