Technique co-founder Michael Saylor has prompt that the U.S. may buy 20% of the Bitcoin provide “at no cost,” and that proudly owning 4 to six million BTC would “repay your complete nationwide debt.”

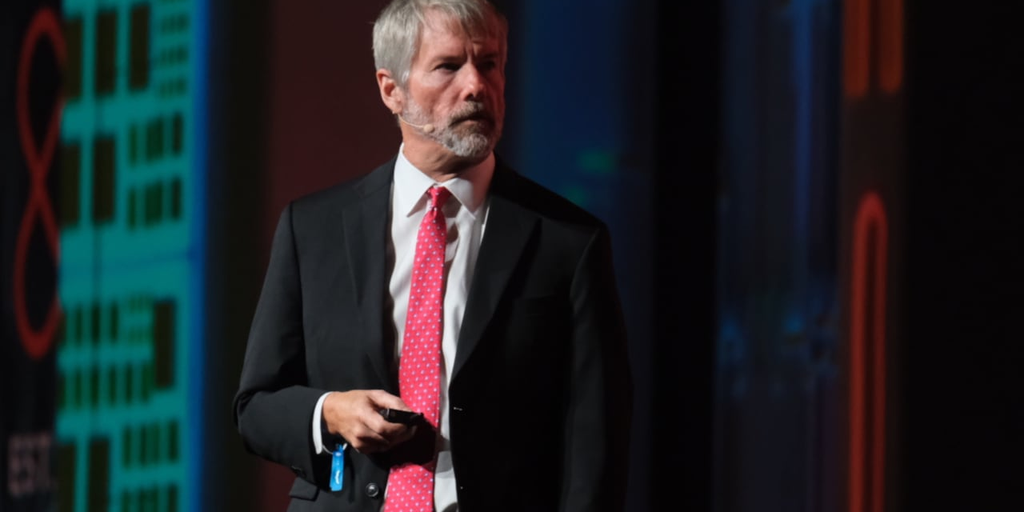

Showing on the annual CPAC convention, Saylor spoke in favor of a strategic Bitcoin reserve, arguing that “the greenback would strengthen” if the U.S. federal authorities created such a stockpile.

He additionally warned that not pursuing such a coverage would danger the U.S. falling behind different nations, claiming that “there’s solely room for one nation-state to purchase up 20% of the community.”

He mentioned, “you wouldn’t need the Saudis shopping for it first, or the Russians, or the Chinese language or the Europeans.”

Saylor’s remarks come as a number of U.S. states transfer nearer to mandating their very own Bitcoin reserves, with one invoice in Utah most not too long ago receiving a good advice from the state’s Senate Income and Taxation Committee.

The remarks additionally come a month after President Donald Trump signed an order making a working group that can take into account the potential of a federal Bitcoin reserve.

Saylor emphasised that the U.S. authorities may purchase up 20% of Bitcoin’s provide “like that,” together with his remark about shopping for BTC “at no cost” presumably a reference to the U.S. authorities’s skill to situation an indefinite provide of {dollars} by way of Treasuries.

Presently, the U.S. authorities holds round 183,422 BTC (almost 1% of the cryptocurrency’s provide), whereas the British authorities owns 61,245 BTC (and the German authorities offered round $2.8 billion in BTC final 12 months).

In the meantime, Saylor’s agency – the not too long ago rebranded Technique – holds over 430,000 BTC, giving it the biggest Bitcoin holdings of any publicly traded firm wherever on this planet.

Saylor had beforehand pitched a Bitcoin reserve technique to Microsoft’s board of administrators, suggesting in a December presentation that the tech large may create as a lot as $5 trillion in shareholder worth (by 2034) by accumulating BTC.

Thus far, neither Microsoft nor some other Huge Tech agency has taken Saylor’s recommendation, and whereas sure lawmakers within the U.S. and elsewhere have made noises about BTC reserves, some observers are skeptical that such noises will ever grow to be a significant actuality.

Requested whether or not he agrees with Saylor’s claims that the U.S. may simply purchase up 20% of all Bitcoin, and that it could profit the U.S. greenback, longtime crypto skeptic and creator David Gerard takes a a lot much less bullish stance.

“There isn’t any believable cause why both of those could be true or how the U.S. would profit from all that Bitcoin,” he tells Decrypt. “Saylor is advocating for U.S. authorities worth assist for Bitcoin and that is all.”

Different, extra sympathetic voices have additionally begun expressing doubt as as to if a nationwide Bitcoin reserve would ever occur or be prudent.

On Wednesday, MIT Cryptoeconomics Lab founder Christian Catalini penned a weblog for the OMFIF suppose tank through which he argues that Bitcoin doesn’t meet the mandatory standards for a reserve asset.

“Strategic reserves are supposed to guarantee stability and supply fast entry throughout a disaster,” he writes. “Nations retailer {dollars} or oil as a result of they want them to repay money owed, settle cross-border obligations and maintain important techniques working when provide chains falter.”

Maybe extra fatally, he additionally argues in opposition to Saylor by suggesting that stockpiling Bitcoin would hurt the U.S. greenback’s standing because the world’s reserve foreign money.

“If the U.S. started amassing Bitcoin on a big scale, it is likely to be seen as a hedge in opposition to the greenback itself – elevating alarms and giving rivals like China or Russia a gap to say that the U.S. not trusts its personal foreign money,” he says.

Such considerations solid a shadow over the current championing of BTC reserves by evangelists equivalent to Saylor and Technique, which continues to build up Bitcoin frequently.

And for David Gerard, Saylor’s feedback yesterday are much less about looking for a giant purchaser for his agency’s personal Bitcoin reserves, and extra about offering additional credibility for its present enterprise technique.

He tells Decrypt, “Microstrategy’s deal appears to be leveraging Bitcoin right into a proxy for {dollars} so insiders can promote firm inventory in scheduled gross sales.”

Final month, Technique’s shareholders voted to extend the corporate’s Class A shares from 330 million to 10.3 billion, coming as a part of efforts to lift $46 billion by promoting a mixture of equities and bonds.

Such an alleged technique has precedent inside the cryptocurrency business, though Gerard warns that it doesn’t all the time finish properly.

He says, “The identical course of occurred with Bitcoin miners within the 2021-2022 bubble: the businesses would discuss Bitcoin slogans, however for those who seemed on the flows of money it was about insiders creating wealth from [stock] buyers who ought to have identified higher, with the exit being chapter or in any case restructuring.”

Edited by Stacy Elliott.

Each day Debrief Publication

Begin day-after-day with the highest information tales proper now, plus unique options, a podcast, movies and extra.