The Actual-World Property (RWA) sector has seen explosive progress in current months, with each its whole market cap and buying and selling quantity surging at an unprecedented tempo. Within the final three months, RWA cash’ market cap jumped 144% to $62.7 billion, whereas the overall worth of tokenized real-world belongings reached $17.3 billion, up 13% in the identical interval.

This speedy growth has been fueled by rising institutional adoption and a extra favorable regulatory atmosphere within the US following Donald Trump’s election. As capital flows into RWA initiatives, each main tokens and rising gamers are benefiting from renewed market enthusiasm.

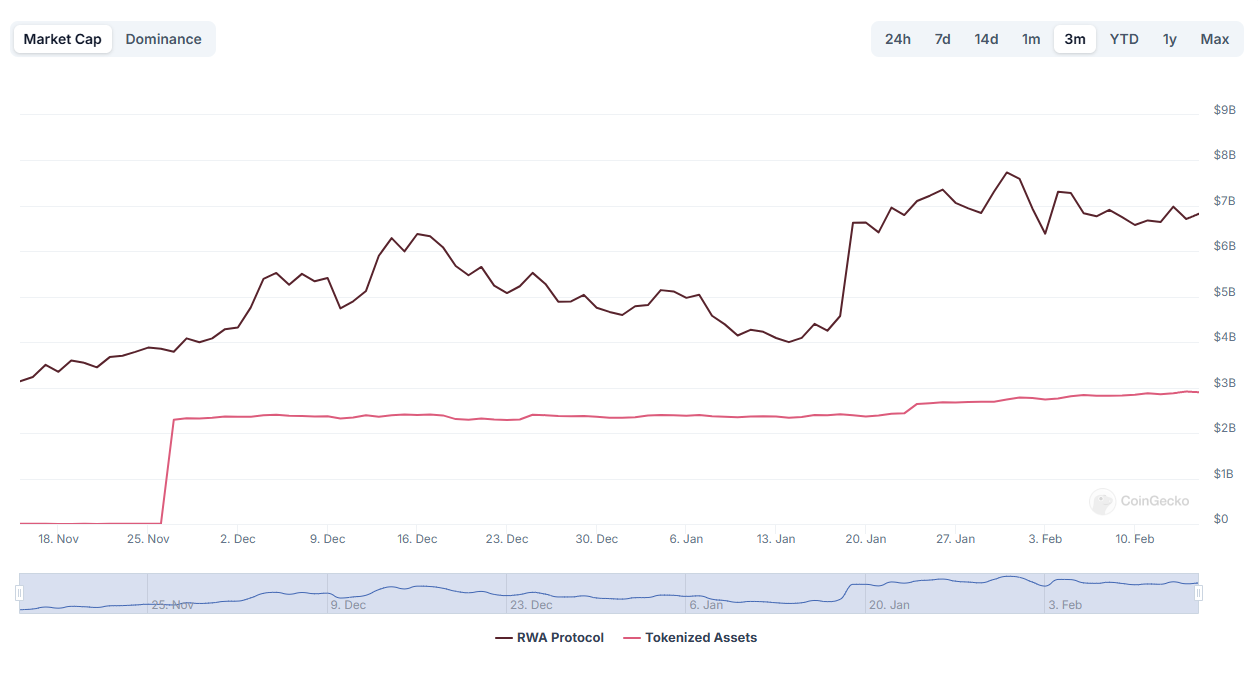

RWA Cash Market Cap Surged 144% Within the Final 3 Months

The whole market cap of RWA cryptos has surged to $62.7 billion, marking a 54% enhance over the previous 12 months.

Nonetheless, probably the most placing progress has come within the final three months, with the market cap leaping from $25.7 billion on November 4, 2024—a formidable 144% rise.

One key issue driving this surge is the shifting regulatory ecosystem within the US following Donald Trump’s election. His administration has signaled a extra crypto-friendly stance, fostering optimism amongst institutional traders and blockchain initiatives tied to real-world asset tokenization.

With expectations of decreased regulatory hurdles and clearer pointers, the RWA sector has skilled a renewed wave of capital inflows, accelerating its progress at an unprecedented tempo.

