Solana (SOL) Whole Worth Locked (TVL) just lately hit $9.90 billion, the bottom degree since November 2024, earlier than recovering barely to $10.3 billion. Regardless of this bounce, SOL’s TVL stays down almost 30% from January 18, reflecting ongoing considerations about its ecosystem.

SOL’s worth can also be below stress, down greater than 8% within the final seven days and over 31% previously 30 days. Technical indicators are exhibiting indicators of restoration, however bearish traits are nonetheless dominant, with SOL buying and selling beneath key resistance ranges.

Solana TVL Reached Its Lowest Ranges Since November 2024

Solana’s Whole Worth Locked (TVL) is presently at $10.3 billion, recovering from a low of $9.90 billion on February 17, the bottom degree since November 14, 2024. Regardless of this rebound, TVL continues to be down almost 30% from $14.2 billion on January 18, reflecting decreased investor confidence.

This decline coincides with controversies surrounding Solana ecosystem, together with accusations of being too extractive and criticism over the launch of the meme coin LIBRA, which has contributed to the outflow of capital.

Monitoring TVL is essential as a result of it reveals the full capital locked in a blockchain’s DeFi ecosystem, indicating liquidity and investor confidence. Though Solana’s TVL has recovered barely, the sharp drop over the previous month highlights ongoing considerations.

If these points aren’t addressed, continued capital outflows might stress SOL’s worth and sluggish its restoration. Conversely, if confidence is restored, a rising TVL might sign renewed curiosity and assist for SOL.

