- The SEC has ended its investigation into Uniswap Labs, deciding to not pursue enforcement motion.

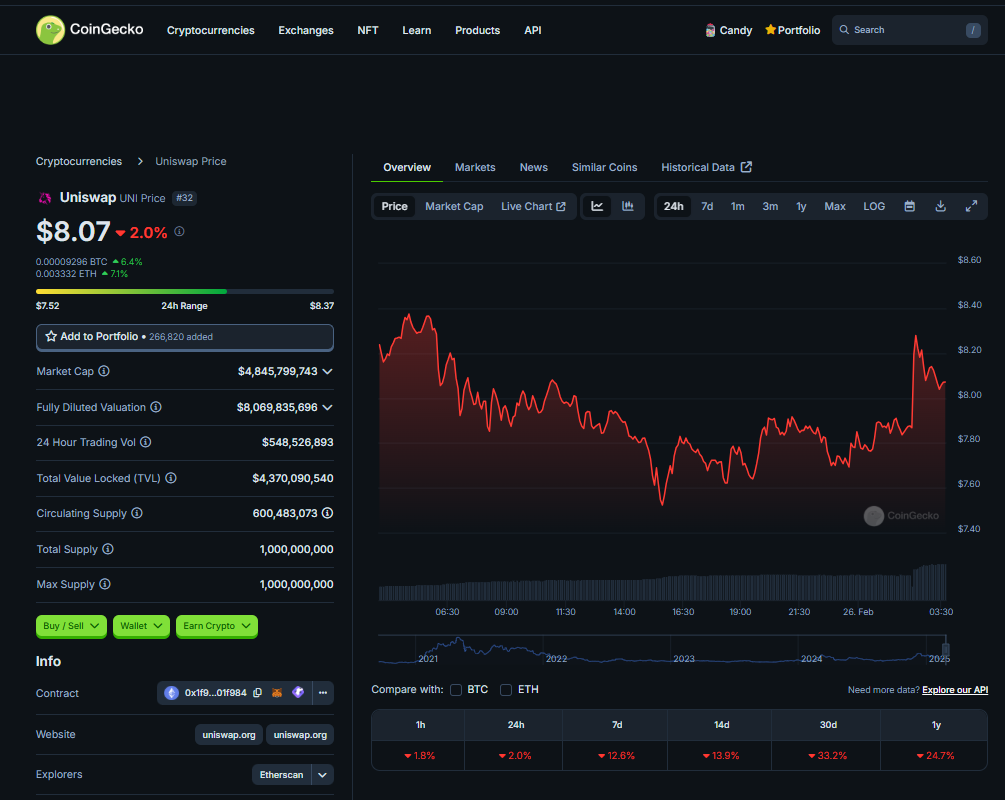

- UNI token jumped 4.6% on the information, although it stays down 0.5% over the previous 24 hours.

- Uniswap v4 launched in January 2025, introducing new developer instruments, safety audits, and a $15M bug bounty.

Uniswap simply dodged a serious regulatory bullet. The SEC has formally ended its investigation into the decentralized trade’s creator, Uniswap Labs, and gained’t be pursuing enforcement motion, based on a Wall Avenue Journal report.

The choice comes months after Uniswap obtained a Wells discover in April 2024, which had signaled potential authorized hassle over allegations that:

- Uniswap was working as an unregistered securities trade.

- Its UNI token might need been an unlawful securities providing.

Again in Could 2024, Uniswap Labs pushed again exhausting, arguing that the protocol doesn’t match the SEC’s definition of an trade. Seems like that protection held up.

UNI Token Jumps on the Information

Merchants reacted immediately—UNI spiked 4.6% in an hour, although it’s nonetheless down 0.5% over the previous 24 hours, per CoinGecko knowledge.

This information comes simply weeks after Uniswap launched v4 in January 2025, an improve that:

- Expanded Uniswap right into a full developer platform.

- Introduced in new customizable options & safety audits.

- Supplied a $15M bug bounty to strengthen safety.

For now, Uniswap Labs can breathe straightforward—however the larger image? Regulatory strain on DeFi isn’t going away anytime quickly.