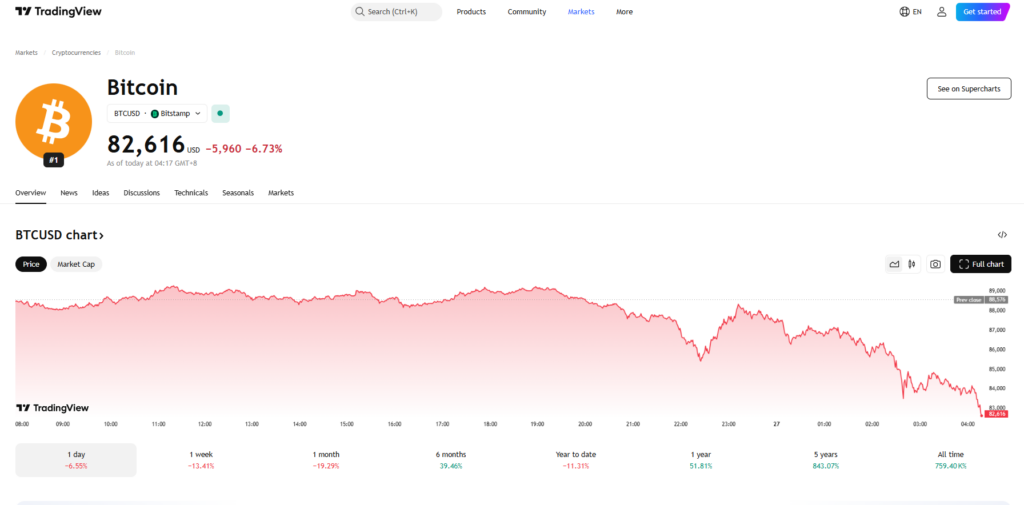

- Bitcoin dropped under $84K, down 12% on the week, whereas Ethereum hit a five-month low at $2,275.

- Over $600 million in liquidations worn out leveraged positions, with Bitcoin main at $335M.

- Macroeconomic uncertainty, Trump’s tariffs, and Nvidia’s earnings report are fueling risk-off sentiment out there.

The crypto selloff isn’t slowing down—Bitcoin plunged to $83,724, its lowest value since early November, whereas Ethereum tanked to $2,275, marking its worst stage since final September.

- Complete liquidations up to now 24 hours? Over $600 million.

- Bitcoin is down 12% on the week, now 23% under its all-time excessive of $108,000.

- Ethereum has been hit even tougher, nonetheless 53% under its 2021 peak of $4,878.

The broader market is down one other 4%, fueled by inflation fears, Trump’s newest tariff threats, cooling meme coin momentum, and the $1.4 billion Bybit hack.

What’s Behind the Market Wipeout?

Merchants are grappling with a storm of macroeconomic uncertainty:

- Trump’s increasing tariffs have raised issues over world commerce instability.

- Inflation worries and fee outlook confusion are maintaining threat property underneath stress.

- Nvidia’s earnings report looms massive, with markets watching carefully—BTC’s volatility could also be tied to merchants positioning forward of the outcomes.

“These deep corrections are normal in BTC bull markets,” mentioned Strahinja Savic of FRNT Monetary. “We noticed a giant retracement in August earlier than breaking $100K in November.”

Savic says the important thing stage to look at now’s Bitcoin’s 200-day shifting common at $81,700—if BTC breaks under that, issues may worsen.

tradingview.com

Futures Liquidations High $613M—Bitcoin Leads the Massacre

The liquidation numbers inform the story:

- $335 million in Bitcoin futures worn out as leverage merchants obtained caught off guard.

- Ethereum liquidations hit $115 million, including to the promoting stress.

- Total, $613 million in leveraged positions obtained erased in 24 hours, per CoinGlass information.

For now? Crypto is deep in risk-off mode—whether or not it’s a brutal however vital correction or the beginning of one thing larger stays to be seen.