Solana is going through mounting promoting stress, buying and selling at its lowest stage since September 2024 following yesterday’s market-wide correction. Excessive concern continues to grip the market as SOL fails to search out sturdy help, with bears sustaining management for the reason that cryptocurrency hit its all-time excessive again in January. Since then, Solana has retraced over 55%, leaving traders unsure about its short-term prospects.

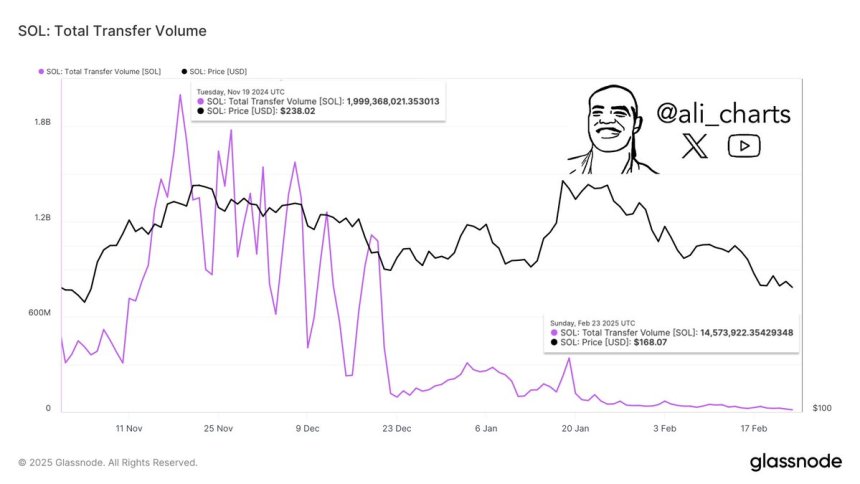

The broader crypto market stays below stress, with altcoins struggling to regain bullish momentum. Analysts warn that additional declines might be on the horizon if SOL fails to carry key ranges. Crypto professional Ali Martinez shared on-chain metrics on X, revealing that Solana’s switch quantity has plummeted dramatically. In line with the information, Solana’s switch quantity has dropped from $1.99 billion in November 2024 to simply $14.57 million immediately. This important decline suggests a steep drop in community exercise and curiosity, elevating issues concerning the present state of the Solana ecosystem.

With bearish sentiment dominating the market and on-chain exercise slowing, the approaching days can be essential for SOL. If bulls fail to defend key help ranges, Solana might see additional draw back. Nevertheless, a powerful restoration in quantity and value motion might point out renewed curiosity and potential for a reversal.

Solana Struggles Beneath $150 as Bears Keep Management

Solana is going through important promoting stress, struggling to interrupt above the $150 mark as bears dominate value motion. The broader market sell-off has taken a heavy toll on SOL, with meme cash experiencing a few of the steepest declines. Solana, which beforehand benefited from the meme coin hype cycle, is now seeing a serious pullback as hypothesis fades.

The value motion stays weak as Solana trades under key demand ranges that when sustained its long-term bullish construction. Bulls have misplaced momentum, failing to determine a powerful restoration, whereas bears proceed to pull your complete market down. If SOL fails to carry above present demand ranges, additional draw back might be anticipated within the quick time period.

Martinez’s on-chain information highlights a troubling development for Solana’s community exercise. In line with Glassnode, Solana’s switch quantity has plummeted from $1.99 billion in November 2024 to simply $14.57 million immediately. This dramatic drop signifies a pointy decline in community utilization and buying and selling exercise, additional reflecting the cooling-off interval in meme coin hypothesis.

The approaching days can be essential for Solana. If SOL can maintain above key demand ranges, a restoration section might start. Nevertheless, continued weak point in quantity and value motion might result in additional declines, making it important for bulls to reclaim momentum quickly.

Value Struggles At $140 Amid Promoting Strain

Solana (SOL) is buying and selling at $141 after experiencing days of intense promoting stress, struggling greater than most altcoins within the present market downturn. The broader crypto market has confronted excessive volatility, with many property seeing sharp declines. Nevertheless, Solana stays one of many worst-hit, failing to determine sturdy help or momentum for a possible rebound.

If bulls can defend the $140 stage, there’s a likelihood for a short-term restoration. Holding above this significant demand zone might present the muse for a push again above key resistance ranges. Nevertheless, sentiment stays weak, and any additional draw back in Bitcoin or the broader market might ship SOL into deeper corrections.

If Solana fails to take care of its present help, the subsequent essential stage to observe is $130, the place consumers might try to step in once more. Nevertheless, a sustained breakdown under this mark would enhance the danger of additional declines into decrease demand zones. The approaching days can be essential for Solana’s value motion, as traders wait to see whether or not bulls can reclaim momentum or if bears will proceed to drive the value downward.

Featured picture from Dall-E, chart from TradingView