BERA has skilled a outstanding 30% worth surge prior to now 24 hours, recovering a good portion of early February losses. Traders welcomed the rally, hoping for sustained positive factors.

Nonetheless, market indicators counsel potential headwinds that might problem the altcoin’s uptrend.

Berachain Bears Make Their Strikes

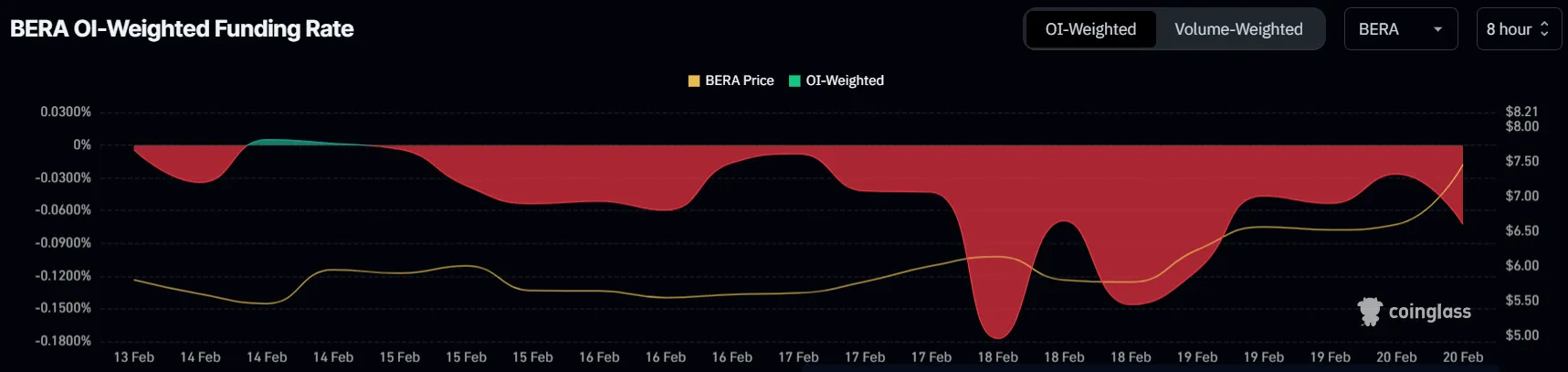

Regardless of the latest rally, BERA’s funding fee stays deeply unfavourable. This means {that a} majority of merchants are putting quick contracts towards the cryptocurrency. Such positioning means that market members anticipate a pullback within the coming days, aiming to capitalize on a possible decline.

The unfavourable sentiment underscores a cautious outlook amongst buyers. Many are hedging towards the potential for a reversal, signaling a insecurity within the sustainability of BERA’s worth enhance. As quick curiosity builds, downward strain on the altcoin might intensify.

