Bitcoin (BTC) is testing investor sentiment once more because it hovers in a precarious place, teasing the potential for a chronic bear cycle.

Amid market uncertainty, analysts and merchants are weighing in on the crypto market’s present state, debating whether or not the latest downturn is a sign of additional losses or a setup for a significant rebound.

Analysts Weigh Crypto Market Restoration

Julio Moreno, head of analysis at CryptoQuant, famous that on Wednesday, Bitcoin holders realized the most important single-day loss since August 2024, totaling a staggering $1.7 billion. This vital sell-off suggests widespread panic amongst merchants, with many selecting to chop their losses as Bitcoin dipped beneath key assist ranges.

“Bitcoin holders realized at this time the most important loss since August 2024: $1.7 billion,” famous Moreno.

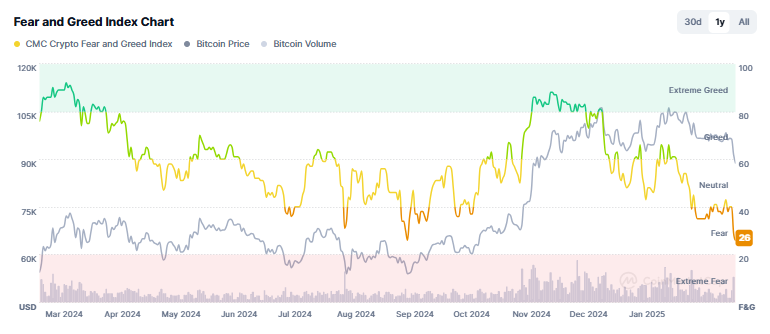

In the meantime, market analyst Miles Deutscher highlighted that the Crypto Concern and Greed Index, a extensively adopted sentiment indicator, has plunged to its lowest since October 2024. In his opinion, nonetheless, excessive concern out there might be a precursor to a worth reversal, indicating that Bitcoin is likely to be approaching a vital turning level.

“Individuals are lastly getting nervous once more. Imagine it or not, that’s precisely what we have to ultimately type a backside,” he defined.

In one other statement, Deutscher identified that BTC change inflows hit their highest stage of the yr amid the latest market turmoil. This implies that merchants rushed to liquidate their holdings as Bitcoin dipped beneath the $90,000 mark.

Nonetheless, he additionally speculated that such panic-driven promoting might set the stage for an surprising bounce, probably catching those that offered off guard.

Mark Cullen, an analyst at AlphaBTC, weighed in on the scenario, highlighting the function of market makers in stabilizing the value. In keeping with Cullen, a Binance change market maker stepped in to forestall a deeper crash, recognizing {that a} additional decline might set off a widespread capitulation occasion.

“They know Bitcoin breaking any decrease will trigger a crypto market-wide crash and clients leaving with burnt fingers,” he acknowledged.

Regardless of the intervention, Cullen stays cautious, suggesting {that a} momentary bounce might happen earlier than the subsequent leg down. Whereas he doesn’t anticipate a direct crash, he didn’t rule out one other drop to the $87,000 vary to determine a better low earlier than a possible restoration.

M2 Cash Provide Mannequin Predicts Bitcoin Surge in March

Some analysts are eyeing March 2025 for a possible bullish flip. Colin Talks Crypto, a well known crypto analyst, pointed to the robust correlation between Bitcoin’s worth actions and the worldwide M2 cash provide.

His mannequin means that Bitcoin’s worth usually reacts to adjustments in liquidity with a lag of roughly 46 days. In keeping with the mannequin, Bitcoin is anticipated to see a big upward transfer round March 7, 2025, although this timeline might shift earlier based mostly on latest developments.

The reducing lag time between M2 actions and Bitcoin’s response means that elevated world liquidity might quickly enhance BTC costs. Whereas the correlation is imperfect, it has traditionally been a powerful directional sign for Bitcoin’s worth developments.

“It’s an uncanny correlation and it’s too shut, for my part, to be coincidence,” the analyst quipped.

If the M2 Cash Provide mannequin holds, Bitcoin might be set for a restoration in early March. Nonetheless, volatility stays the dominant theme within the brief time period, and merchants ought to brace for potential bounces as macroeconomic components affect institutional sentiment.

“… the value must get well above $96,000-$100,000, which can affirm the market’s readiness for brand spanking new progress. If the strain persists, the market might enter a section of a deeper correction,” StealthEx CEO Maria Carola shared with BeInCrypto.

Including to the bearish strain, Bitcoin ETFs have recorded substantial web outflows. As BeInCrypto reported, Institutional traders, who performed a significant function in Bitcoin’s rally to new highs, look like pulling funds out of the market, elevating considerations about additional draw back danger.

“This course of [institutional redemptions] places vital strain on the BTC price since issuers are pressured to promote the asset to cowl withdrawal requests,” MEXC COO Tracy Jin advised BeInCrypto.

Disclaimer

In adherence to the Belief Undertaking tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nonetheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.