Este artículo también está disponible en español.

In a memo launched on February 25, 2025, Matt Hougan—Chief Funding Officer (CIO) at Bitwise Asset Administration—drew putting parallels between as we speak’s crypto market and what he noticed in July 2024. Titled “Quick-Time period Ache, Lengthy-Time period Acquire (Redux),” Hougan’s newest evaluation means that, regardless of the present pullback, the trade’s underlying fundamentals stay as compelling as ever.

Crypto Echoes Of July 2024

Hougan opened his memo by recalling the surroundings in July 2024, when he penned an earlier piece referred to as “Quick-Time period Ache, Lengthy-Time period Acquire.” Again then, crypto markets have been reeling: “Bitcoin, which had peaked above $73,000 in March 2024, had fallen to roughly $55,000, a 24% pullback. Ethereum was down 27% over the identical time interval.”

On the time, Hougan famous that “the crypto market is dealing with a bizarre dynamic proper now. All of the short-term information is unhealthy, and all of the long-term information is nice.” He additionally cited catalysts similar to potential ETF inflows, the upcoming Bitcoin halving, and extra supportive policymaking in Washington, D.C., contrasting them with then-immediate dangers like Mt. Gox distributions and authorities gross sales of Bitcoin.

Associated Studying

That evaluation proved well timed. “Shortly after I wrote the memo, Bitcoin bottomed and proceeded to tear straight to $100,000,” Hougan wrote. In his newest be aware, he sees an identical duality at play: destructive short-term developments on one hand, and highly effective long-term tailwinds on the opposite.

