Cardano has been buying and selling beneath $1 for a month, struggling to regain the momentum it had on the finish of 2024. Whereas ADA has proven indicators of restoration, technical indicators stay blended. BBTrend turned constructive once more however remains to be removed from its earlier highs.

The Ichimoku Cloud suggests an indecisive section, the place ADA is trying to stabilize however lacks robust bullish affirmation. With key resistance at $0.83 and assist at $0.65, its subsequent transfer will likely be essential in figuring out whether or not it will possibly escape of its vary or face additional draw back towards $0.50.

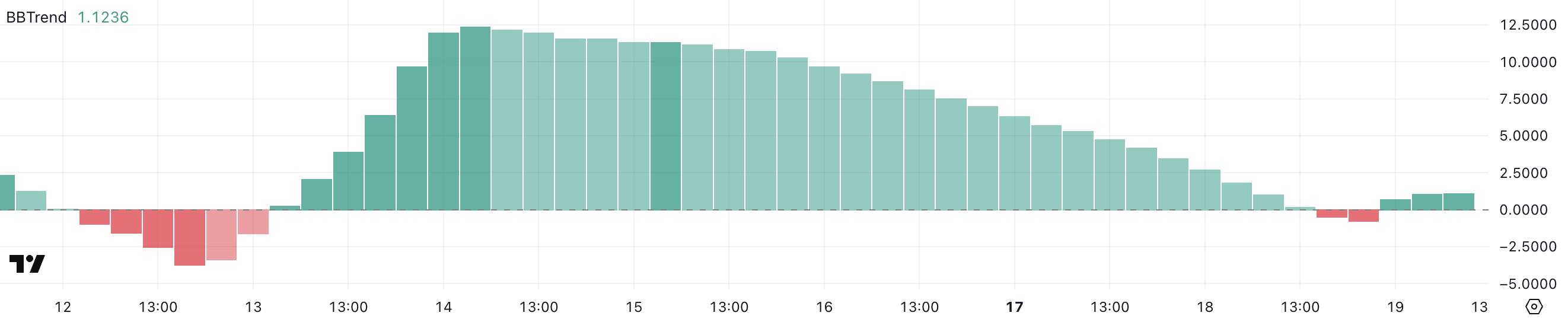

ADA BBTrend Is Again to Optimistic After Briefly Touching Unfavourable Ranges

Cardano’s BBTrend is at the moment at 1.12, recovering from a quick dip into unfavourable territory at -0.77 yesterday. Between February 13 and February 18, BBTrend remained constructive, peaking at 12.3 on February 14, indicating robust bullish momentum throughout that interval.

Nevertheless, the current decline and subsequent rebound counsel that ADA has been experiencing elevated volatility, with worth motion fluctuating between bullish and bearish phases.

Whereas BBTrend is now again in constructive territory, it stays far beneath its current peak, signaling that ADA’s momentum has weakened however has not fully shifted right into a downtrend.

BBTrend, or Bollinger Band Pattern, is an indicator that helps measure pattern energy primarily based on Bollinger Bands. It fluctuates between constructive and unfavourable values, with constructive readings suggesting an uptrend and unfavourable readings indicating bearish situations.

ADA’s BBTrend at 1.12 means that the asset is holding onto a weak bullish construction however is missing robust upside momentum. If BBTrend continues rising, it may verify renewed shopping for strain, supporting a sustained uptrend.

Nevertheless, if it turns unfavourable once more, it will point out that ADA is struggling to keep up upward momentum, growing the chance of additional consolidation or perhaps a new downtrend.

