Bitcoin Faces Sharp Correction

Bitcoin has skilled a significant correction, plunging to its lowest degree since early November 2024. This sudden drop has shaken the bullish outlook that many buyers had for BTC and altcoins, casting doubt on the potential for enormous returns in 2025. The sharp decline has led to elevated concern throughout the market, with buyers rising anxious a couple of doable shift right into a bear market.

The market is now in excessive concern, as additional promoting stress may drive BTC to even decrease ranges. With sentiment at its lowest level in months, merchants are watching intently to see if Bitcoin can stabilize or if a deeper correction is on the horizon. Traditionally, main sell-offs have been adopted by both robust bounces or prolonged consolidation phases, making the following few buying and selling periods essential.

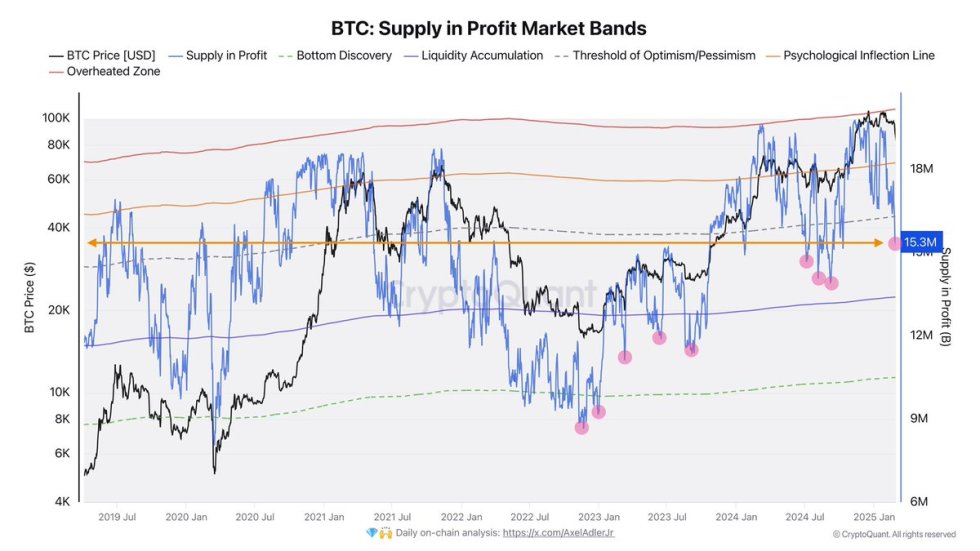

High analyst Axel Adler shared insights on X, revealing that presently, 4.4 million BTC from the full provide have moved right into a loss. This metric represents the variety of cash purchased and offered across the $95K degree, reflecting what number of merchants at the moment are holding BTC at a loss. Moreover, the provision in revenue has dropped from 19.7 million BTC to fifteen.3 million BTC, indicating that a good portion of holders are underwater.

With Bitcoin now buying and selling beneath key assist ranges, the market should resolve whether or not this correction marks the beginning of a bearish part or is simply one other pullback earlier than a rebound. If BTC fails to carry its present ranges, an additional drop could possibly be imminent, but when bulls regain management, this could possibly be a robust shopping for alternative for long-term buyers.

Bitcoin Struggles at $80K Amid Bear Market Fears

Bitcoin is buying and selling at $80,190 after experiencing days of relentless promoting stress and rising concern {that a} new bear market could possibly be unfolding. The cryptocurrency has misplaced over 18% of its worth since final Sunday, shaking investor confidence and bringing BTC to its lowest degree since early November 2024.

Bulls now face a crucial problem as they have to defend the $80K mark and push BTC again above $85,500 as quickly as doable. This degree is essential as a result of it aligns with each the 200-day shifting common (MA) and the 200-day exponential shifting common (EMA)—two key indicators of long-term pattern energy. Failing to reclaim these ranges may sign additional draw back stress, making a bearish continuation extra possible.

If BTC fails to react positively at present ranges, the following key assist zone sits round $75K. Shedding this degree may set off much more panic promoting, additional confirming a bearish shift in market construction. Alternatively, a fast restoration above $85,500 may restore confidence, setting the stage for a possible bounce towards $90K within the coming weeks. The following few buying and selling periods might be essential in figuring out Bitcoin’s short-term trajectory.

Featured picture from Dall-E, chart from TradingView