At the moment, roughly $2.04 billion value of Bitcoin (BTC) and Ethereum (ETH) choices are set to run out, creating important anticipation within the crypto market.

Expiring crypto choices typically results in notable value volatility. Subsequently, merchants and traders carefully monitor the developments of immediately’s expiration.

Choices Expiry: $2.04 Billion BTC and ETH Contracts Expire

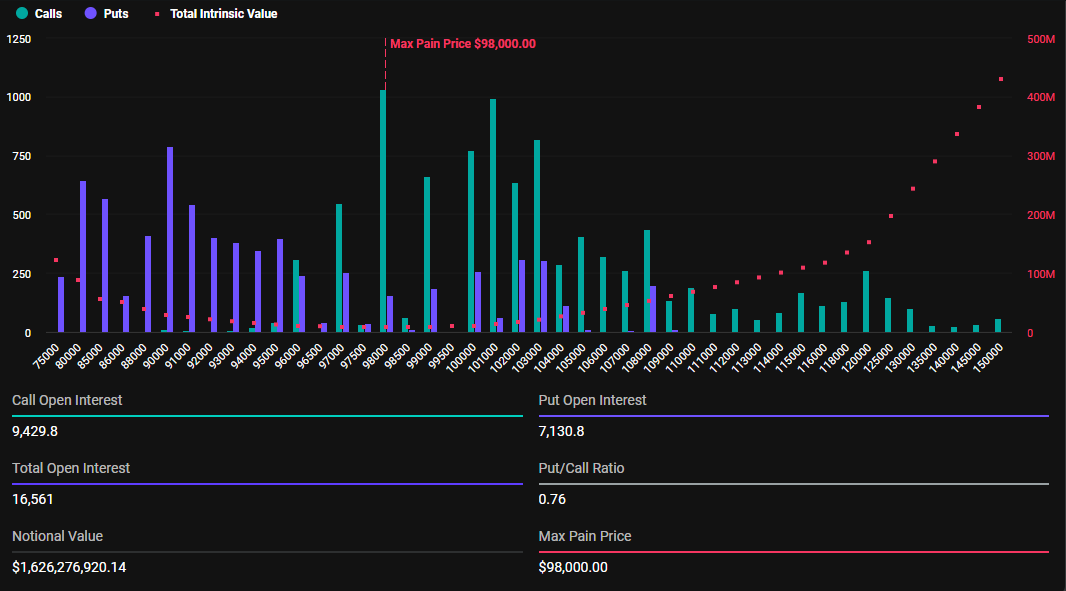

At the moment’s expiring Bitcoin choices have a notional worth of $1.62 billion. These 16,561 expiring contracts have a put-to-call ratio of 0.76 and a most ache level of $98,000.

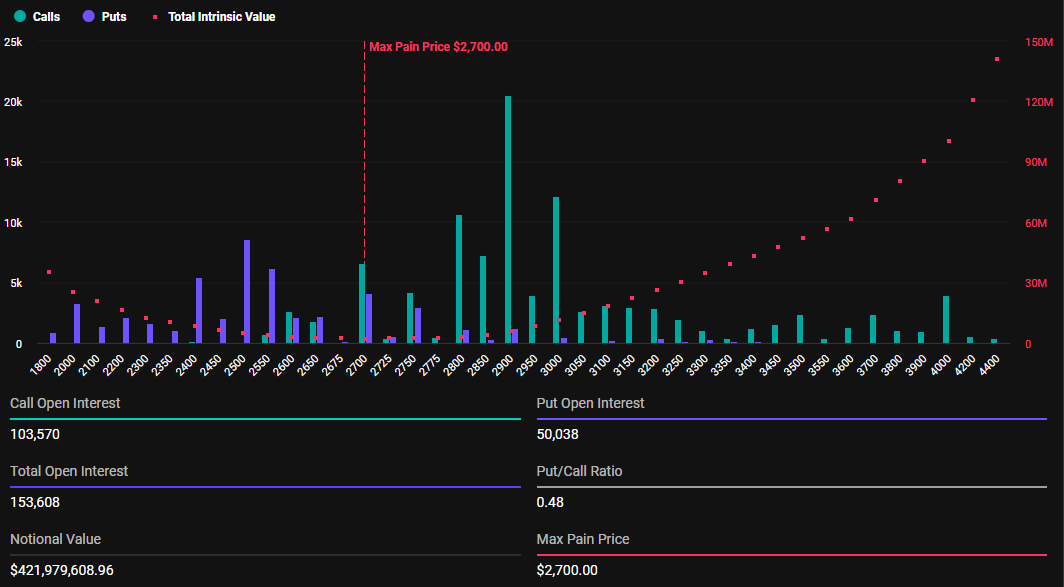

Alternatively, Ethereum has 153,608 contracts with a notional worth of $421.97 million. These expiring contracts have a put-to-call ratio of 0.48 and a max ache level of $2,700.

On the time of writing, Bitcoin trades at $98,215, a 1.12% improve since Friday’s session opened. Ethereum trades at $2,746, marking a 0.20% lower. Within the context of choices buying and selling, the put-to-call ratio beneath 1 for BTC and ETH suggests a prevalence of buy choices (calls) over gross sales choices (places).

Nonetheless, in accordance with the max ache idea, Bitcoin and Ethereum costs may gravitate towards their respective strike costs because the expiration time nears. Doing so would trigger many of the choices to run out nugatory and thus inflict “max ache”. Because of this BTC and ETH costs may register a minor correction because the choices close to expiration at 8:00 AM UTC on Deribit.

It explains why analysts at Greeks.dwell famous a cautiously bearish sentiment available in the market, with low volatility irritating merchants. They counsel ongoing concern amongst merchants and traders, notably round Bitcoin, with merchants carefully monitoring key value factors.

“The group sentiment is cautiously bearish with low volatility irritating merchants. Individuals are watching $96,500 stage with skepticism about upward momentum, whereas discussing potentialities of volatility clustering at low ranges round 40%,” the analysts wrote.

Elsewhere, Deribit warns that whereas low volatility feels secure, this sense of security is barely momentary, as markets have a tendency to not wait lengthy.

Bitcoin Value Outlook: Key Ranges and Market Outlook

Bitcoin trades round $98,243, hovering above a vital demand zone between $93,700 and $91,000. This space has beforehand acted as sturdy help, indicating patrons could step in to defend these ranges.

Alternatively, a key provide zone is positioned at round $103,991, the place promoting stress has traditionally been important. BTC has struggled to interrupt previous this stage, making it a significant resistance to look at.

From a value motion perspective, BTC has been forming decrease highs and decrease lows, suggesting a short-term bearish pattern. Nonetheless, the current value motion hints at a doable reversal, as BTC is making an attempt to bounce off its demand zone.

The amount profile additionally exhibits important buying and selling exercise close to $103,991, reinforcing the resistance stage. In the meantime, a noticeable low quantity space close to $91,000 means that if BTC breaks beneath this stage, a pointy drop may observe as a result of lack of sturdy help.

In the meantime, the Relative Energy Index (RSI) is presently at 50.84, indicating impartial momentum. Whereas BTC is just not overbought or oversold, the RSI’s slight upward pattern may sign rising shopping for curiosity.

If Bitcoin holds above the $93,700 help zone, it could try a push in direction of the $100,000 milestone. Nonetheless, a breakdown beneath $91,000 may set off a transfer decrease, probably testing the $88,000 to $85,000 vary.

Disclaimer

In adherence to the Belief Venture tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nonetheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.