XRP is correcting by nearly 30% within the final 30 days, with its value buying and selling beneath $3 for almost a month. The Directional Motion Index (DMI) exhibits a powerful downtrend, with the Common Directional Index (ADX) surging above 35, indicating elevated bearish momentum.

Nonetheless, a possible reversal may happen if the SEC drops its lawsuit towards XRP, probably triggering a rally towards key resistance ranges.

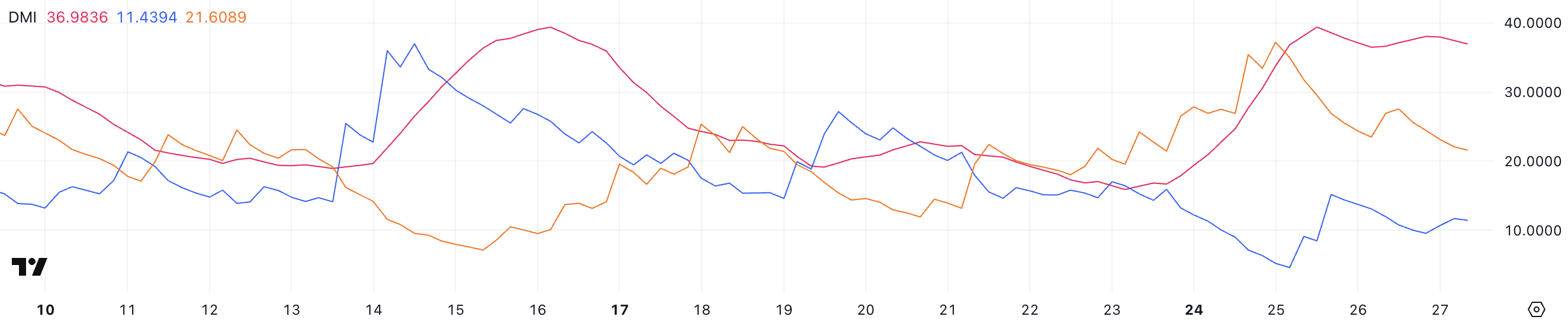

XRP DMI Reveals the Lack of a Clear Path

XRP’s Directional Motion Index (DMI) reveals that its Common Directional Index (ADX) is at present at 36.98, a major enhance from 15.89 simply 4 days in the past.

The ADX is a pattern energy indicator that doesn’t point out the course of the pattern however measures its depth. Sometimes, an ADX worth above 25 indicators a powerful pattern, whereas a price beneath 20 suggests a weak or non-trending market.

With XRP’s ADX rising sharply above 35, it signifies that the present downtrend is gaining momentum.

This surge in ADX means that market individuals are displaying stronger conviction, making the present pattern extra prone to proceed.

In the meantime, XRP’s +DI (Optimistic Directional Indicator) is at 11.4, down from a excessive of 15.1 two days in the past, indicating weakening bullish strain. In distinction, the -DI (Unfavourable Directional Indicator) has declined to 21.6 from 37.2 on February 2, displaying a lower in bearish momentum.

Regardless of the discount in bearish strain, the -DI stays above the +DI, confirming that the downtrend remains to be intact. The widening hole between the ADX and the directional indicators means that the downward pattern is powerful and chronic.

Till the +DI crosses above the -DI, signaling a possible pattern reversal, XRP is prone to stay in a bearish part.

