Este artículo también está disponible en español.

Solana has skilled intense promoting strain, now buying and selling at its lowest ranges since November 2024 and erasing all of the features from the post-election rally. As soon as a pacesetter within the altcoin market, Solana is now dealing with severe dangers because the meme coin euphoria that fueled its rise has became a massacre, elevating issues about its long-term sustainability.

Associated Studying

The speculative frenzy surrounding meme cash initially drove large transaction volumes and liquidity to the Solana ecosystem. Nevertheless, because the hype fades and main sell-offs proceed, the influence is now weighing closely on SOL’s worth motion. Analysts recommend that the speedy cycle of hypothesis and liquidation has left Solana weak to additional draw back.

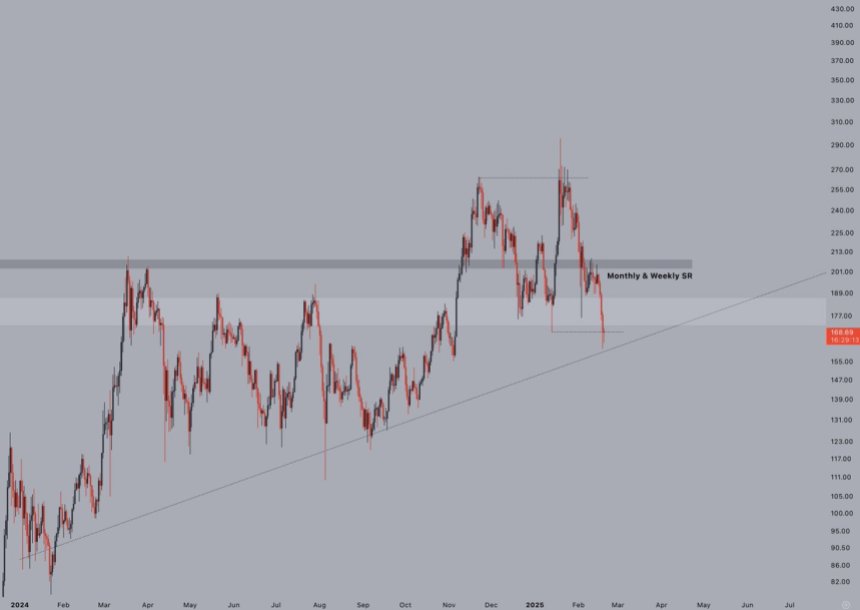

Crypto analyst Jelle shared an evaluation on X, revealing that SOL took out the current lows however managed to shut above the earlier lows, signaling a possible aid transfer. Jelle emphasised that this may very well be an important second for SOL, as reclaiming key ranges might ignite a robust restoration. Nevertheless, the approaching days will likely be crucial, because the market awaits affirmation of a bounce or additional draw back. Traders are carefully watching Solana’s worth motion, because it teeters on the sting of a significant transfer.

Solana Testing Crucial Demand Ranges

Solana has confronted large promoting strain since reaching its all-time excessive in late January, with its worth now struggling to get well amid a broader downturn within the altcoin market. Unfavorable sentiment continues to dominate because the meme coin frenzy that when fueled Solana’s progress has became a legal responsibility, dragging down liquidity and investor confidence.

Associated Studying

The speedy rise and fall of speculative meme cash on the Solana community have created an unstable buying and selling atmosphere, with merchants hesitant to reinvest within the ecosystem. This shift has led to a decline in decentralized trade (DEX) volumes, additional exacerbating Solana’s battle to keep up bullish momentum. The community’s fundamentals stay robust, however worth motion means that buyers are rising cautious.

Jelle’s evaluation on X reveals that SOL took out the current lows however managed to shut above the earlier lows. Whereas this indicators a possible aid transfer, it’s removed from confirming a full restoration. Jelle needs to see a robust bounce from right here—ideally with SOL reclaiming $185 earlier than the top of enterprise on Friday.

Merchants and buyers are holding a detailed watch on the 3-day and weekly candle closes to find out the subsequent main transfer for Solana. A profitable reclaim of the $185 degree might restore confidence and push the worth again towards $200. Nevertheless, failure to take action may result in additional draw back strain, as Solana stays weak to broader market actions and the continued volatility within the meme coin sector.

SOL Worth Attempting To Reclaim Key Ranges

Solana (SOL) is at present buying and selling at $173, holding above the essential $170 assist degree. Bulls should defend this worth to keep up short-term momentum and stop a deeper correction. A push above the $185 mark is important for a restoration, as this degree aligns with the 200-day shifting common, a key indicator of long-term energy. Reclaiming this degree would sign a shift in momentum and open the door for a stronger upside transfer towards greater resistance ranges.

Nevertheless, if SOL fails to push above the $185 mark within the coming days, promoting strain might intensify, main to a different downturn. Bears stay in management so long as the worth stays under this crucial threshold, and a rejection at $185 might set off additional draw back, doubtlessly revisiting assist round $160 or decrease.

Associated Studying

The approaching days will likely be essential for Solana, as merchants look ahead to affirmation of a reversal or a continuation of the bearish development. A breakout above $185 might present the momentum wanted for SOL to regain its bullish trajectory, whereas a failure to reclaim this degree would doubtless end in additional losses. Market sentiment stays fragile, with buyers carefully monitoring worth motion for any indicators of a sustainable restoration.

Featured picture from Dall-E, chart from TradingView