Cardano (ADA) has been down virtually 34% within the final 30 days and greater than 15% prior to now week. Its market cap is now at $22 billion. It has been buying and selling under $1 for over a month, reflecting persistent bearish sentiment.

Technical indicators present a robust downtrend, with ADX rising to 46.8, signaling intensified promoting stress. Nevertheless, if key help ranges maintain, ADA might reverse its development and doubtlessly break above $1 in March.

Cardano ADX Reveals the Present Downtrend Is Robust

ADA’s ADX is presently at 46.8, rising sharply from 10.3 on February 23. The Common Directional Index (ADX) measures the energy of a development with out indicating its path.

It ranges from 0 to 100, with values above 25 signaling a robust development and values under 20 suggesting a weak or non-trending market. An ADX above 40 signifies a really sturdy development, exhibiting that market members are extremely assured within the present worth motion.

With ADA’s ADX at 46.8 and the worth in a downtrend, it signifies that the bearish momentum is gaining energy. This means that promoting stress is intensifying, making a continuation of the downtrend extra seemingly.

Except shopping for curiosity will increase considerably, ADA might face additional draw back. The excessive ADX worth confirms that the present bearish development is powerful and protracted, decreasing the chance of a fast reversal.

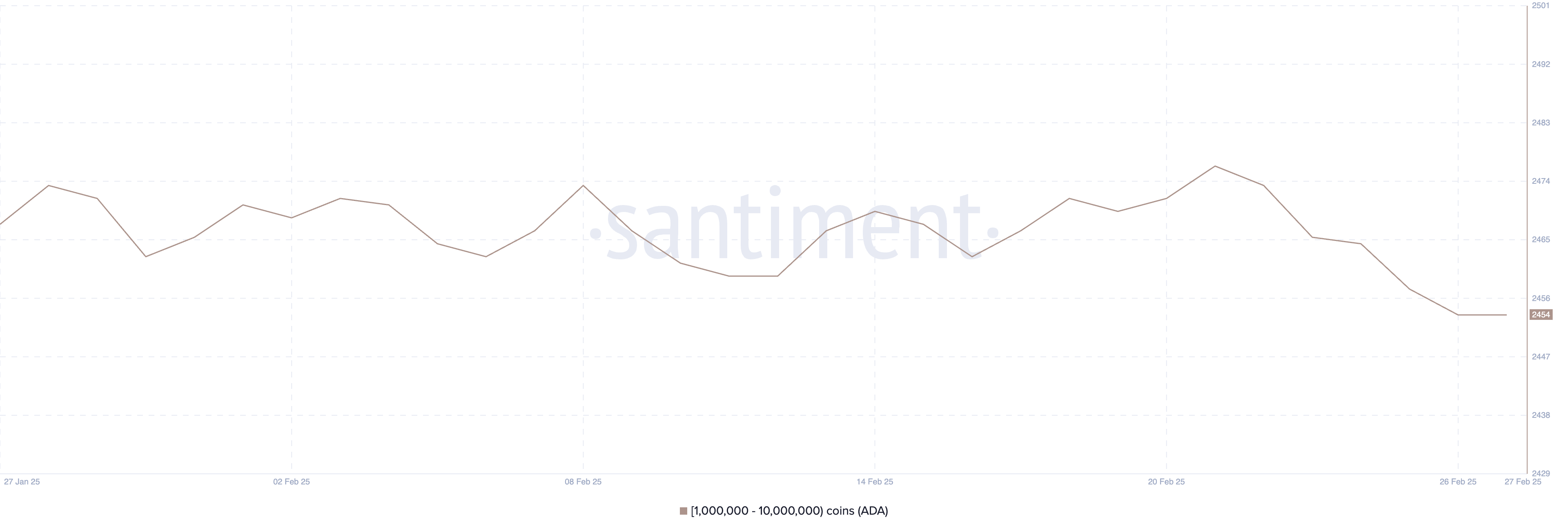

ADA Whales Simply Hit Their Lowest Degree Since Early January

The variety of Cardano whales – addresses holding between 1 million and 10 million ADA – has been steadily lowering over the previous week, dropping from 2,477 on February 21 to 2,454 presently. That is the bottom degree since January 9.

Monitoring these whales is essential as a result of they characterize massive buyers whose shopping for or promoting actions can considerably impression market liquidity and worth actions.

When whale addresses lower, it means that main holders are both decreasing their positions or distributing their holdings, which may point out a bearish sentiment.

This sharp decline within the variety of Cardano whales might sign growing promoting stress, doubtlessly resulting in additional draw back for ADA’s worth.

As massive holders scale back their publicity, it could possibly create extra provide available in the market, driving costs decrease. Moreover, a lowering variety of whales suggests weakened confidence amongst massive buyers, which might set off additional promoting from smaller holders.

If this development continues, ADA might face elevated downward momentum within the coming days.

Will Cardano Return to $1 In March?

ADA’s EMA strains presently present a bearish setup, with short-term strains positioned under long-term ones, indicating ongoing downward momentum.

ADA might take a look at the essential help degree at $0.5 if this downtrend continues strongly. If this help is misplaced, the worth might decline additional to $0.32, marking its lowest degree since early November 2024.

This bearish configuration suggests continued promoting stress, growing the chance of additional draw back except shopping for curiosity picks up.

Nevertheless, if the help at $0.5 is examined and holds, Cardano worth might discover the energy to reverse its development.

On this bullish situation, ADA might rise to check the resistance at $0.65.

If that degree is damaged, the worth might proceed climbing to $0.83 and even $0.90, doubtlessly paving the way in which for a rally above $1 for the primary time since late January.

Disclaimer

In keeping with the Belief Venture pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. At all times conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.