This morning the crypto market awakened in crimson panic mode, dragged down by a distinctly bear value motion. Bitcoin misplaced the important thing help of $90,000 whereas Ethereum fell under the psychological threshold of $2,500.

What are the causes which can be resulting in such a big retracement of the crypto sector? Are we on the daybreak of the start of a brand new bear market?

Let’s take a deep breath and calmly analyze your complete scenario.

Massacre for the crypto market: BTC -7.4%, ETH -10.8%

The crypto market simply doesn’t wish to get better: after a month of deep corrections, right here comes one other heavy decline. Within the final 24 hours, Bitcoin loses 7.4%, dropping from $95,000 to the present $88,000. Ethereum, then again, information a double-digit proportion drawdown, failing the assault on $2,700 and collapsing under $2,400. Total, the capitalization of your complete digital asset sector has misplaced $146 billion, with a contraction of about 5%.

Even on the altcoin entrance, we don’t see optimistic alerts: in the meanwhile we will solely draw a veil over all these cash which have virtually worn out the income of the final bull wave. SOL drops by 14.2% approaching 130 {dollars}, XRP falls by 13.3% to 2.1 {dollars}, and DOGE loses 12.1% returning to 0.19 {dollars}. Solely Pi community and a few stablecoin handle to keep up a impartial value construction, whereas remoted instances like BNB register much less intense declines in comparison with these of the bear benchmark Bitcoin.

Scenario on the open curiosity and funding fee facet: the place are we headed?

Very attention-grabbing to focus on how the open curiosity of just about all crypto belongings is scaling downwards. Whereas the decline noticed yesterday appeared pushed by a speculative spirit, justified by the rise in futures positions, on this case plainly a number of gamers are exiting the market. On BTC, for instance, in keeping with Coinalyze information, we discover a big drop of about 2 billion {dollars} in open curiosity, approaching new month-to-month lows at 28.2 billion {dollars}.

On the similar time, the funding fee has remained in optimistic territory throughout all crypto belongings, which implies that longs proceed to pay shorts to maintain their positions open. This fuels a state of affairs of curiosity from spinoff alternate buyers, who nonetheless discover the seek for a bull sample interesting. This development seems extra pronounced on cash like HYPE, XRP, and DOGE.

The scenario on the macro entrance stays bullish, particularly for Bitcoin which, in contrast to altcoins, had not but fallen so aggressively. There are nonetheless all of the situations in place for a brand new potential bullish leg up, even when within the quick time period the ball is managed by the bears. At this level, a return above 100,000 {dollars} would supply the orange forex the arrogance wanted for a brand new rally. Quite the opposite, nonetheless, a drop under 75,000 {dollars} (EMA 50 weekly) would improve the probabilities of an prolonged bear market.

What are the components triggering the bear market?

Within the midst of this bear storm, buyers are in search of a scapegoat accountable for the crypto market crash. Though we can not say with certainty that there was a selected occasion that triggered the dump, we will nonetheless delve into the affect of some eventualities which have hit the business in latest days.

To start with, there was the $1.4 billion hack at Bybit which contributed to making a local weather of uncertainty, which then resulted in a promoting development. Though there have been no direct penalties for Bybit buyers, many customers have been frightened by the incident, evaluating the episode to the FTX saga. Moreover, some inaccuracies leaked on X, erroneously explaining how the hackers would have offered all of the stolen ether available on the market. This hoax facilitated the market decline, serving to to convey FUD.

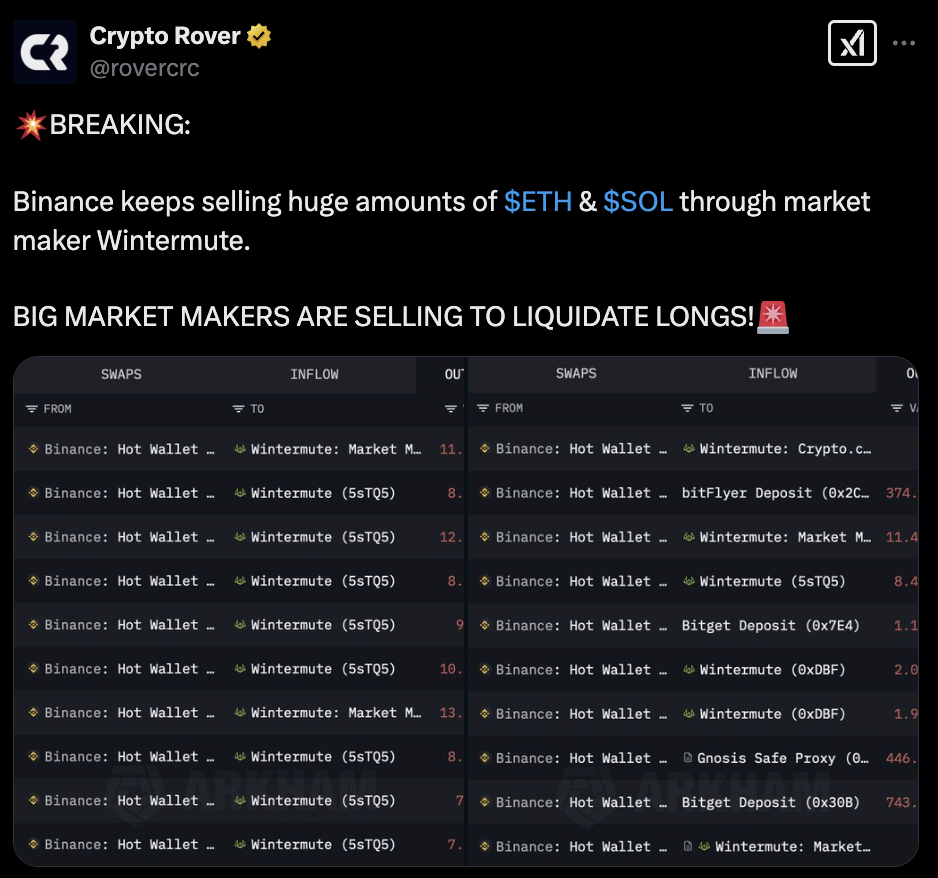

One other issue that partly explains at present’s decline is represented by the steady gross sales of the large market maker Wintermute. The latter, which supplies liquidity for buying and selling on a variety of exchanges, has chosen in latest hours to liquidate massive positions of BTC, ETH, and SOL available on the market, creating sturdy downward promoting stress.

Consequently, there have been cascades of liquidations of lengthy positions, which have accelerated the bearish dynamic. Within the final 24 hours, in keeping with Coinglass information, we discover liquidations amounting to 1.47 billion {dollars}, of which 1.36 billion got here from longs. Over 600 million have evaporated from Bitcoin futures whereas about 300 million have been worn out on Ethereum.

The one doable remark in such circumstances is: REKT!