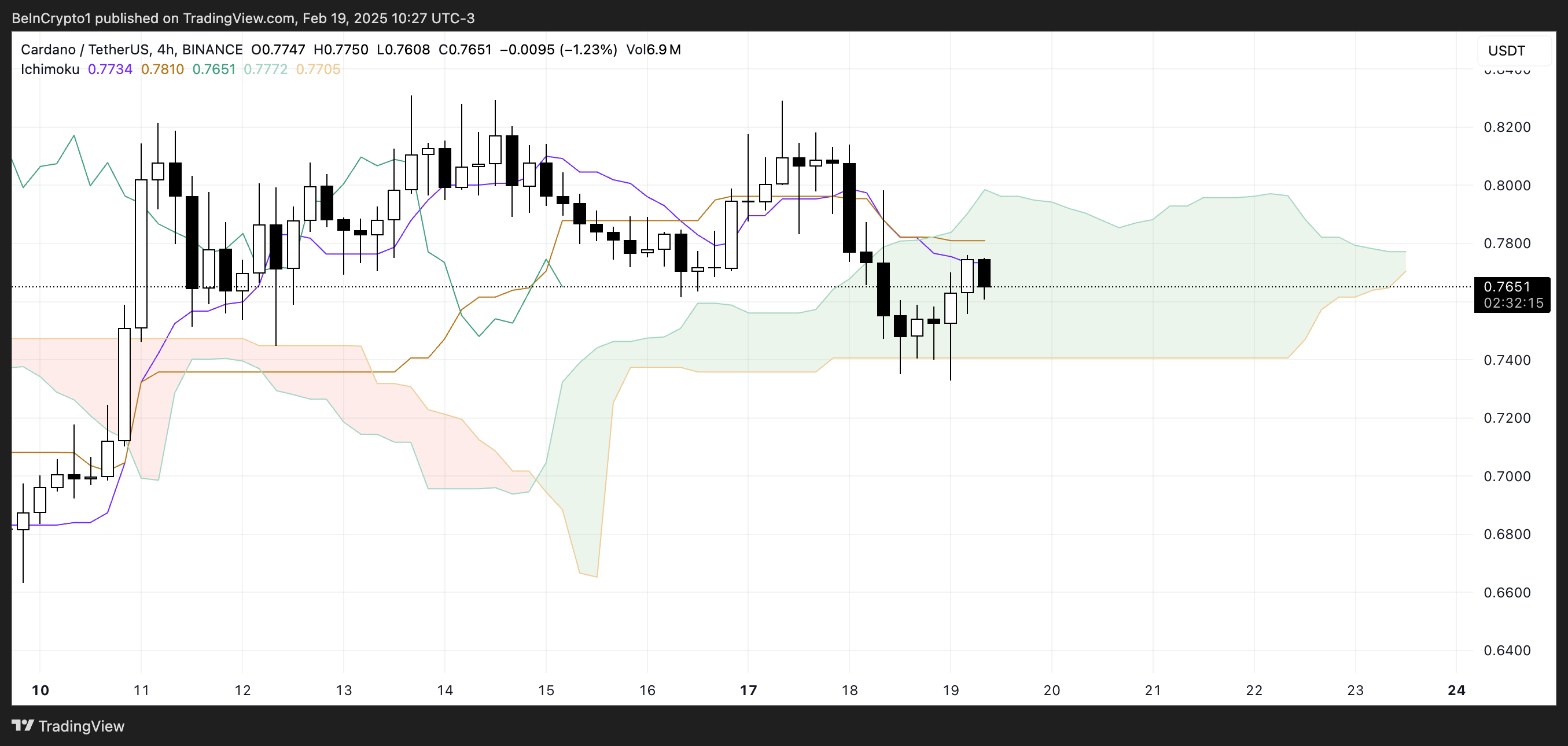

Ichimoku Cloud Exhibits a Combined State of affairs for Cardano

The Ichimoku Cloud chart for Cardano at the moment reveals a blended setup. Value is buying and selling contained in the inexperienced cloud, indicating a state of indecision.

The inexperienced cloud (Kumo) means that ADA is trying to stabilize, however with the orange Senkou Span B remaining flat, the market lacks robust momentum in both course.

The purple Tenkan-sen (conversion line) is positioned slightly below the orange Kijun-sen (baseline line), displaying that short-term momentum stays weak. ADA’s means to stay contained in the cloud means that it’s neither in a confirmed uptrend nor a downtrend, making the following breakout essential for outlining its course.

The inexperienced Chikou Span (lagging line) is barely above some previous worth motion, which hints at a possible shift towards bullish momentum, however affirmation remains to be wanted.

If the value of ADA manages to interrupt above the cloud and set up itself above the orange Kijun-sen, it may sign a pattern reversal and a transfer into bullish territory.

Nevertheless, if the value fails to carry throughout the cloud and falls beneath it, bearish strain may take over once more, resulting in additional draw back. The present Ichimoku setup suggests ADA is at a key inflection level, with its subsequent transfer doubtless figuring out the broader pattern for the approaching days.

Cardano Can Check $0.83 Quickly

Cardano is at the moment buying and selling inside an outlined vary, with resistance at $0.83 and assist at $0.65.

The short-term shifting averages are clustered carefully collectively however stay beneath the long-term ones, indicating that whereas there’s some consolidation, the general pattern remains to be missing upward momentum. If ADA manages to ignite a sustained uptrend, it may push upward to check the $0.83 resistance degree.

A profitable break above this barrier would possibly pave the best way for additional positive factors, doubtlessly reaching $0.9 after which climbing as excessive as $0.98, marking its highest degree because the finish of January.

Conversely, if the present momentum fails to materialize into a robust uptrend and bearish forces strengthen, ADA would possibly lose its assist at $0.65.

A breakdown at this key degree may expose ADA to additional declines, with the value presumably falling to round $0.5, which represents a possible 34% correction from present ranges.

Disclaimer

Consistent with the Belief Venture pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.