Ethereum (ETH) worth has remained in a consolidation part, buying and selling under $3,000 since February 2. Over the previous weeks, indicators like RSI, DMI, and EMA recommend that ETH lacks sturdy momentum, with neither patrons nor sellers taking full management.

The narrowing hole between its EMA traces hints at a possible shift, however ETH should overcome key resistance ranges to regain bullish momentum. In the meantime, if assist ranges fail to carry, a deeper correction towards $2,160 may very well be on the desk.

Ethereum RSI Has Been Impartial For Two Weeks

Ethereum Relative Energy Index (RSI) is at the moment at 54.2, staying impartial since February 3. RSI measures worth momentum, with values between 30 and 70 indicating a balanced market.

Ethereum has remained inside this vary, suggesting neither patrons nor sellers have taken management. This implies ETH has but to enter an overbought zone above 70 or an oversold zone under 30.

RSI ranges from 0 to 100, with key ranges at 30 and 70. A studying above 70 indicators overbought circumstances, whereas under 30 suggests oversold ranges. At 54.2, ETH is in impartial territory, which means worth motion lacks sturdy momentum.

For ETH worth to succeed in $3,000, the RSI would probably want to maneuver towards 60 or increased, indicating elevated shopping for strain. A push above 70 might sign sturdy bullish momentum, serving to ETH break key resistance ranges.

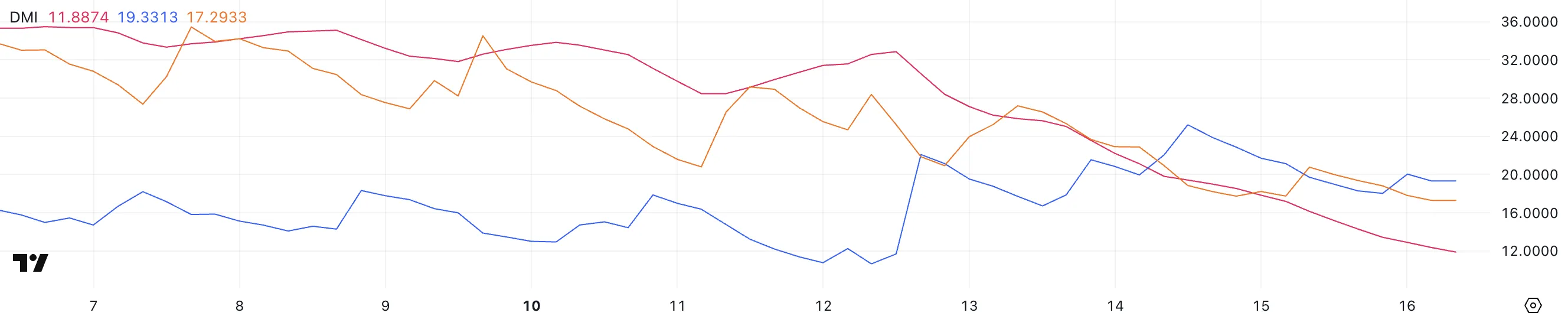

ETH DMI Reveals the Lack of a Clear Path

Ethereum Directional Motion Index (DMI) reveals its Common Directional Index (ADX) at 11.8, steadily declining since February 12, when it was at 32.8.

ADX measures development power, with values above 25 indicating a robust development and under 20 suggesting a weak or no development. The regular decline indicators fading momentum, which means ETH lacks a transparent directional push.

ADX is a part of the DMI, which additionally contains the +DI (optimistic directional indicator) and -DI (detrimental directional indicator). +DI is at 19.3, down from 25.2 two days in the past, whereas -DI is at 17.2, down from 18.8.

This implies each bullish and bearish pressures are weakening. For ETH to regain $3,000, ADX would wish to rise above 20, signaling stronger development momentum, whereas +DI must climb above -DI with a wider hole, indicating renewed bullish power.

ETH Value Prediction: Will Ethereum Return To $3,000 In February?

Ethereum worth has been buying and selling between $2,800 and $2,550 since February 7. Its EMA traces nonetheless present a bearish outlook, as short-term traces stay under long-term ones.

Nevertheless, the hole between them is narrowing, suggesting a possible shift in momentum. For ETH to succeed in $3,000 in February, it should first break the $2,800 resistance after which maintain a transfer above $3,020. If momentum strengthens, ETH might even take a look at $3,442, a degree final seen in late January.

On the draw back, if Ethereum retests the $2,551 assist and fails to carry, additional declines might comply with.

Dropping this key degree might open the door for a drop towards $2,160, a considerably decrease assist.

Disclaimer

According to the Belief Mission tips, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. All the time conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.