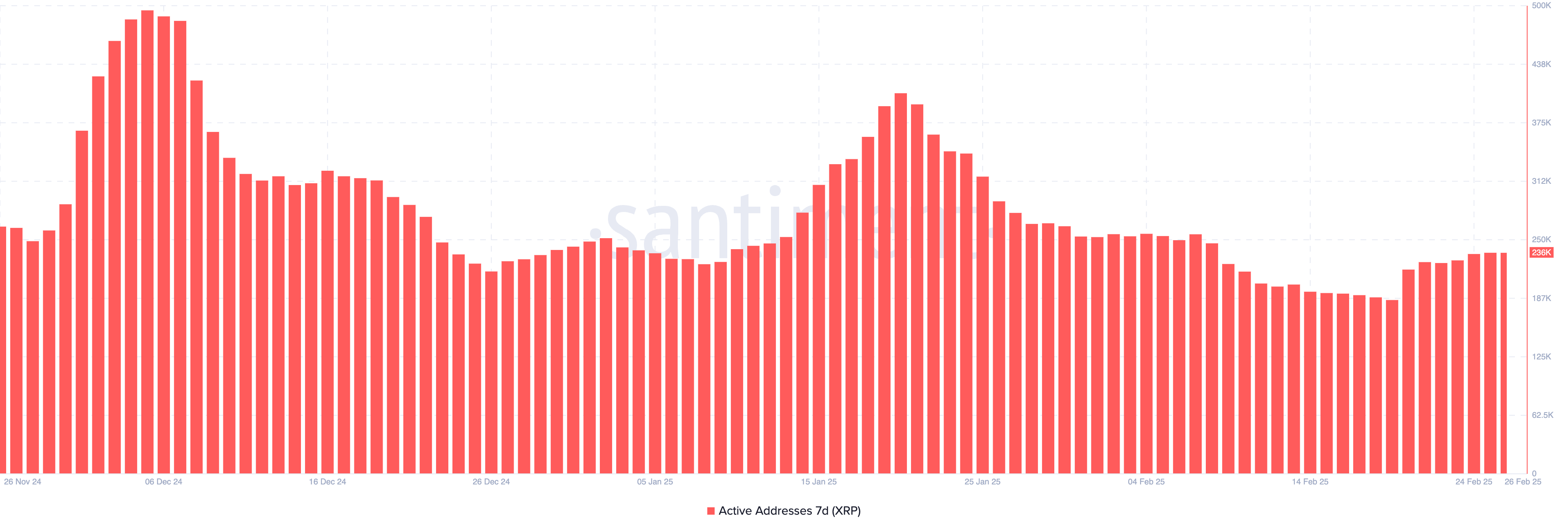

XRP Lively Addresses Are Recovering After Reaching Its Lowest Degree In 3 Months

The variety of 7-day XRP Lively Addresses dropped from 407,000 on January 20 to about 186,000 on February 19, the bottom degree since November 2024.

This metric is essential as a result of it measures person engagement and community exercise, reflecting demand for XRP. A decline suggests diminished curiosity and bearish sentiment, whereas a rise signifies rising participation and potential shopping for strain. The sharp drop signaled waning investor curiosity, contributing to XRP’s bearish outlook.

Not too long ago, XRP Lively Addresses began to get well, reaching 236,000 – up 26.8% within the final week. This enhance suggests rising person exercise and renewed curiosity within the community.

Traditionally, rising energetic addresses can precede value recoveries as participation results in greater demand. If this pattern continues, it may help a possible value rebound, however sustained development is required to substantiate a bullish shift.

XRP’s Uptrend Largely Relies on the SEC and Ripple Lawsuit

XRP’s EMA strains at present present a bearish setup, with short-term strains beneath long-term ones. The value has been buying and selling beneath $3 since February 1.

This alignment suggests continued downward momentum, as shorter EMAs replicate current bearish sentiment. If the downtrend persists, XRP may check two robust help ranges at $2.15 and $2.06.

If these are misplaced, XRP value may fall to $1.77, dropping beneath $2 for the primary time since November 2024.

Nonetheless, a pattern reversal is feasible, particularly if the SEC drops its lawsuit towards XRP in March. Not too long ago, the SEC dropped circumstances towards Gemini, Uniswap, Robinhood, and Coinbase, signaling a shift in regulatory strain.

If the lawsuit is dropped, it may set off an uptrend, with XRP testing resistances at $2.36 and $2.52. If these ranges are damaged, XRP may proceed rising in direction of $2.71, doubtlessly reversing the bearish outlook.

Disclaimer

According to the Belief Venture tips, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.