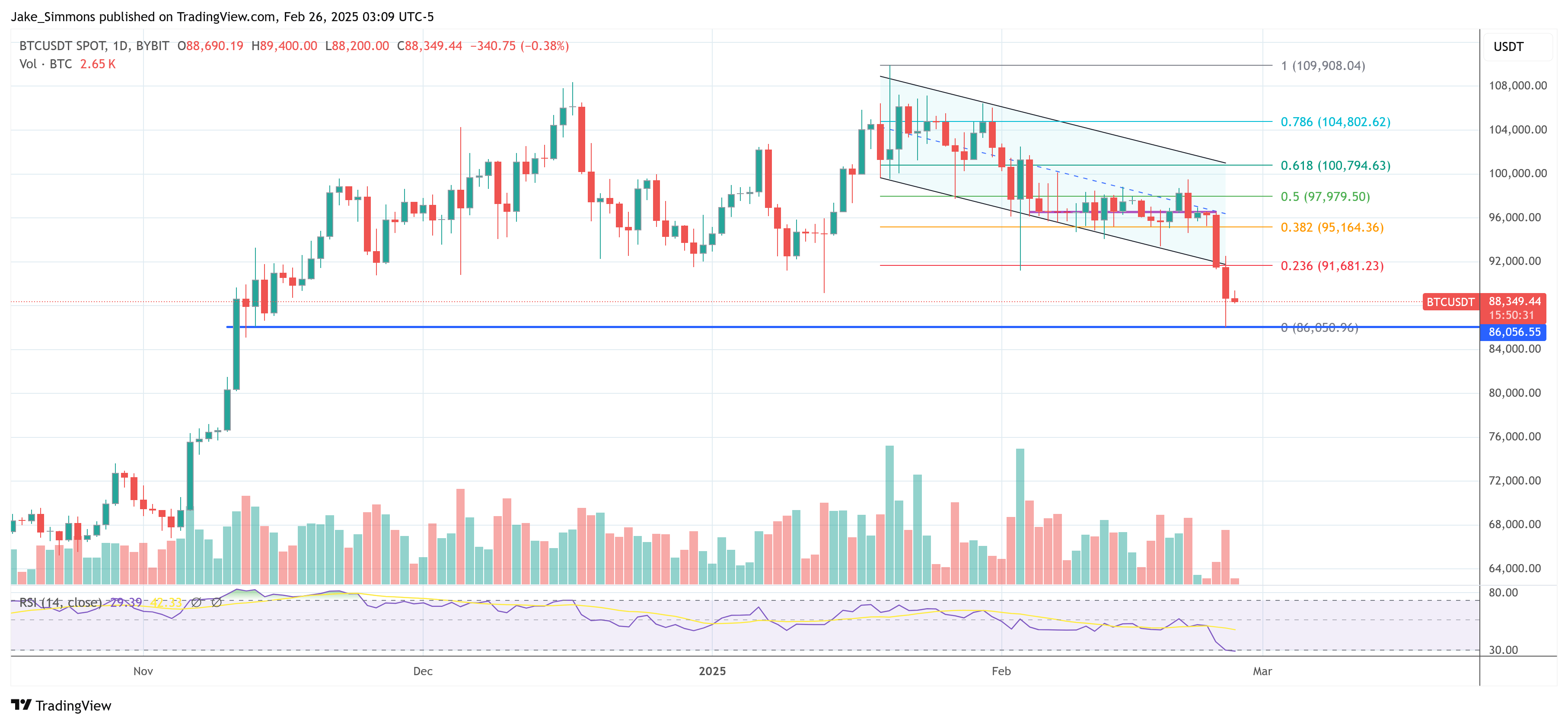

Yesterday, crypto markets have been beneath renewed strain: Bitcoin dropped at one level greater than 10% to as little as $86,050, Ethereum by 18%, and Solana decrease by 21%. The speedy set off: final weekend’s hack of Bybit, a Singapore-based change, which suffered a $1.5 billion Ethereum theft by way of a phishing rip-off.

Although Bybit dipped into its reserves to make shoppers complete, the breach reverberated throughout the trade. The hack adopted on the heels of a spate of memecoin scams, together with Libra, endorsed by Argentine President and famous crypto proponent Javier Milei. The memecoin value buyers billions in what Hougan described as a “multi-billion-dollar rip-off.”

Furthermore, Melania, a mission tied to First Woman Melania Trump, additionally collapsed, inflicting substantial losses for token holders. Trump, a memecoin linked to US President Donald Trump fared no higher.

“Taken collectively, these occasions in all probability spell the tip of the current memecoin growth,” Hougan commented. Whereas many institutional and long-term crypto individuals might view the memecoin sector with skepticism, its buying and selling quantity and buzz have fueled total market exercise—notably within the Solana ecosystem.

Associated Studying

Regardless of the destructive headlines, Hougan factors to a strong basis beneath crypto markets. First, Hougan highlights the pro-crypto regulation beneath the Trump administration. In his view, “We’re within the early days of an enormous shift in Washington’s angle in the direction of crypto.” He cites the US Securities and Change Fee’s current choice to drop high-profile lawsuits towards firms like Coinbase and ongoing legislative efforts round stablecoins and market construction. Such developments, he argues, will assist crypto break into mainstream finance.

Second, institutional adoption continues to be rising. Massive-scale patrons—together with asset managers, firms, and even governments—proceed to build up Bitcoin. Hougan notes that up to now this yr, “buyers have plowed $4.3 billion into bitcoin ETFs,” and he expects that determine to balloon to $50 billion by year-end.

Hougan additionally expects a stablecoin growth. Stablecoin property beneath administration have climbed to a report $220 billion, marking a 50% leap from final yr. With favorable laws making its means by way of Congress, Hougan believes the sector might develop to $1 trillion by 2027.

Lastly, the Bitwise CIO predicts the rebirth of DeFi and tokenization. Lending, buying and selling, prediction markets, and derivatives see report heightened utilization. In the meantime, the tokenization of real-world property continues to hit all-time highs in property beneath administration, suggesting that blockchain-based representations of conventional securities and commodities could also be on the rise.

Hougan refers again to his July 2024 thesis to underline as we speak’s alternative. On the destructive facet, markets should navigate aftershocks from Bybit’s large hack and the implosion of a number of memecoin tasks. On the constructive facet, regulatory readability, institutional inflows, stablecoin growth, and DeFi innovation proceed unabated.

“That is what I name a no brainer,” Hougan wrote, underscoring his stance that critical long-term elements overwhelmingly outweigh the short-term setbacks. He does supply a measured warning, noting this pullback might show extra pronounced than final summer season’s dip: “The memecoin growth was giant, and the hangover could possibly be extra important. It would take days, weeks, or months to work by way of it.”

But his conclusion stays agency: the long-term progress narrative stays intact. “When that occurs, I like my cash on the long run,” he acknowledged, reiterating that endurance may be rewarded in a market usually swayed by headline-driven volatility.

At press time, BTC traded at $88,349.

Featured picture created with DALL.E, chart from TradingView.com