Automated Market Makers (AMMs), BNB Ecosystem Cash, and AI are the highest three crypto narratives to look at for the final week of February. AMMs are going through a difficult week, with all high seven cash in crimson, however potential catalysts like Unichain’s development and competitors in Solana’s DEX area maintain them related.

The BNB ecosystem is gaining momentum with CZ’s renewed advocacy, an AI-focused roadmap, and surging exercise on PancakeSwap. In the meantime, the AI narrative is displaying combined alerts. Whereas the broader AI crypto market struggles, tasks like Story (IP), CLANKER, FORT, and BNKR are capitalizing on area of interest use circumstances.

Automated Market Makers (AMMs)

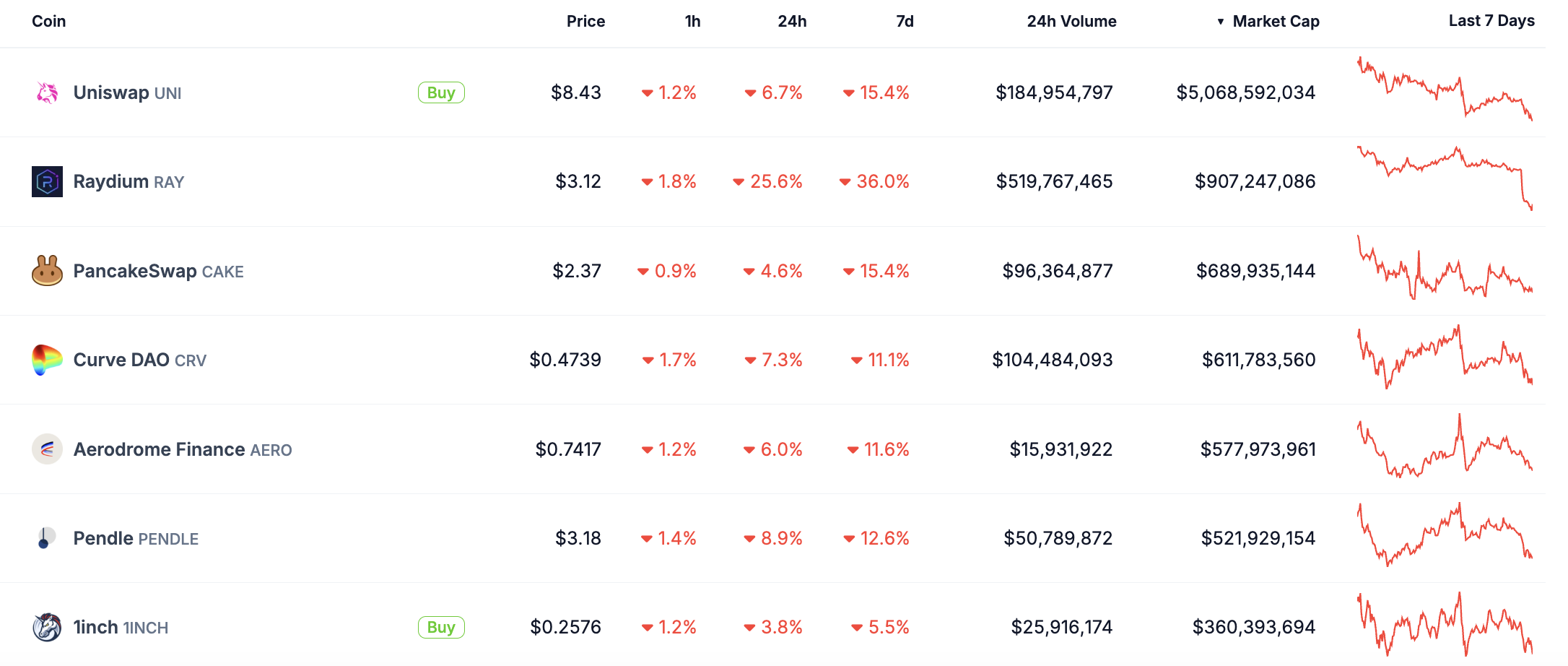

AMMs cash have had a tough week, with all seven high seven cash in crimson. Automated Market Makers are decentralized exchanges that permit customers to commerce digital belongings with out utilizing a conventional order ebook.

They depend on liquidity swimming pools, the place customers present funds that facilitate buying and selling and earn charges in return. This mannequin enhances liquidity and removes the necessity for centralized intermediaries, making AMMs a vital a part of decentralized finance (DeFi).

RAY is the most important loser among the many high AMMs. Rumors about Pumpfun launching their very own AMM answer might influence Raydium’s utilization and payment technology, inflicting its worth to fall virtually 30% in simply 24 hours.

UNI and CAKE are each down 15%, because the market doesn’t appear enthusiastic about Uniswap’s new chain, Unichain. Moreover, CAKE is correcting after its latest surge alongside the rising BNB ecosystem.

