After spending most of February buying and selling inside a spread, Bitcoin (BTC) has damaged beneath the consolidation zone, slipping below $90,000 for the primary time since November. The main coin now trades at $88,956.

This downturn indicators rising bearish stress, elevating issues that the decline may prolong additional into March.

Vary-Certain or Breakout? Specialists Weigh In

In line with Brian, lead analyst at Santiment, Bitcoin whales proceed to cut back their buying and selling exercise, rising the probability of an additional decline within the coin’s worth.

“Bitcoin whales appear to have taken a little bit of a breather and aren’t accumulating for the time being (largely staying flat),” Brian informed BeInCrypto.

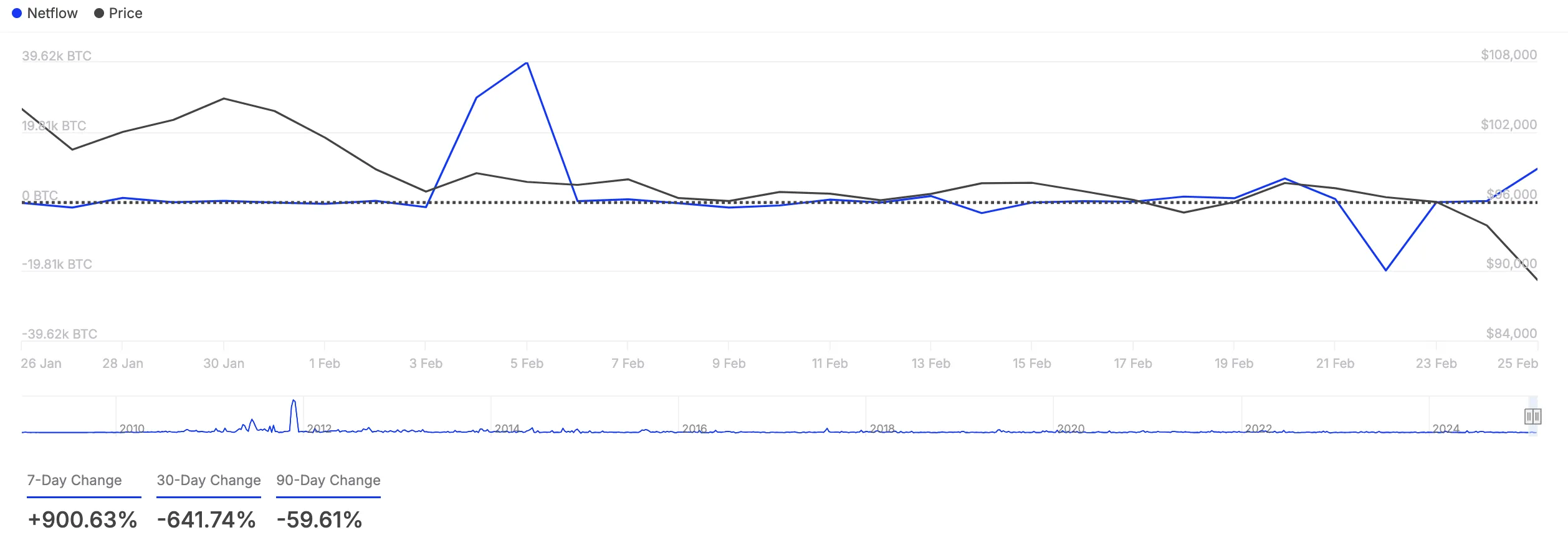

The decline in Bitcoin’s giant holders’ netflow corroborates Brian’s place. In line with IntoTheBlock, the metric has plummeted by over 600% prior to now 30 days.

Giant holders confer with whale addresses that maintain greater than 0.1% of an asset’s circulating provide. Their netflow tracks the quantity of cash they purchase and promote over a selected interval.

When it falls, these key buyers are lowering their token holdings, signaling elevated promoting exercise. This will exacerbate the downward stress on BTC’s value as provide will increase available in the market.

For John Glover, Ledn’s Chief Funding Officer (CIO), BTC will possible stay range-bound between $89,000 and $108,000 in March.

“From a technical perspective, BTC is following 1 of two paths. Within the first place, there’s a good potential for a dip to $89,000 and even $77,000 earlier than the following rally. Within the second, we have now already seen the lows, and the following transfer will probably be increased, as much as ~$130,000. It’s not possible to foretell which path we’re on, and short-term predictions are meaningless when intraweek/intra-month strikes are dictated by information and, lately, by the actions of massive gamers like Technique. My private view is that we stay caught in a spread of $89,000 to 108,000 in March,” Glover stated.

Additional, given President Donald Trump’s pro-crypto stance, some buyers marvel how his insurance policies would possibly affect Bitcoin’s value in March. Nonetheless, Glover believes that a lot of the “Trump impact” has already performed out.

“Nearly all of the “Trump impact” has already been felt. We all know he’s very supportive of digital property and has set in movement his plans to streamline rules related to crypto. I don’t assume he is a significant component within the quick run,” Glover said.

Bitcoin Nears Oversold Ranges – Is a Rebound on the Horizon?

Bitcoin could also be oversold and prepared for a rebound, as mirrored by its Relative Power Index (RSI) readings. At press time, this momentum indicator is downward at 31.16.

The indicator measures an asset’s oversold and overbought market situations. It ranges between 0 and 100, with values above 70 indicating that the asset is overbought and due for a decline. Alternatively, values beneath 30 recommend that the asset is oversold and should witness a rebound.

BTC’s RSI studying means that it’s nearing oversold territory. This hints at a doable rebound towards $92,325 if the promoting stress eases.

Alternatively, if this decline persists, the coin’s value may drop to $80,835.

Disclaimer

Consistent with the Belief Venture tips, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.