Abu Dhabi’s Mubadala Sovereign Wealth Fund has taken a daring step into the Bitcoin market, investing $436 million in US-listed spot Bitcoin exchange-traded funds (ETFs).

This acquisition, revealed in a February 14 submitting with the SEC, highlights the nationwide fund’s rising curiosity in digital belongings.

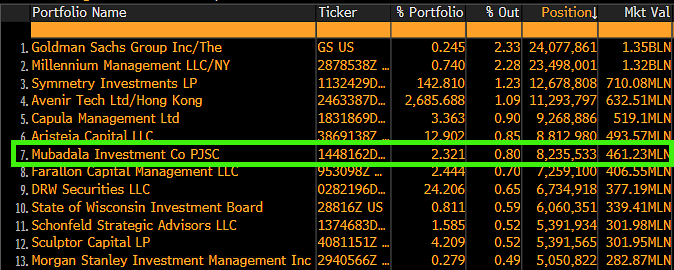

Abu Dhabi’s Mubadala Turns into Seventh-Largest Holder of BlackRock’s Bitcoin ETF

Mubadala’s submitting reveals that its funding was directed at BlackRock’s iShares Bitcoin ETF (IBIT), securing over 8.2 million shares within the fourth quarter of 2024. This marks a contemporary place for the fund, as no earlier holdings of IBIT have been reported in earlier filings.

Following this acquisition, Bloomberg ETF analyst James Seyffart famous that Mubadala now ranks because the seventh-largest identified holder of IBIT.

The fund joins an elite checklist of institutional buyers, trailing main corporations reminiscent of Goldman Sachs, Millennium Administration, and Symmetry Investments.

In the meantime, Binance founder Changpeng Zhao famous that Mubadala is just one of Abu Dhabi’s sovereign wealth funds. He prompt that different state-backed funding entities may additionally have publicity to Bitcoin ETFs.

Market observers additionally identified that Mubadala’s funding aligns with the UAE’s broader push to ascertain itself as a number one blockchain and digital asset innovation hub. Through the years, Abu Dhabi has positioned itself as a major vacation spot for corporations on the lookout for supportive funding circumstances.

This has resulted within the introduction of progressive rules which have attracted main trade gamers looking for a crypto-friendly jurisdiction.

The International Bitcoin Adoption Race

Mubadala’s funding displays a rising pattern amongst international establishments looking for Bitcoin publicity.

This shift comes as policymakers think about the potential for a strategic crypto reserve. Some within the US authorities have prompt that Bitcoin could possibly be a part of this initiative.

US Senator Cynthia Lummis underscored the importance of Mubadala’s growth, suggesting {that a} international race for Bitcoin publicity was unfolding.

“I instructed you the race was on. It’s time for America to win,” Lummis wrote on X (previously Twitter).

The lawmaker has launched the Bitcoin Act of 2024, proposing the creation of a US Bitcoin reserve. The plan entails promoting a portion of the federal government’s gold holdings to fund the acquisition. If enacted, it could safe 1 million Bitcoin, roughly 5% of the whole provide.

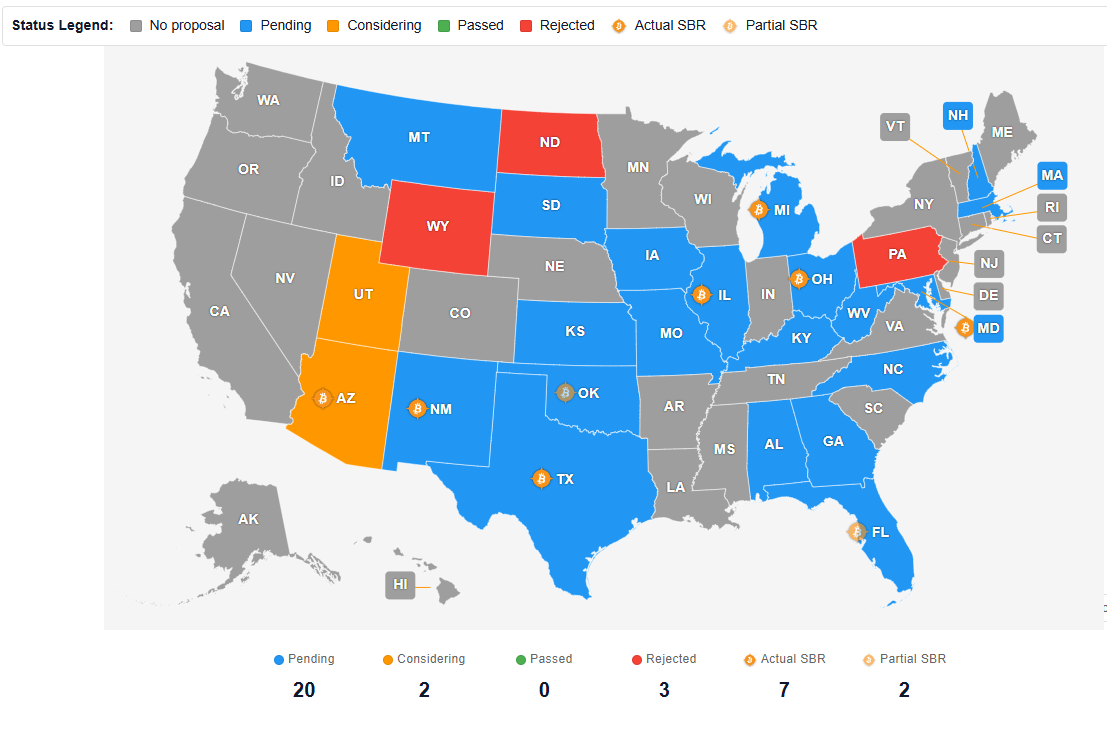

Whereas the federal authorities’s stance stays unsure, a number of US states have taken unbiased steps to combine Bitcoin into their monetary insurance policies. Over 20 states have both proposed or enacted laws to facilitate cryptocurrency investments.

Trade leaders view these developments as an indication of a worldwide race for Bitcoin adoption. Satoshi Act Fund CEO Dennis Porter emphasised that US states are driving this shift. Contemplating this, analysts count on the nation to emerge as a number one pro-Bitcoin nation.

Disclaimer

In adherence to the Belief Challenge pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any selections based mostly on this content material. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.