- BlackRock has added its Bitcoin ETF to a $150 billion model-portfolio, probably driving new institutional demand.

- The agency will allocate 1-2% of its portfolio fashions to Bitcoin, aligning with the crypto market’s latest surge.

- Regardless of Bitcoin’s value drop, BlackRock sees long-term progress potential and is doubling down on its crypto technique.

In what could possibly be a seismic shift for the digital asset area, BlackRock has formally built-in its extensively well-liked Bitcoin ETF into its huge $150 billion model-portfolio ecosystem. With the $11 trillion asset supervisor bringing its iShares Bitcoin Belief (IBIT) into the fold, Bloomberg reviews counsel that this transfer may unlock a contemporary wave of demand for Bitcoin publicity.

BlackRock is ready to allocate between 1% and a pair of% of its portfolio fashions to the Bitcoin ETF, a choice that would amplify investor curiosity. As a part of a broader asset redistribution technique, this adjustment aligns with the explosive progress in crypto markets over the previous six months, fueling hypothesis about institutional urge for food for Bitcoin.

BlackRock Expands Bitcoin ETF Attain, Demand Surge Might Comply with

Crypto’s trajectory since late 2024 has been nothing wanting outstanding. With the U.S. authorities making important strides in regulatory readability, the market has witnessed huge valuation surges. A serious driver? BlackRock’s position in pushing via Spot Bitcoin ETF approvals, a growth that basically altered the funding panorama.

Institutional traders now have a extra structured, compliant avenue to achieve Bitcoin publicity. And IBIT? It’d simply be one of the crucial profitable ETF launches in monetary historical past. Now, with its inclusion in BlackRock’s $150 billion model-portfolio technique, the fund’s progress prospects appear even stronger.

crypto.com

BlackRock’s Technique Amidst Market Volatility

“We consider Bitcoin has long-term funding advantage and may probably present distinctive and additive sources of diversification to portfolios,” said Michael Gates, BlackRock’s head portfolio supervisor for its Goal Allocation ETF mannequin portfolios.

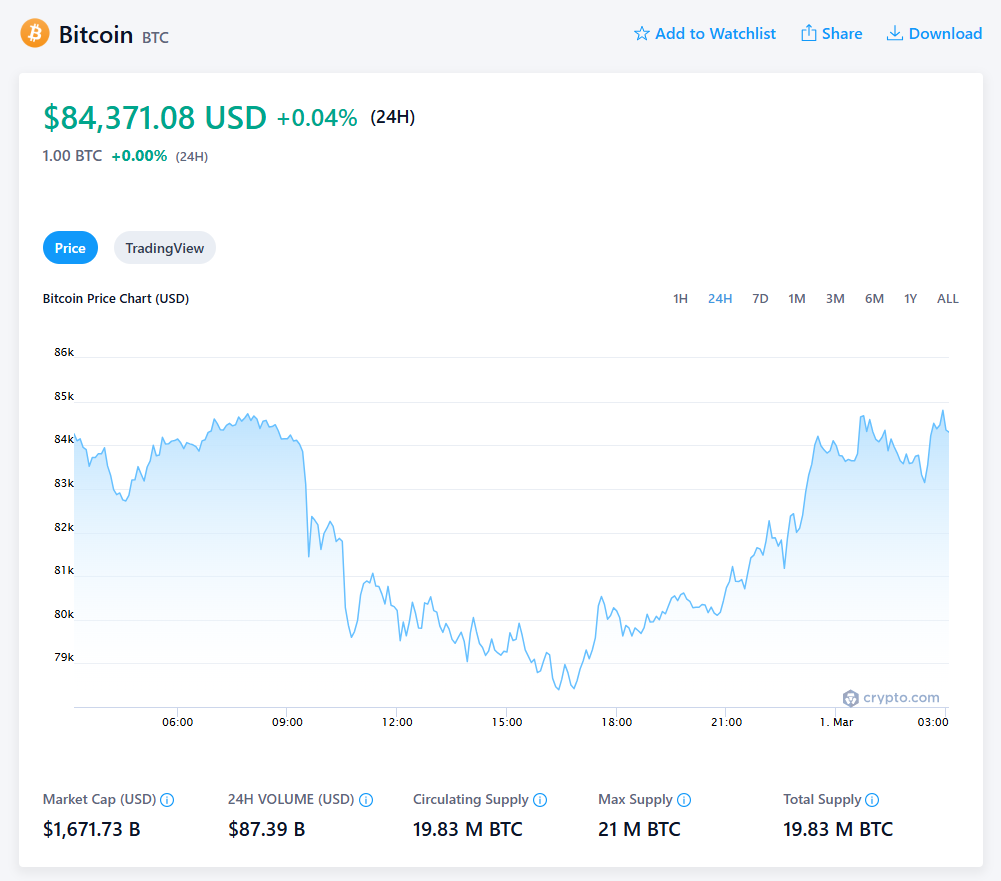

The choice comes at an fascinating time. Bitcoin, after hitting an all-time excessive above $110,000 in early 2024, has pulled again, at the moment sitting beneath $84,000. Some skeptics see this as a short-term setback, whereas others interpret BlackRock’s transfer as a long-haul play, reinforcing the idea that Bitcoin’s potential stays sturdy.

Whether or not this integration will push Bitcoin’s demand to new heights stays to be seen. However one factor is definite—BlackRock is doubling down on its crypto play, and the monetary world is taking discover.