Following a value crash to under $80,000 final week, Bitcoin has skilled some market restoration over the previous 48 hours, rising by over 7.5% to commerce above $86,000. Amid this market rebound, crypto market knowledgeable Ali Martinez has noticed essentially the most vital help stage for the premier cryptocurrency in the mean time.

Bitcoin Faces ‘Air Hole’ Under $83K – A Breakdown Might Be Brutal

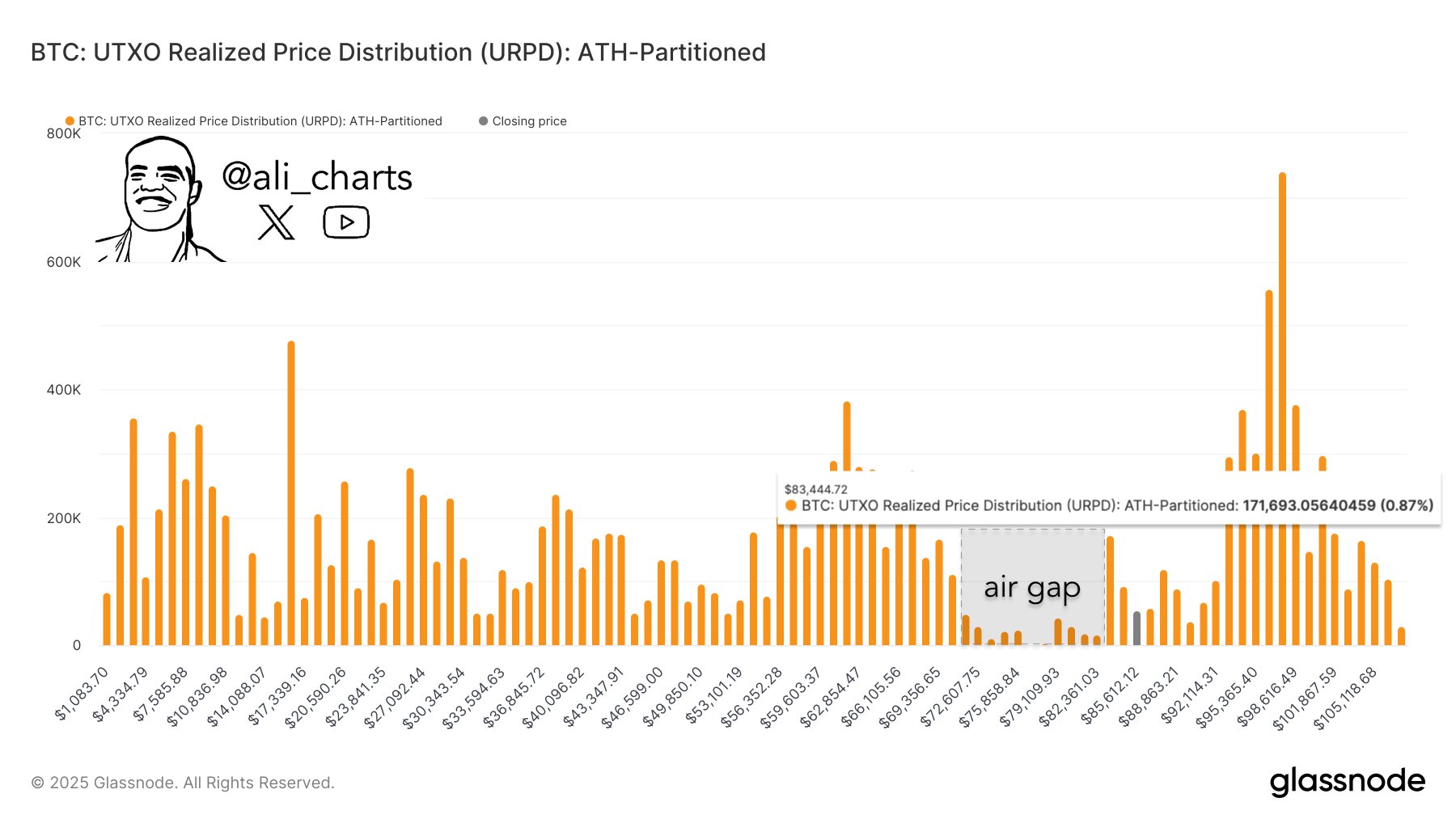

In an X put up on Saturday, Martinez shared a puzzling perception on the Bitcoin market. Utilizing the UTXO Realized Value Distribution (URPD) metric partitioned at all-time highs, the analyst has recognized $83,440 as essentially the most important Bitcoin help zone.

Typically, the URPD is an on-chain metric that exhibits the worth ranges at which unspent transaction outputs (UTXOs) final moved, thereby measuring how a lot Bitcoin was transacted at completely different value ranges. Every bar on the URPD chart represents a value vary, and the peak of the bar signifies the variety of BTC transacted at that stage.

Subsequently, the URPD can be utilized to establish potential help and resistance ranges as it might present if a major quantity of BTC was acquired or offered at a selected value stage.