Nonetheless, RAY continues to be a dominant pressure in Solana, which may lead some customers to query whether or not the latest drop isn’t an overreaction.

Chris Chung, founding father of Solana decentralized change aggregator Titan believes that this may very well be good for the Solana ecosystem in any case.

“The truth that pump.enjoyable is creating its personal automated market maker (AMM) isn’t any shock – it’s an apparent enterprise transfer. They’ve created a lot quantity with meme coin buying and selling that it was solely a matter of time earlier than they constructed infrastructure to benefit from the charges. This creates competitors for Jupiter and Meteora, however Raydium is probably the most affected, given meme cash make up nearly all of the quantity on Raydium,” Chung instructed BeInCrypto.

Additionally, Unichain is in its early days, and a brand new altcoin season might enhance its utilization. Moreover, the BNB ecosystem seems to have constructed good momentum in the previous couple of weeks, which might set the stage for a CAKE worth restoration.

All that mixed makes AMMs some of the attention-grabbing crypto narratives for this week.

“Now that competitors within the Solana DEX area is heating up, exchanges will doubtless begin competing for token listings. Some count on this to result in decrease charges, however I consider we’re extra prone to see different incentives, like income sharing, token allocations past liquidity pool charges, or promoting assist. DEXs have massive treasuries and we’re going to see them dipping into these to make their providing stand out,” mentioned Chung.

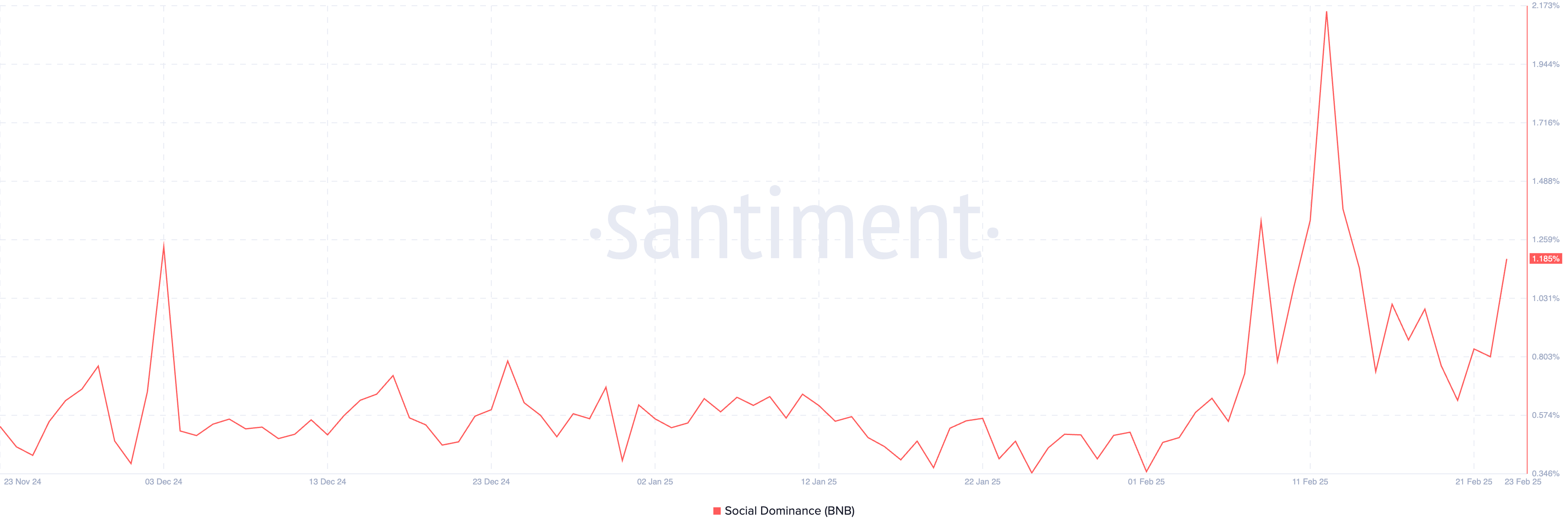

BNB Ecosystem Cash

BNB chain has been within the highlight not too long ago as CZ has renewed his advocacy for the community. The chain launched an AI-focused roadmap and a brand new answer to make it simpler for customers to launch new cash.

These developments for the BNB chain additionally align with different crypto narratives, comparable to meme cash and synthetic intelligence.

PancakeSwap, the biggest decentralized change on the BNB ecosystem, skilled a surge in charges, leaping from $2 to $3 million in early January to persistently staying above $4 million and even reaching $18 million on some days since January 16.

This development displays elevated exercise and curiosity within the BNB chain.

The chain has additionally seen the rise of trending meme cash, comparable to BROCCOLI, impressed by CZ’s canine, and TST, which has develop into one of many greatest native meme cash on the BNB chain.

If this momentum continues, it might entice extra builders and new cash to the chain, benefiting present merchandise and altcoins throughout the ecosystem.