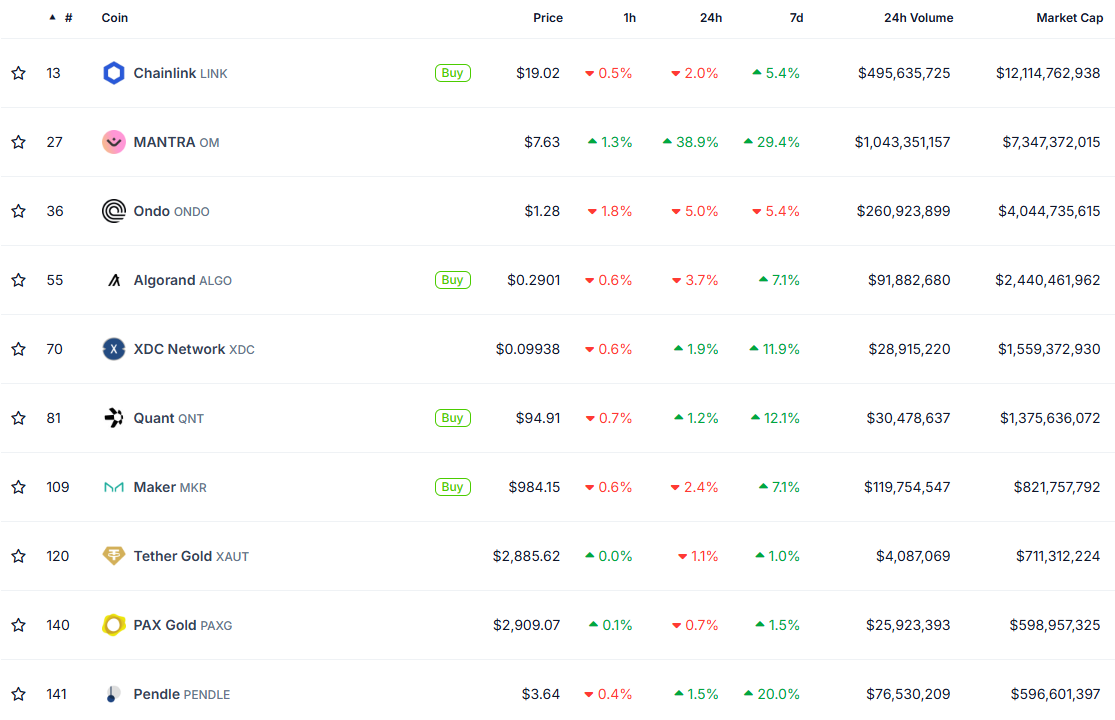

Actual-World Property Leaders Are Up In The Final Seven Days

A lot of the greatest Actual-World Property tokens have continued their robust uptrend, with solely ONDO exhibiting a decline prior to now seven days.

Regardless of this short-term dip, ONDO stays up a formidable 382% during the last 12 months, solidifying its place as one of many top-performing belongings within the sector.

Whereas ONDO lags within the weekly timeframe, different main RWA gamers have maintained their momentum, pushing the general market larger.

Mantra has climbed almost 30% within the final week, whereas Injective (INJ) has gained greater than 16%, reflecting sustained investor curiosity within the sector.

Past these main names, smaller RWA initiatives have additionally seen explosive strikes, with PinLink surging 86% and XVS rising 77%.