In line with Martinez’s evaluation, URPD information from Glassnode exhibits that traders acquired 171,693 BTC (0.87% of whole provide) at $83,440.72, changing this value stage into a robust help zone. It is because bitcoin bulls are prone to step in and purchase extra BTC at this stage in any case of a retest.

Nevertheless, there’s a notable air hole between $72,000 – $82,000 with low ranges of UTXO recorded on this value vary. Thus, a decisive fall under $83,440 will lead to an additional value decline as a result of lack of demand within the quick cheaper price ranges.

Bitcoin RSI Backs Rebound Quest – Extra Positive factors Forward?

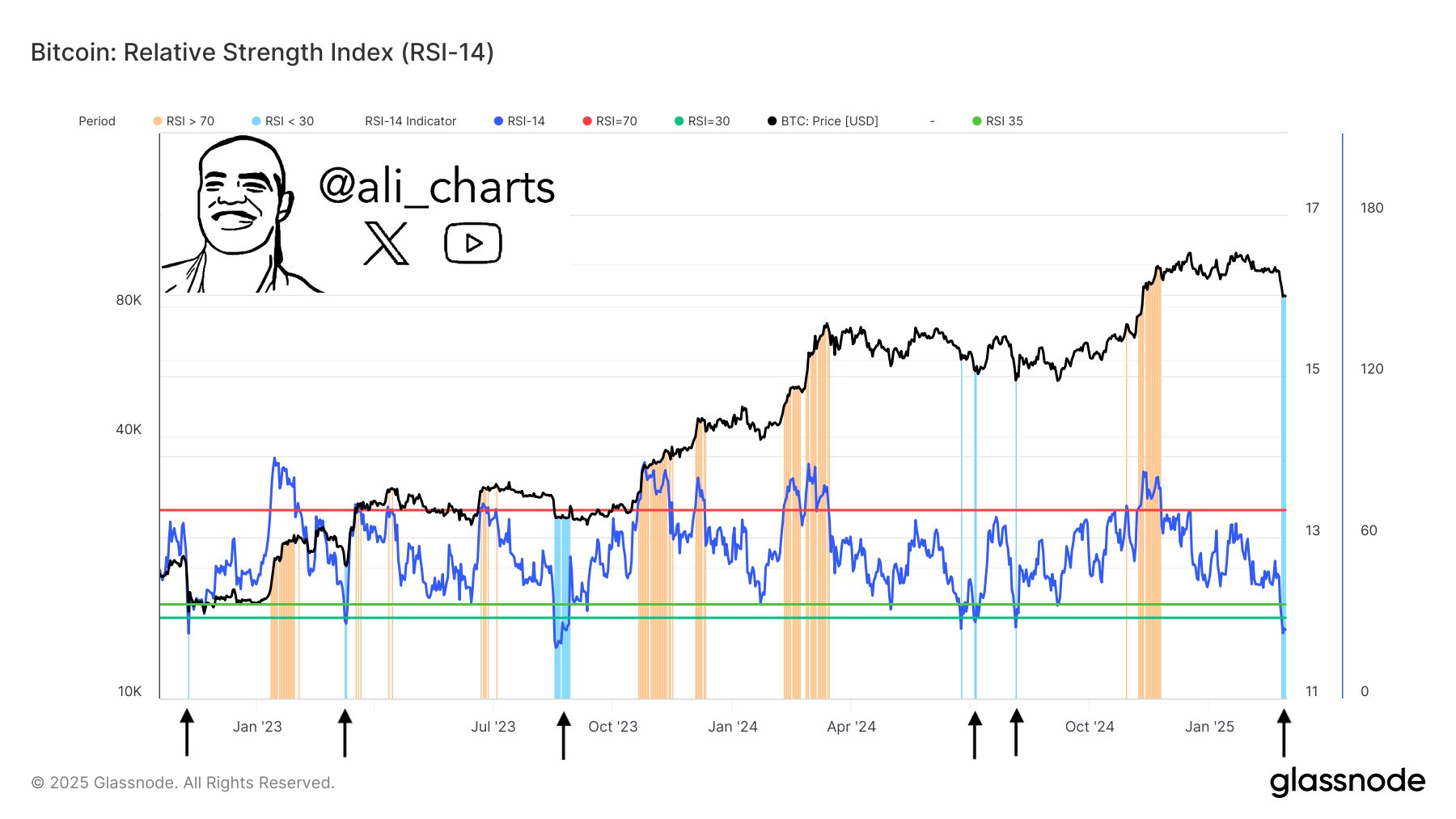

In one other evaluation put up on the BTC market, Martinez has hinted on the potential for additional value features amidst the continued value restoration. In line with the crypto knowledgeable, Bitcoin has traditionally recorded a value rebound after its Relative Power Index( RSI) went under 30.

The RSI measures the momentum of value actions and determines if an asset is overbought (above 70) or oversold (under 30). Martinez states that Bitcoin’s RSI has not too long ago touched 24 within the oversold zone suggesting a rebound to reclaim earlier excessive value ranges could happen in keeping with historic information.

At press time, Bitcoin trades at $86,383 after rising by 2.32% up to now 24 hours. Following the worth correction up to now week, BTC stays at 21.02% off from its all-time at $109,114.

Featured picture from iStock, chart from Tradingview