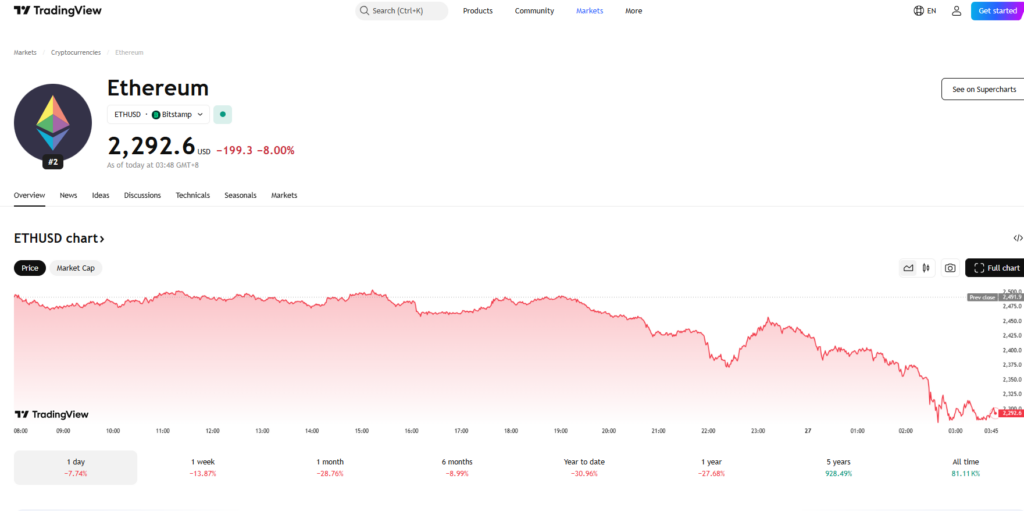

- Ethereum is struggling at $2,400, with analyst Justin Bennett warning of a possible drop to $1,000 if assist breaks.

- Ethereum ETFs noticed $128M in outflows this week, with BlackRock’s ETHA shedding $48M in a single day.

- Some analysts stay bullish, predicting a return to $4,000 and elevated institutional curiosity if staking is authorised.

Ethereum has been below heavy promoting stress, plunging practically 20% over the previous month and now clinging to assist round $2,400. With no main catalyst, crypto analyst Justin Bennett warns that ETH might crash all the best way right down to $1,000 if the present degree doesn’t maintain.

Ethereum Caught in Lengthy-Time period Channel—Breakdown Incoming?

Bennett’s evaluation factors to Ethereum buying and selling inside a long-term logarithmic channel courting again to 2017. Proper now, ETH is testing the decrease boundary of this construction—a degree that has contained worth actions since mid-2022.

- ETH briefly touched $2,855.23 in current weeks, however didn’t maintain momentum above $2,800.

- Technical indicators present weak bullish momentum, with Ethereum nonetheless caught in a essential assist zone.

- “Almost a month later, and bulls haven’t been capable of do something,” Bennett famous, emphasizing Ethereum’s lack of energy.

If this assist fails, Ethereum might spiral right down to the $1,000 vary—a state of affairs that many merchants aren’t ready for.

tradingview.com

Ethereum ETFs Bleeding Out—Institutional Curiosity Fades

The promoting stress isn’t simply coming from retail merchants—establishments are additionally pulling again.

- Ethereum ETFs have seen 4 straight days of outflows.

- Over $128M exited ETH ETFs in simply two days this week.

- BlackRock’s ETHA alone misplaced $48M in a single day.

With institutional confidence fading, Ethereum’s underperformance might worsen earlier than it improves.

Analysts Nonetheless Betting on Ethereum’s Restoration

Not everyone seems to be satisfied Ethereum is doomed. Crypto analyst Wolf believes ETH continues to be in a “wholesome, however boring” accumulation part and predicts a return to $4,000 in Q2—which might kick off the subsequent bull run.

In the meantime, Ted Pillows sees Ethereum staking integration as a game-changer, noting that the SEC’s acknowledgment of Grayscale’s staking proposal might set off a flood of institutional funding.

“Ethereum staking is coming,” Pillows mentioned, including that huge cash might stream in “like loopy” as soon as the approval occurs.

For now? Ethereum sits at a vital second—both it holds assist and bounces, or it dangers one other brutal selloff.