Argentina’s President Javier Milei has distanced himself from the LIBRA meme coin after selling it in a now-deleted tweet.

His clarification follows accusations that the undertaking’s builders drained roughly $107 million in what seems to be a pump-and-dump scheme.

LIBRA Meme Coin Controversy

On February 14, Milei’s X account endorsed LIBRA, a Solana-based meme coin, which triggered a surge in buying and selling exercise. The token’s market cap briefly hit $4.5 billion as buyers rushed in.

The undertaking claimed its objective was to assist Argentina’s economic system by funding small companies and native ventures. Julian Peh, co-founder of KIP Protocol, confirmed the platform’s involvement, stating that its position was to handle fund distribution somewhat than oversee the token itself.

“Our main position is to assist run the fund allocation to the Argentinian firms, and fewer on the token aspect. We aren’t the [Market maker]…We are going to put collectively the plan to run the Challenge Libertad as per the unique goal. We might not have gotten the assistance we did to launch it if we weren’t severe. Not a single SOL will probably be used outdoors of the aim of operating Challenge Viva La Libertad,” Peh mentioned.

Nonetheless, doubts shortly emerged relating to the legitimacy of the launch. Crypto analyst Conor Grogan identified that the pockets deploying LIBRA had acquired funds from an change that doesn’t require Know Your Buyer (KYC) verification.

As issues mounted, Milei addressed the problem, stating that he had initially shared the undertaking to assist a personal initiative, one thing he does repeatedly.

Upon additional evaluate, he retracted his endorsement and deleted the submit. Following his assertion, LIBRA’s value plummeted by round 90%.

“I used to be not conscious of the small print of the undertaking and after having change into conscious of it I made a decision to not proceed spreading the phrase (that’s the reason I deleted the tweet). To the filthy rats of the political caste who need to benefit from this example to do hurt, I need to say that on daily basis they affirm how vile politicians are, they usually enhance our conviction to kick them within the ass,” Milei mentioned.

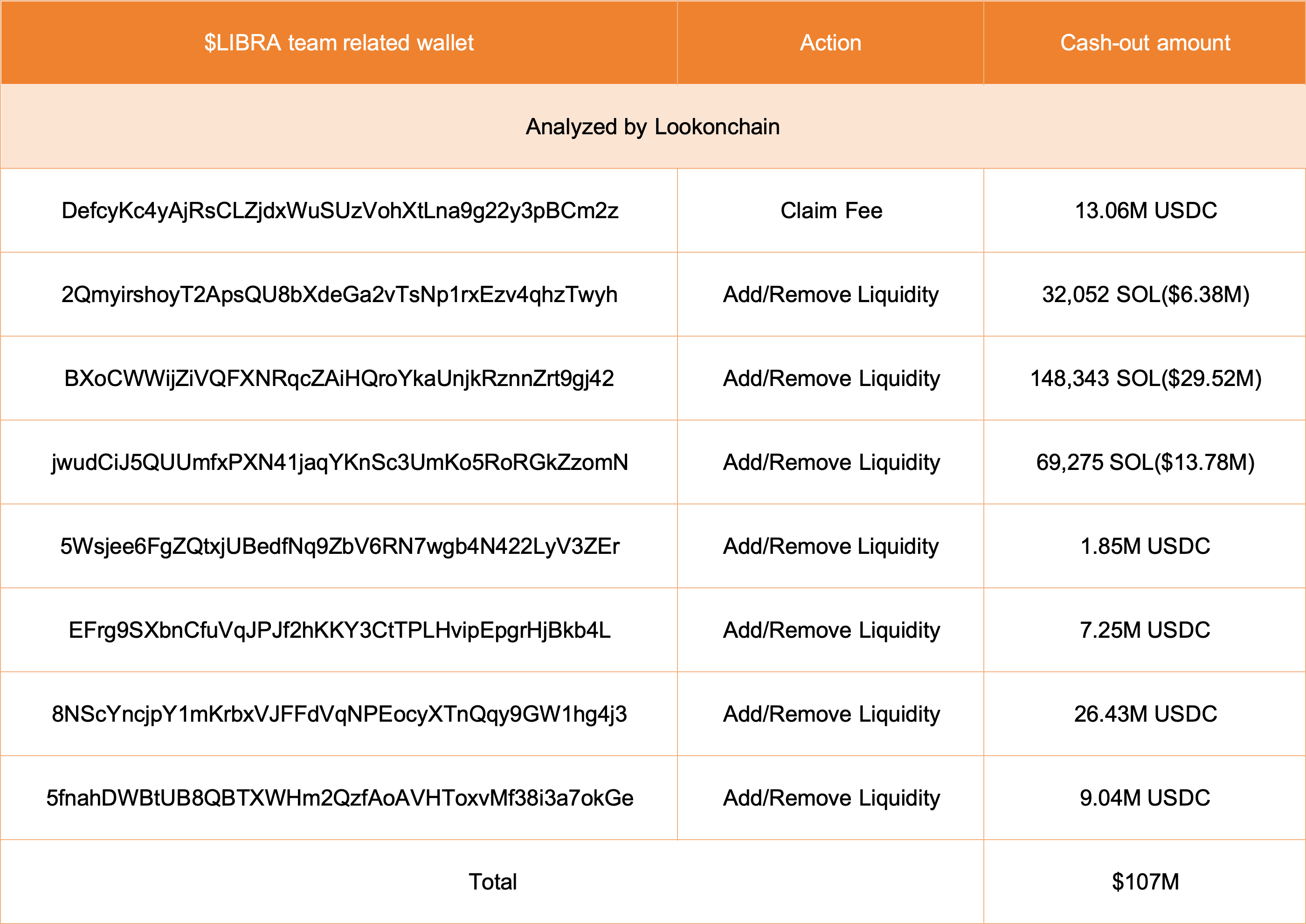

In the meantime, blockchain evaluation from Lookonchain revealed that insiders had withdrawn roughly $107 million. Eight wallets linked to the undertaking moved $57.6 million in USDC and 249,671 SOL, price practically $50 million. Analysts prompt these withdrawals have been tied to liquidity manipulation and gathered charges.

Moreover, crypto analyst EmberCN reported that insiders made a minimum of $20.18 million by front-running the promotional tweet, shopping for seconds after it was posted, and promoting after the worth spike.

Political Meme Cash and Trade Reactions

The LIBRA fallout highlights issues surrounding politically affiliated meme cash. Comparable hypothesis surrounded the launch of the TRUMP token in January and the Central African Republic’s CAR meme coin.

In each instances, merchants rushed to purchase in earlier than questioning their legitimacy. Whereas these tokens turned out to be genuine, LIBRA’s fast collapse has raised alarms throughout the crypto neighborhood.

Trade figures have condemned the scenario. Sonic Labs co-founder Andre Cronje criticized the development, suggesting that meme coin merchants don’t have interaction with decentralized finance or blockchain expertise.

“[Meme coin traders are] a demographic that doesnt care about decentralized finance and even blockchains. So memes arent stealing any consideration, because the individuals werent our individuals within the first place,” Cronje said.

However, SlowMist founder Yu Xian referred to as for accountability, stating that these accountable ought to face authorized penalties.

“Assist everybody in defending your rights; the instigator have to be punished by legislation, and hopefully, they may even face the President’s wrath,” Xian added.

The LIBRA controversy displays the dangers of speculative meme cash, significantly when linked to political figures. The incident has additional fueled discussions about regulatory oversight and investor safety within the crypto area.

Disclaimer

In adherence to the Belief Challenge pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nonetheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any choices primarily based on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.