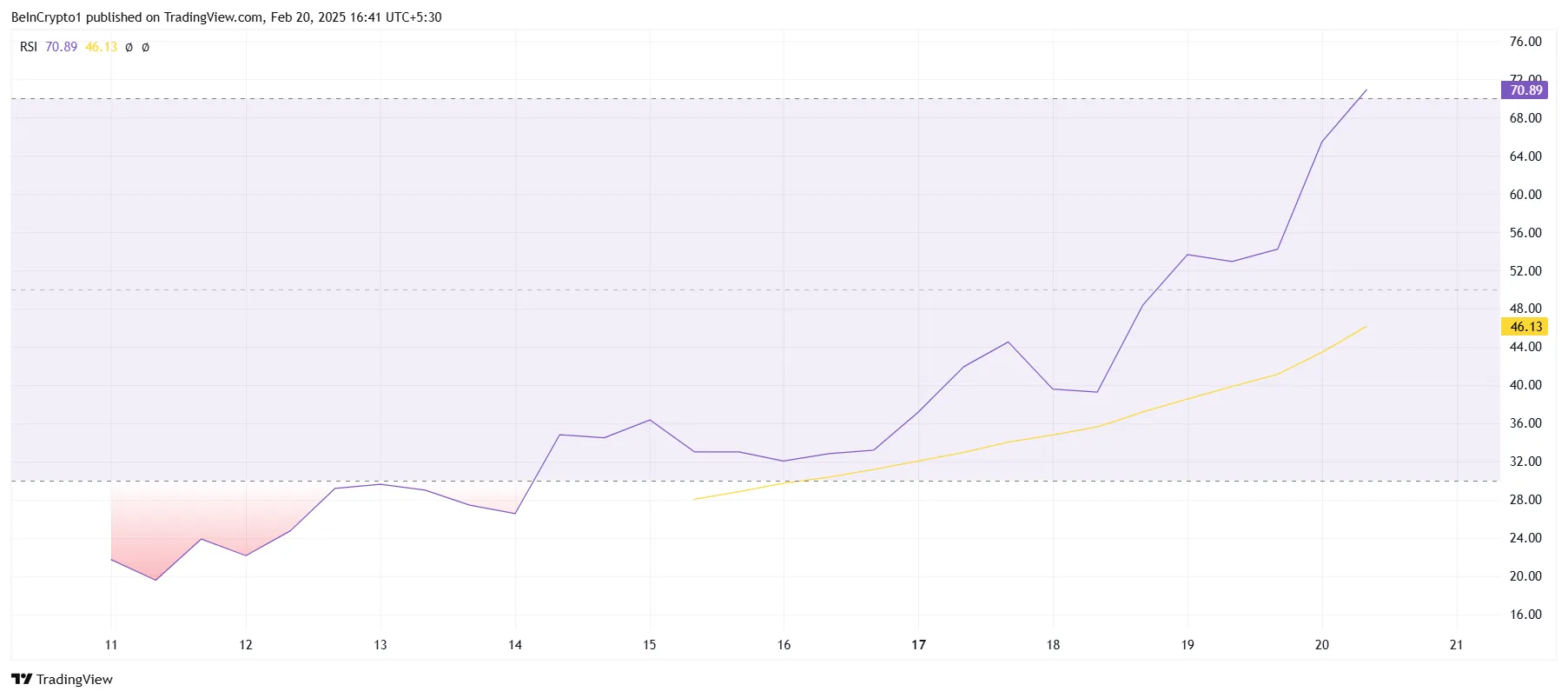

From a technical standpoint, BERA’s macro momentum presents warning indicators. The Relative Power Index (RSI) has entered the overbought zone, crossing the 70.0 threshold. Traditionally, such ranges have preceded worth corrections, as merchants take income and momentum slows.

If the RSI sustains its place on this territory, promoting strain might emerge, resulting in a possible worth reversal. Whereas bullish sentiment stays intact for now, technical alerts counsel a attainable downturn if shopping for quantity doesn’t assist additional positive factors.

BERA Worth Could Not Make A New Excessive

At the moment, BERA trades at $8.13, making an attempt to beat resistance at $8.72. The altcoin can also be working to solidify $7.71 as an important assist stage. Holding above this worth would strengthen bullish sentiment, probably paving the best way for additional positive factors.

Nonetheless, prevailing market circumstances point out a bearish outlook. The mixture of unfavourable funding charges and overbought RSI ranges means that BERA might battle to maintain its uptrend. A failure to take care of assist at $7.71 might see the altcoin testing decrease ranges, with $7.07 performing as the following important assist. If promoting strain will increase, an additional decline towards $6.24 is feasible.

However, if broader market momentum stays bullish, BERA might defy expectations. A profitable breach of the $8.72 resistance would set the stage for a retest of its all-time excessive at $9.23.

In such a state of affairs, the bearish thesis can be invalidated, and continued shopping for strain might push BERA into worth discovery mode.

Disclaimer

In keeping with the Belief Mission tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.