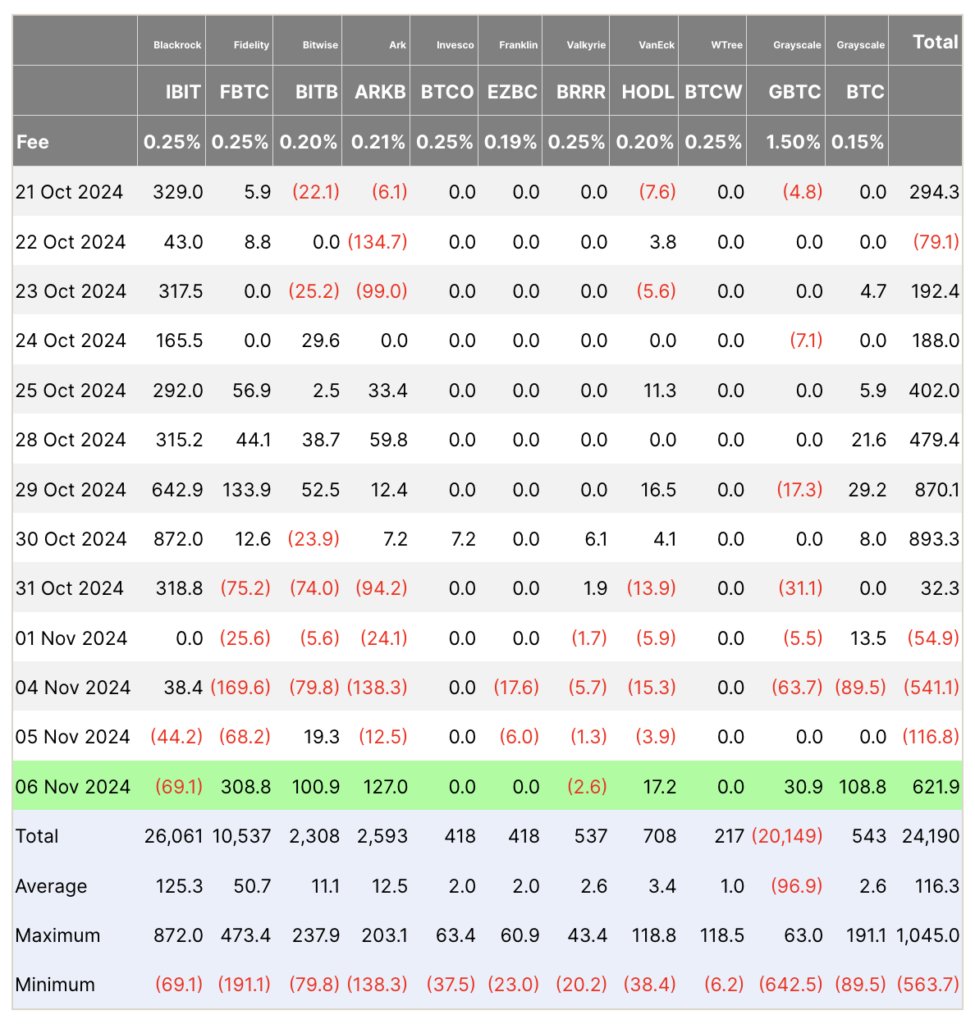

Main asset administration corporations reported important inflows of their Bitcoin ETFs following Donald Trump’s victory within the 2024 US presidential election. On Nov. 6, Constancy’s FBTC noticed an influx of $308.8 million, whereas BlackRock’s IBIT skilled an outflow of $69.1 million. Grayscale’s GBTC and BTC recorded an influx of $30.9 million and $108 million, respectively, reversing earlier outflows.

Bitcoin’s value surged to a brand new all-time excessive of $76,400, breaking its earlier document twice for the reason that election. This value enhance coincided with the substantial ETF inflows, suggesting renewed institutional curiosity. Ark’s ARKB reported an influx of $127 million, and Bitwise’s BITB gained $100.9 million on the identical day.

The shifts in ETF holdings mirror a fancy market response. Corporations like Valkyrie and VanEck additionally reported adjustments of their Bitcoin ETF positions. Valkyrie’s BRRR had a slight outflow of $2.6 million, whereas VanEck’s HODL noticed an influx of $17.2 million.

The publish Bitcoin ETFs document $621 million influx amid uncommon BlackRock outflow following US election appeared first on CryptoSlate.