Synthetic Intelligence

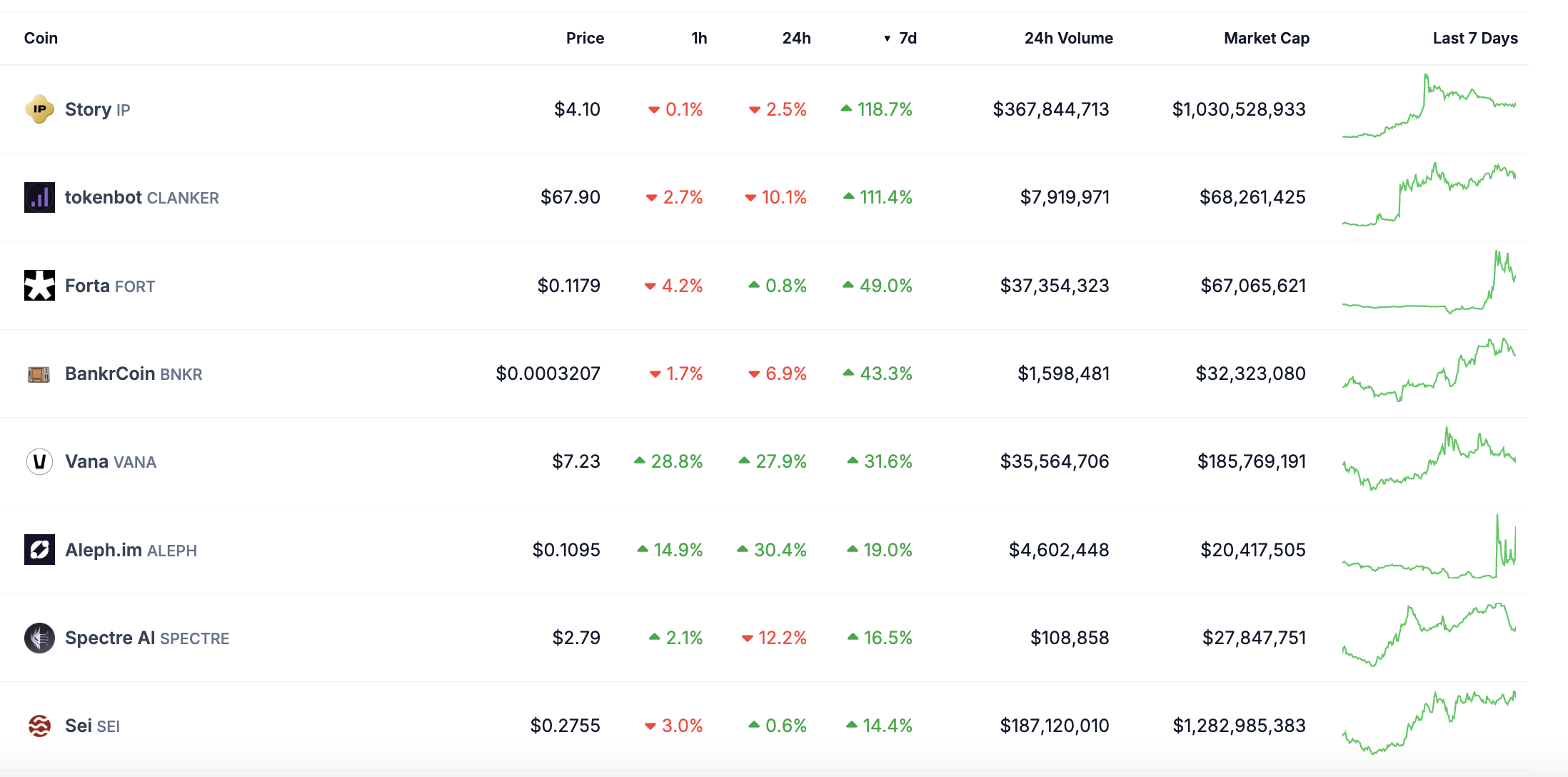

Though a number of AI cash are struggling, with RENDER, FET, and VIRTUAL all registering double-digit losses within the final seven days, some particular segments are managing to rise regardless of the general narrative correction.

Story (IP) is a standout performer, up roughly 120% within the final week. It has develop into some of the trending altcoins and rapidly reached a $1 billion market cap. Equally, CLANKER, one in all Base’s greatest coin launchpads, is up 111%, reaching its highest worth ranges since early January 2025.

FORT is up 49%, leveraging on its safety crypto firewall following the Bybit hack. BNKR has additionally gained 43%, capitalizing on the narrative round crypto AI brokers and crypto companions.

Perhaps the market is signaling that merely branding as an “AI coin” isn’t sufficient anymore. This shift might open up more room for cash which might be turning into extra particular about their use circumstances and never simply defining themselves as a “crypto AI framework” or a “crypto AI agent coin.”

The submit Prime 3 Crypto Narratives to Watch For the Final Week of February appeared first on BeInCrypto.