Solana Indicators Are Nonetheless Bearish However Recovering

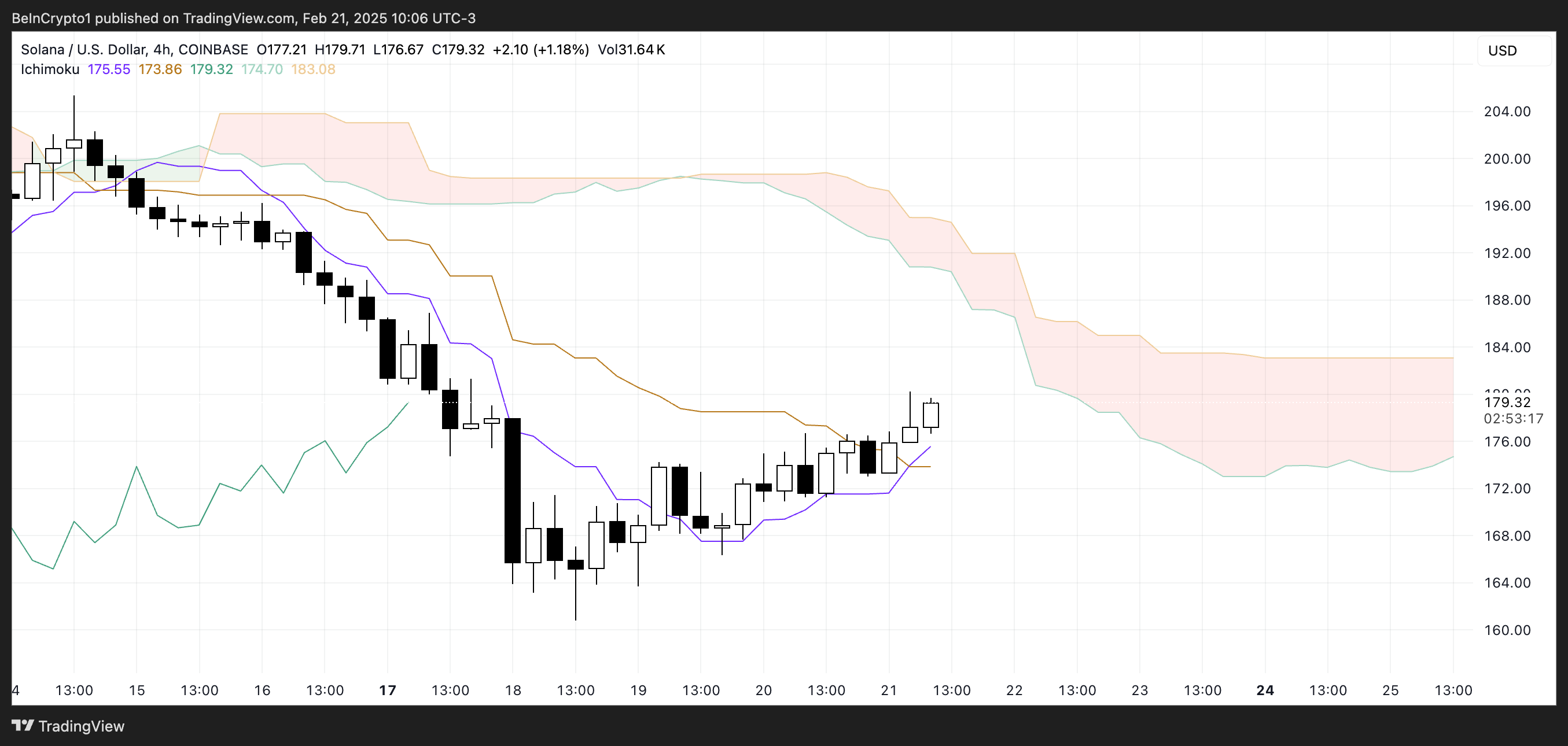

Solana’s Ichimoku Cloud chart reveals that the value is presently beneath the purple cloud, indicating that the bearish pattern continues to be dominant. Nonetheless, the value is now buying and selling above the blue Tenkan-sen (conversion line) and the orange Kijun-sen (bottom line), suggesting that bearish momentum is weakening.

This might point out a possible short-term restoration as patrons are beginning to acquire some management. However, the thick purple cloud overhead acts as a powerful resistance, which Solana would wish to interrupt by to verify a bullish reversal.

On this case, the truth that Solana stays below the purple cloud means that the general downtrend is just not but reversed.

Nonetheless, if the value can break above the cloud, it might be a powerful bullish sign. Conversely, failure to interrupt the resistance might result in renewed promoting stress, persevering with the bearish pattern.

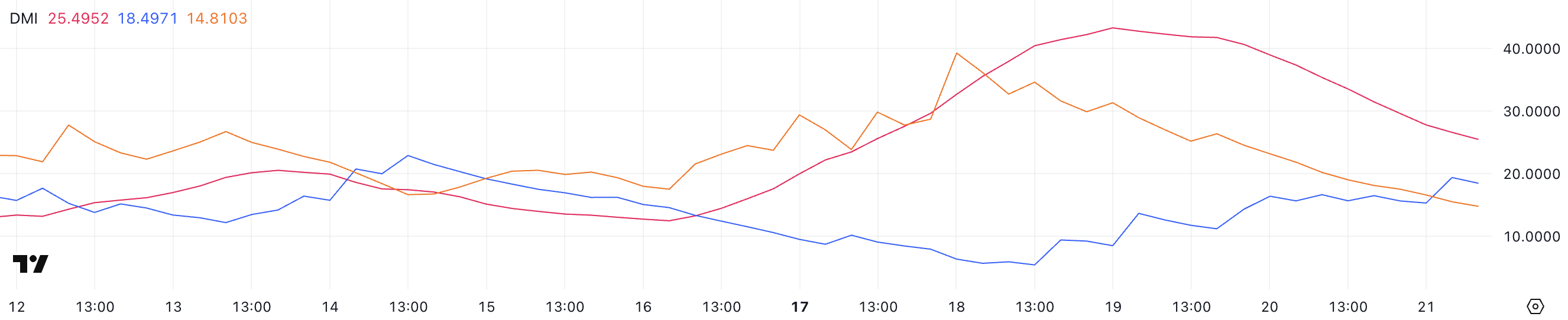

Solana’s Directional Motion Index (DMI) chart reveals that its Common Directional Index (ADX) is presently at 25.4, down from 43 simply two days in the past when SOL’s worth dropped to round $165.

This decline in ADX signifies that the power of the downtrend is weakening, though the pattern itself continues to be current. An ADX above 25 usually indicators a powerful pattern, however the lowering worth means that bearish momentum is shedding energy. This might doubtlessly result in a consolidation part.

In the meantime, the +DI is at 18.4, rising from 5.4 three days in the past, whereas the -DI is at 14.8, dropping from 39.2 over the identical interval. This shift reveals that purchasing stress is step by step rising as promoting stress declines. If +DI continues to rise above -DI, it might point out a possible pattern reversal.

Nonetheless, since SOL continues to be in a downtrend, it might want sustained shopping for momentum to interrupt the bearish sample. If +DI fails to take care of its upward motion, the downtrend might resume.

Solana Can Reclaim $200 Ranges If The Downtrend Is Reverted

Solana’s Exponential Transferring Common (EMA) traces nonetheless point out a bearish pattern, because the short-term EMAs are beneath the long-term ones. Nonetheless, the course of those traces has began to shift barely since yesterday, with Solana worth rising by 4%.

This implies that promoting stress is weakening and that purchasing curiosity is step by step returning. If this momentum continues, it might result in a pattern reversal. Nonetheless, that may require the short-term EMAs to cross above the long-term ones.

If SOL can totally reverse the present downtrend, it might first check the resistance at $183. A profitable break above this degree would sign a stronger bullish momentum, doubtlessly pushing the value to the subsequent resistance at $197.

If shopping for stress continues to construct, SOL worth might even goal $220, representing a big restoration.

Conversely, if the downtrend persists and promoting stress intensifies, SOL might retest the assist at $159.

A break beneath this degree would point out a continuation of the bearish pattern. That may result in a drop in direction of $147, its lowest degree since October 2024.

Disclaimer

Consistent with the Belief Undertaking pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.