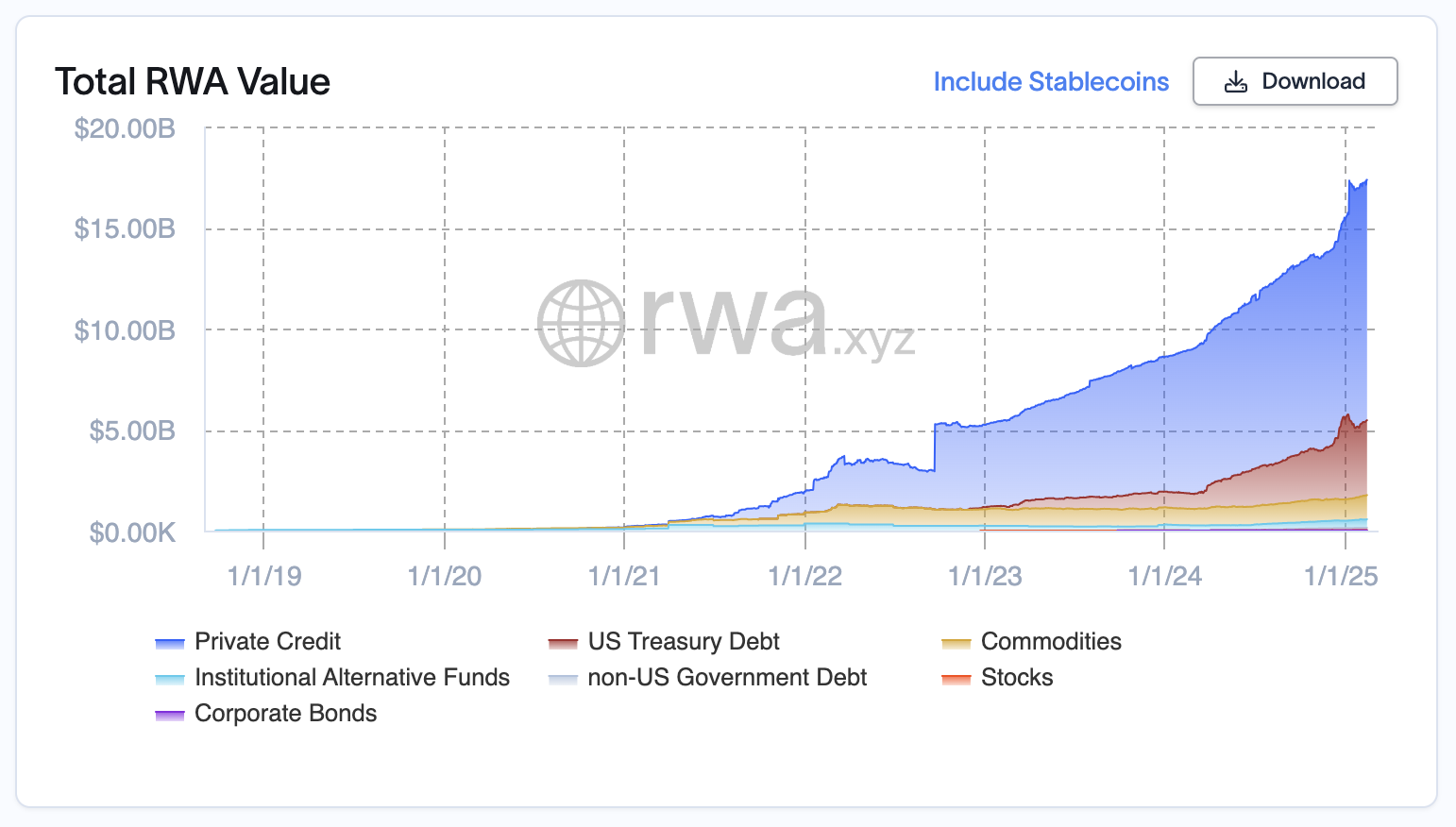

Complete RWA Worth Surged Within the Final Months

The whole worth of real-world belongings (RWA) has reached $17.3 billion, marking a 13% enhance in simply the final three months and a 96% surge over the previous 12 months.

The regular rise in RWA worth displays rising confidence within the sector, pushed by each institutional participation and increasing use circumstances.

At the moment, Non-public Credit score dominates the RWA market, accounting for $11.9 billion of the overall worth. It’s adopted by US Treasury Debt at $3.7 billion and Commodities at $1.2 billion.

The focus in Non-public Credit score means that traders see tokenization as a extra environment friendly option to entry yield. On the similar time, US Treasury Debt’s presence highlights the demand for on-chain publicity to low-risk authorities securities.

Disclaimer

In keeping with the Belief Mission pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.