Hedera (HBAR) has climbed above $0.21 within the final 24 hours. Nevertheless, it’s nonetheless making an attempt to get well from a 40% correction over the previous 30 days. Regardless of this short-term rebound, technical indicators recommend that bearish momentum stays in management.

ADX readings point out that the present pattern lacks power, whereas the Ichimoku Cloud setup reinforces that resistance stays dominant. With EMAs nonetheless signaling a bearish construction, HBAR faces key ranges that would decide whether or not it continues to get well or dangers additional draw back.

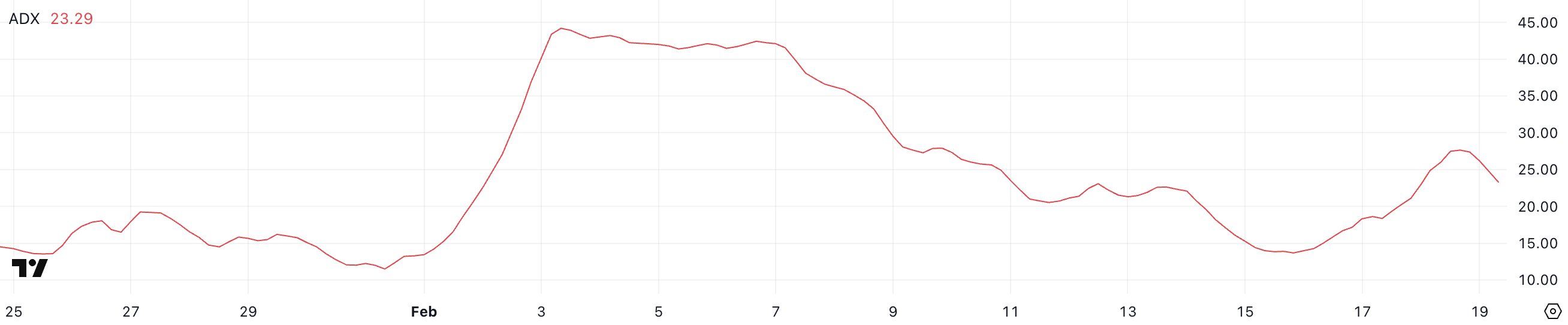

HBAR ADX Reveals the Present Development Isn’t That Sturdy

Hedera’s ADX is at the moment at 23.2, down from 27.4 yesterday after surging from 13.8 simply 4 days in the past. This current spike, adopted by a slight decline, means that pattern power has been growing however is now dropping some momentum.

ADX measures the general power of a pattern, not its path. Whereas Hedera has been making an attempt to shift from a downtrend into an uptrend, the present lower in ADX signifies that this transition is just not but firmly established.

For a powerful bullish pattern to develop, ADX would wish to carry above 25 and ideally proceed rising.

The Common Directional Index (ADX) gauges pattern power on a scale from 0 to 100. Readings above 25 point out a powerful pattern, whereas values beneath 20 recommend weak or range-bound worth motion.

Hedera ADX at 23.2 locations it slightly below the brink of a powerful pattern, that means that whereas some momentum has constructed up, it hasn’t but confirmed a definitive shift to an uptrend. If ADX begins climbing once more and strikes previous 25, it may sign that purchasing strain is strengthening and the reversal is gaining traction.

Nevertheless, if it continues to drop, it could point out that the current try to interrupt out of the downtrend is dropping steam, leaving HBAR weak to additional consolidation or perhaps a renewed decline.

HBAR Ichimoku Cloud Reveals a Bearish Setup

The Ichimoku Cloud chart for Hedera stays in a bearish setup, with the worth buying and selling beneath the purple cloud. That indicators continued draw back momentum. The cloud (Kumo) is thick and projected to stay purple, indicating sturdy resistance forward and suggesting that the bearish pattern remains to be intact.

The purple Tenkan-sen (conversion line) is now positioned beneath the orange Kijun-sen (baseline line). This displays the shortage of a confirmed bullish reversal.

Nevertheless, the worth has managed to climb above the purple Tenkan-sen. This indicators a short-term restoration try, although it stays inadequate to verify a pattern shift.

The inexperienced Chikou Span (lagging line) stays effectively beneath the worth and the cloud, displaying that the HBAR market remains to be going through residual bearish strain from earlier worth motion.

For a significant pattern reversal, the worth would wish to interrupt above the orange Kijun-sen and finally transfer into the cloud, lowering the affect of bearish momentum. If HBAR can surpass the cloud and flip it inexperienced, it could point out a possible shift towards a bullish pattern.

Till that occurs, the Ichimoku setup means that HBAR remains to be struggling to realize power. So, any upward motion wants additional affirmation earlier than signaling a sustained restoration.

Hedera Can Fall by a Additional 42% If the Downtrend Will get Stronger

Hedera’s EMA traces recommend a bearish setup, with short-term shifting averages positioned beneath long-term ones. This reinforces the continuing downtrend.

This alignment signifies that promoting strain stays dominant, making it tough for HBAR to ascertain a significant restoration until momentum shifts. The value at the moment sits close to a key help degree of $0.17. If this degree is examined and misplaced, HBAR may face a deeper decline towards $0.12, marking a possible 42% correction from present ranges.

With the EMAs nonetheless trending downward, any short-term bounces would should be met with sustained shopping for strain to problem the present bearish construction.

Nevertheless, if the worth of Hedera can reverse the pattern and short-term EMAs begin crossing above long-term ones, it may regain bullish momentum.

On this case, the primary main resistance to observe is $0.25. If that degree is damaged, HBAR may proceed climbing towards $0.35.

A sustained uptrend may even push HBAR again to $0.40, which was final seen in mid-January. That will symbolize a 90% upside from present costs.

Disclaimer

Consistent with the Belief Venture pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. All the time conduct your personal analysis and seek the advice of with an expert earlier than making any monetary choices. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.