Pi Community’s PI Token formally debuted on February 20, marking a serious milestone for the challenge.

Nevertheless, the long-awaited launch led to intense promoting stress as early adopters tried to money in, inflicting a pointy drop in worth.

By February 21, the PI had collapsed to $0.60, however the decline was short-lived. The token recovered with sturdy momentum, fueled by renewed investor curiosity.

On the time of writing, PI is buying and selling at $1.52, reflecting a 160% restoration from the low level. This surge is principally because of rising demand, with hypothesis surrounding a potential itemizing on Binance enjoying a key position.

As of February 22, over 212,000 votes had been solid on whether or not PI must be listed on Binance, with over 86% in favor. Because the voting involves a detailed, many buyers are anticipating an official itemizing, which might additional enhance the token’s worth.

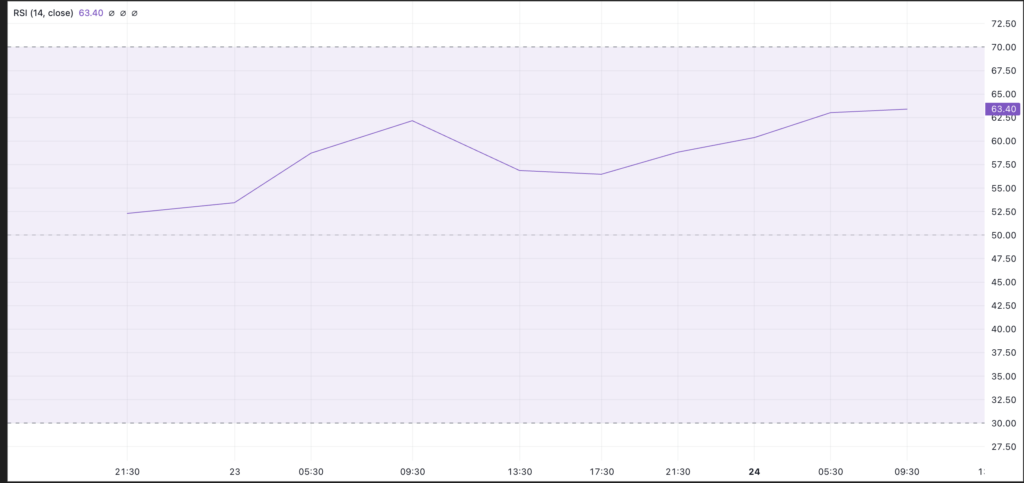

Technical indicators additionally level to rising bullish sentiment. The PI Relative Power Index (RSI), which tracks momentum, is at 63.40 on the four-hour chart, signaling sturdy shopping for stress.

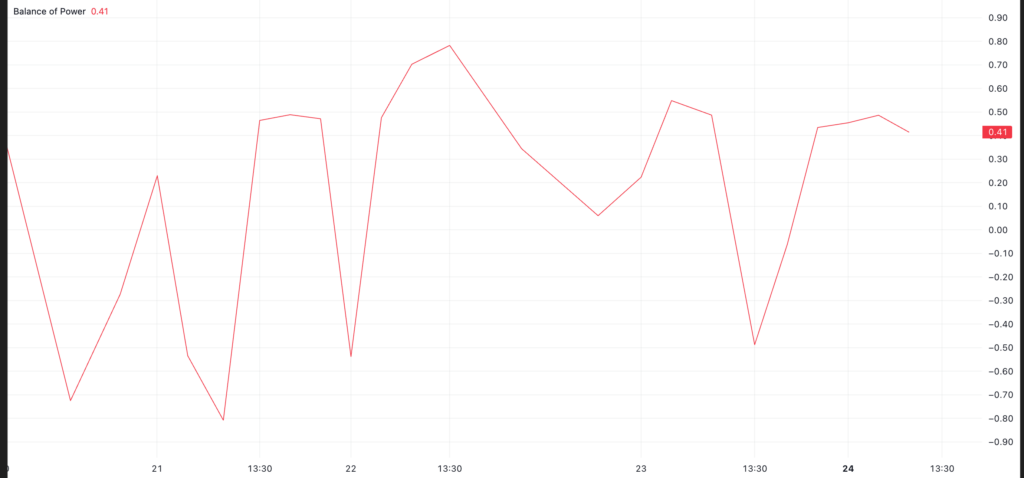

Moreover, the Steadiness of Energy (BoP) indicator, which measures the energy of consumers versus sellers, is at 0.41, reinforcing the optimistic outlook. When this indicator is optimistic, it means that consumers are in management, growing the chance of continued worth good points.

Since its launch, PI has maintained an upward trajectory, buying and selling above a key uptrend line. This sustained bullish momentum is proof that buyers proceed to help greater costs. If the development holds, PI might break the $2 mark and ultimately attain its earlier excessive of $2.20.

Nevertheless, any sharp improve in profit-taking might disrupt this outlook. If promoting stress intensifies, PI might break beneath $1.50, with additional declines resulting in $1.34.

For now, motion within the PI market stays sturdy, with merchants watching carefully for any indicators of additional good points – or an imminent correction.