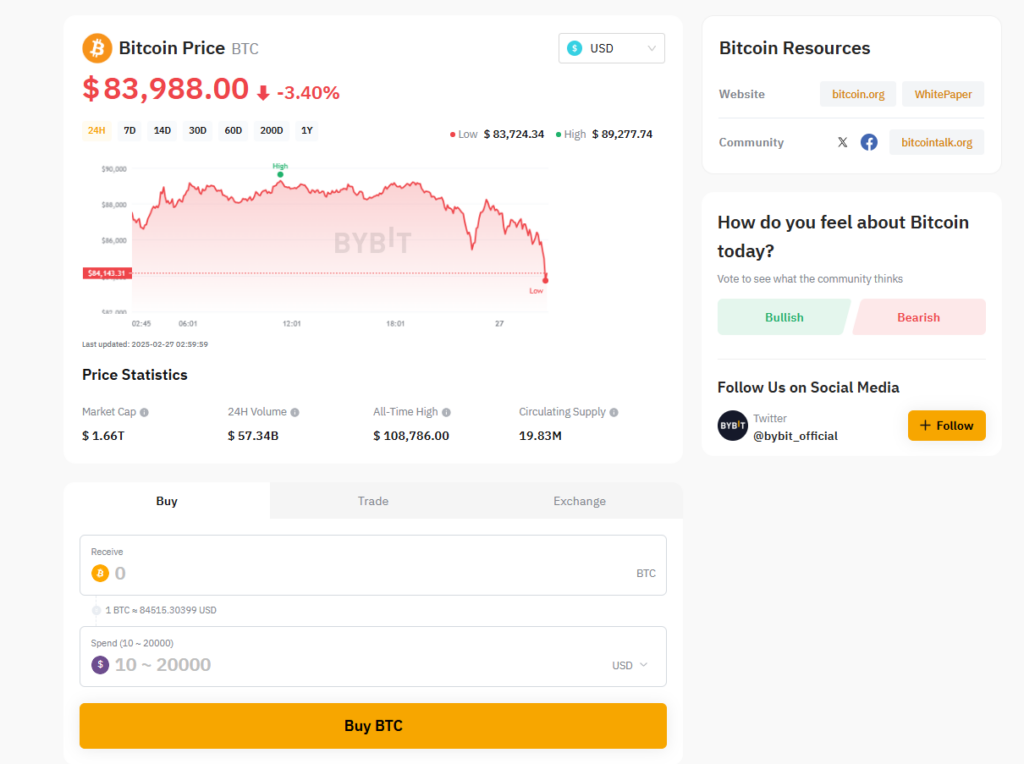

- Bitcoin dropped under $86K, down 20% from its all-time excessive as market sentiment weakens.

- Bitcoin ETFs noticed $2.7B in outflows over two weeks, with a file $1B pulled on Feb. 25.

- Uncertainty over Trump’s Bitcoin reserve plan and macroeconomic pressures are including to investor fears.

Bitcoin continues its downward slide, now hovering round $86,000, down practically 10% prior to now week and 20% off its all-time excessive from only a month in the past. The Trump-fueled crypto rally that when despatched BTC hovering previous $100K? It is likely to be dropping steam.

Different main cryptos aren’t trying significantly better—Ethereum dipped 1% in 24 hours, whereas Solana took a steeper hit, falling over 4%.

Why the Drop? Bybit Hack, Meme Coin Scandals & Market Jitters

Bitcoin has been caught in a uneven vary for weeks, trying to find a catalyst. However now? It’s discovered one—simply not the sort bulls needed.

- Bybit, a Dubai-based trade, was hacked on Feb. 21, with North Korea’s Lazarus Group allegedly stealing $1.4 billion in crypto belongings.

- The Argentina memecoin scandal resurfaced doubts within the crypto house, after President Javier Milei’s LIBRA token collapsed, leaving traders rattled.

- Market sentiment is shifting—fears of additional draw back are creeping in.

Mix hacks, scandals, and weak momentum, and also you get a cocktail of uncertainty weighing down the market.

bybit.com

Bitcoin ETFs Bleeding Out—$2.7B Pulled in Two Weeks

Simply weeks in the past, Bitcoin ETFs have been the most well liked monetary product in the marketplace. Now? Traders are bailing.

- U.S. Bitcoin ETFs have seen $2.7 billion in outflows in simply two weeks—with over $1 billion pulled on Feb. 25 alone.

- This sustained sell-off is dragging Bitcoin decrease, as institutional demand slows.

- Confidence isn’t what it was—and ETF outflows are a obtrusive sign of that.

With out contemporary demand, Bitcoin’s worth is feeling the burden of all that promoting stress.

Bitcoin Reserve? Nonetheless No Phrase from the Trump Administration

Crypto traders have been ready for a giant transfer—a U.S. Bitcoin reserve below Trump’s management. However to this point? Radio silence.

Whereas some state governments are pushing ahead, the federal authorities stays indecisive, and that uncertainty isn’t serving to market sentiment.

Macroeconomic Pressures—BTC Beginning to Act Like a Inventory?

Bitcoin is now not only a area of interest asset—it’s reacting to international occasions like by no means earlier than.

- Inflation reviews and financial information are influencing costs, very similar to in conventional markets.

- Trump’s newest spherical of tariffs has shaken investor confidence, including one other layer of volatility.

- As Bitcoin turns into extra mainstream, it’s transferring extra just like the inventory market—and that comes with new dangers.

For now? Bitcoin bulls are in search of a lifeline, whereas bears are eyeing decrease ranges. The place BTC heads subsequent will depend on whether or not the market can shake off this uncertainty—or if the ache continues.