Ondo Finance (ONDO) briefly surged virtually 20% yesterday, however the features have been reversed inside 24 hours. Regardless of this pullback, ONDO stays a significant participant within the real-world asset (RWA) sector.

Technical indicators counsel momentum is slowing, whereas whale exercise has declined for the primary time in over two weeks. Whether or not ONDO can get better and push previous key resistance ranges or proceed its correction towards decrease assist zones will depend upon market sentiment and potential future developments relating to its inclusion within the reserve.

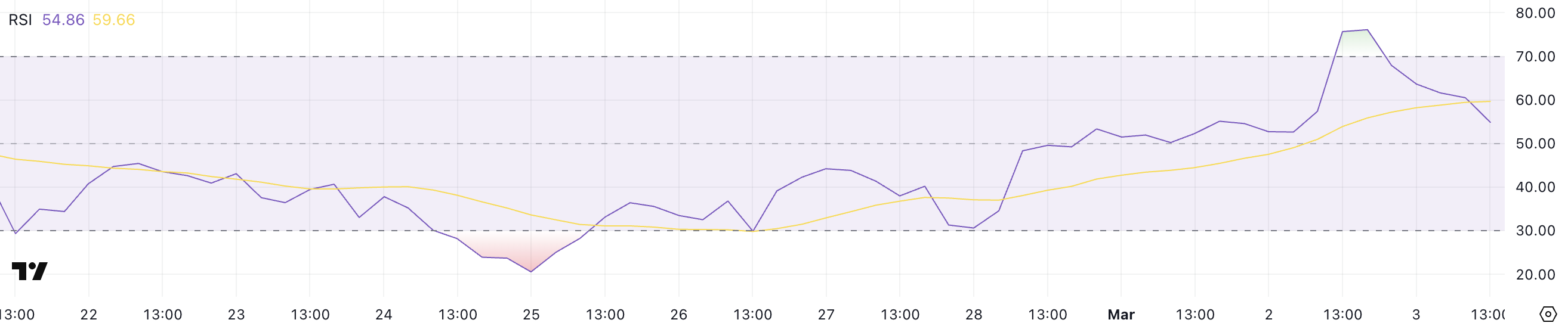

ONDO RSI Is Going Down After Reaching Its Highest Ranges In 3 Months

ONDO surged in momentum yesterday, pushing its Relative Power Index (RSI) to 76.1 earlier than cooling off to 54.8.

The RSI is a extensively used momentum oscillator that measures the velocity and magnitude of worth actions on a scale from 0 to 100. Readings above 70 point out overbought situations, typically signaling a possible pullback.

In the meantime, readings under 30 counsel oversold situations that will result in a rebound. With ONDO’s RSI briefly crossing 70 for the primary time in three months, merchants took it as an indication of sturdy bullish momentum earlier than the current retracement.

Now sitting at 54.8, ONDO’s RSI has dropped again to impartial territory, reflecting a slowdown in shopping for strain. This means that the current rally might have been overextended, resulting in profit-taking and a possible interval of consolidation.

If RSI stabilizes above 50, ONDO might keep its bullish construction and try one other transfer increased.

Nevertheless, if it continues to say no towards 40 or decrease, it might point out weakening momentum, rising the probabilities of additional draw back.

