Final week went by means of underneath the flag of filings for a number of change traded-funds on cryptocurrencies from the likes of Grayscale, 21Shares, Canary and others. Among the many most notable developments within the crypto investments subject was the submitting for GADA — a Cardano ETF from Grayscale, one of many greatest gamers on this phase of the crypto market.

In consequence, the worth of ADA, the native token of the Cardano blockchain, confirmed distinctive efficiency and soared by 20% contained in the week, going up from as little as $0.663 to $0.83 per coin.

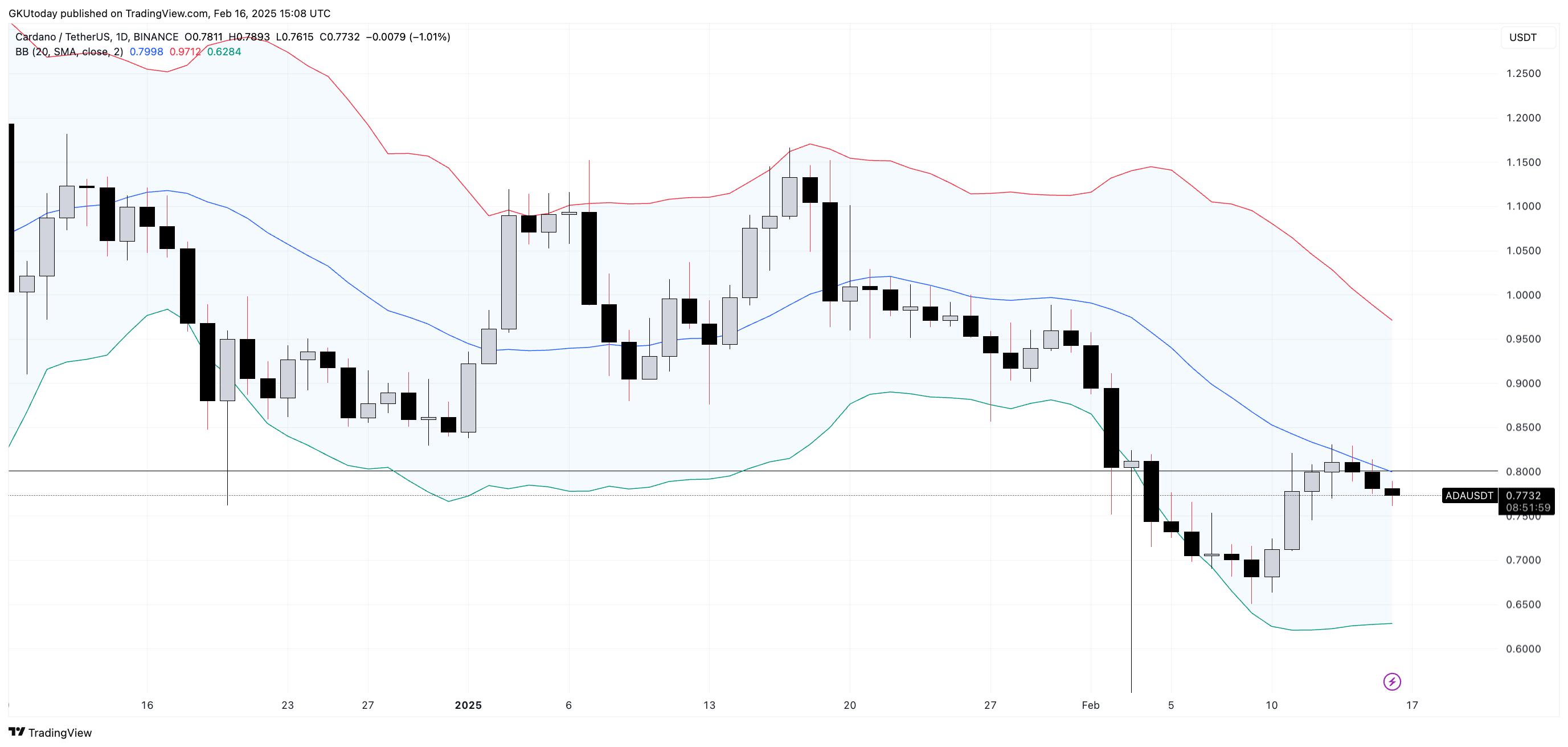

Nevertheless, ADA didn’t do one factor — preserve above essential resistance stage at $0.8, and within the final three days its worth fell under the important thing threshold. Proper now the Cardano token is quoted at $0.77, and the image doesn’t seem like a short-term downfall.

Bollinger Bands additionally sign weak spot for ADA as the worth stays under the median curve of the favored indicator on a each day time-frame.

With the ETF information being “priced in” already and the fears, uncertainty and doubts surrounding the crypto market proper now, it makes ADA extra liable to downfall then additional ascent.

Downfall, nevertheless, is a powerful phrase as all the pieces can change inside days, and if the market out of the blue will get its dose of positivity, this infamous resistance stage for ADA would be the first one to be examined.

Making an attempt to make a conclusion, it might be said that impartial triggers for the Cardano token proper now got here to an finish, and the favored altcoin is as soon as once more managed by total crypto market motion. The place it is going to take the coin, although, is an open query.