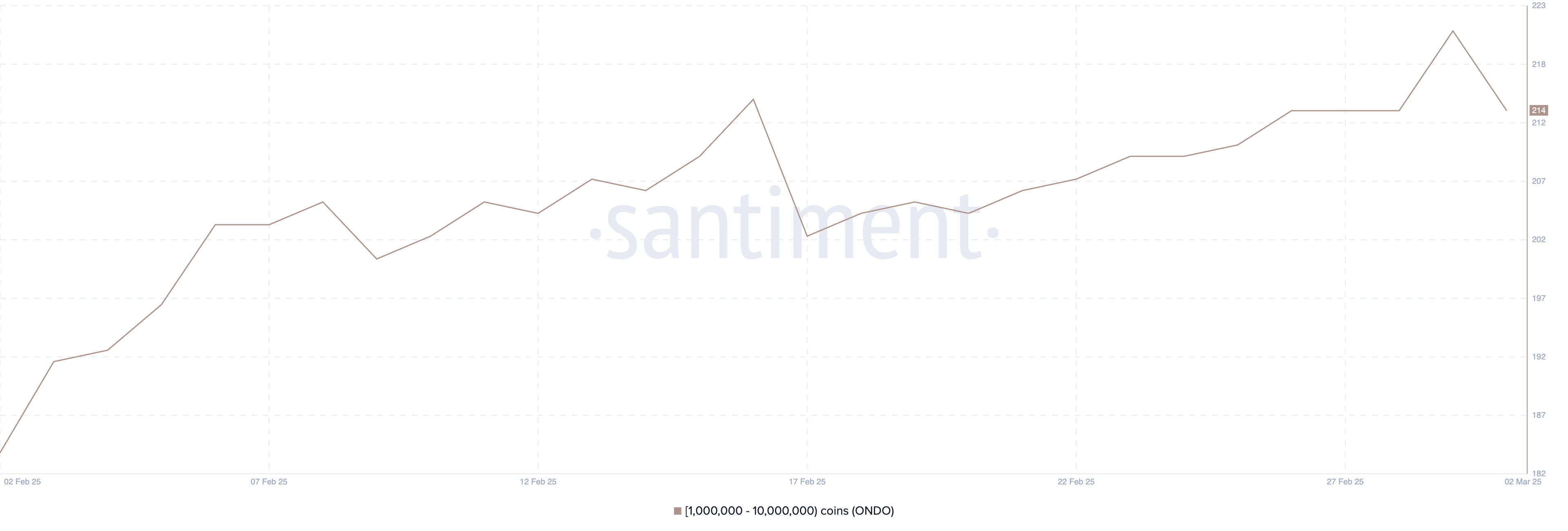

The Quantity Of ONDO Whales Dropped For The First Time Since Mid-February

The variety of ONDO whales – wallets holding between 1 million and 10 million ONDO – had been steadily rising since February 17, rising from 203 to 221 by March 1.

Nevertheless, this development reversed in the previous couple of days, with the variety of whales now dropping to 214. Monitoring whale exercise is essential as a result of giant holders can considerably impression worth actions by means of their shopping for or promoting selections.

A rising variety of whales typically indicators accumulation, suggesting confidence in ONDO’s long-term potential, whereas a decline might point out distribution, rising the danger of promoting strain.

Regardless of the current drop, the present variety of whales stays excessive in comparison with earlier months. That means that broader confidence within the asset continues to be intact.

Nevertheless, that is the primary decline in over 15 days, which might sign that some giant holders are taking earnings or repositioning. If this development continues downward, the RWA coin might face elevated promoting strain, probably resulting in additional corrections.

Alternatively, if whale numbers stabilize or begin rising once more, it might point out renewed accumulation. This could counsel a possible worth rebound.

ONDO Falls Under $1

The broader market rally pushed ONDO’s worth near $1.20 yesterday earlier than a correction started, signaling that merchants have been taking earnings.

Whereas ONDO stays a key participant within the real-world asset (RWA) sector, its short-term worth motion will depend upon whether or not the present pullback deepens or stabilizes.

If the correction continues, it might take a look at assist round $0.95. Additional declines might probably convey it right down to $0.90 or $0.88. If it drops under $0.80, this may be the primary time that has occurred since November 2024.

Nevertheless, if bullish sentiment returns, ONDO might regain momentum, particularly if the US takes a extra crypto-friendly stance on RWAs or if ONDO is ultimately added to the US strategic crypto reserve.

In that situation, it might break by means of resistance at $1.26 and $1.44, with a robust rally probably sending it towards $1.66.

Disclaimer

According to the Belief Venture pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.