Story Protocol just lately introduced the acquisition and tokenization of partial copyrights for 2 hit songs, “No person’s Love” by Maroon 5 and “Daisies” by Katy Perry.

Bringing Maroon 5 and Katy Perry’s copyrights onto the blockchain may open up a brand new wave of funding, making it simpler for buyers to entry the music copyright sector. However does the development of tokenizing Actual World Belongings (RWA) within the music trade really have potential?

Story Protocol Tokenizes Songs By Maroon 5 & Katy Perry

In accordance with an official announcement from Story Protocol (IP), the Aria protocol—a part of the Story ecosystem—has acquired and tokenized a portion of the copyrights for the hit songs No person’s Love by Maroon 5 and Daisies by Katy Perry.

The selection of Maroon 5 and Katy Perry seemingly stems from their standing as top-tier artists with large fan bases. Maroon 5 has gained three Grammy Awards and offered over 135 million information worldwide, whereas Katy Perry has offered over 100 million information, with a number of diamond-certified singles.

“Katy Perry and Maroon 5 aren’t simply topping charts anymore—they’re topping funding portfolios,” commented an X person.

Each No person’s Love and Daisies have excessive streaming numbers, producing sustainable passive income. Tokenizing the copyright for these songs permits for the rights to be divided into digital tokens that buyers can commerce or maintain.

This transfer is a part of a broader plan to accumulate parts of over 50 copyrights from main artists, together with BLACKPINK, Miley Cyrus, Justin Bieber, and others, as beforehand introduced by Story Protocol.

Does Music Copyright Tokenization Have Actual Potential?

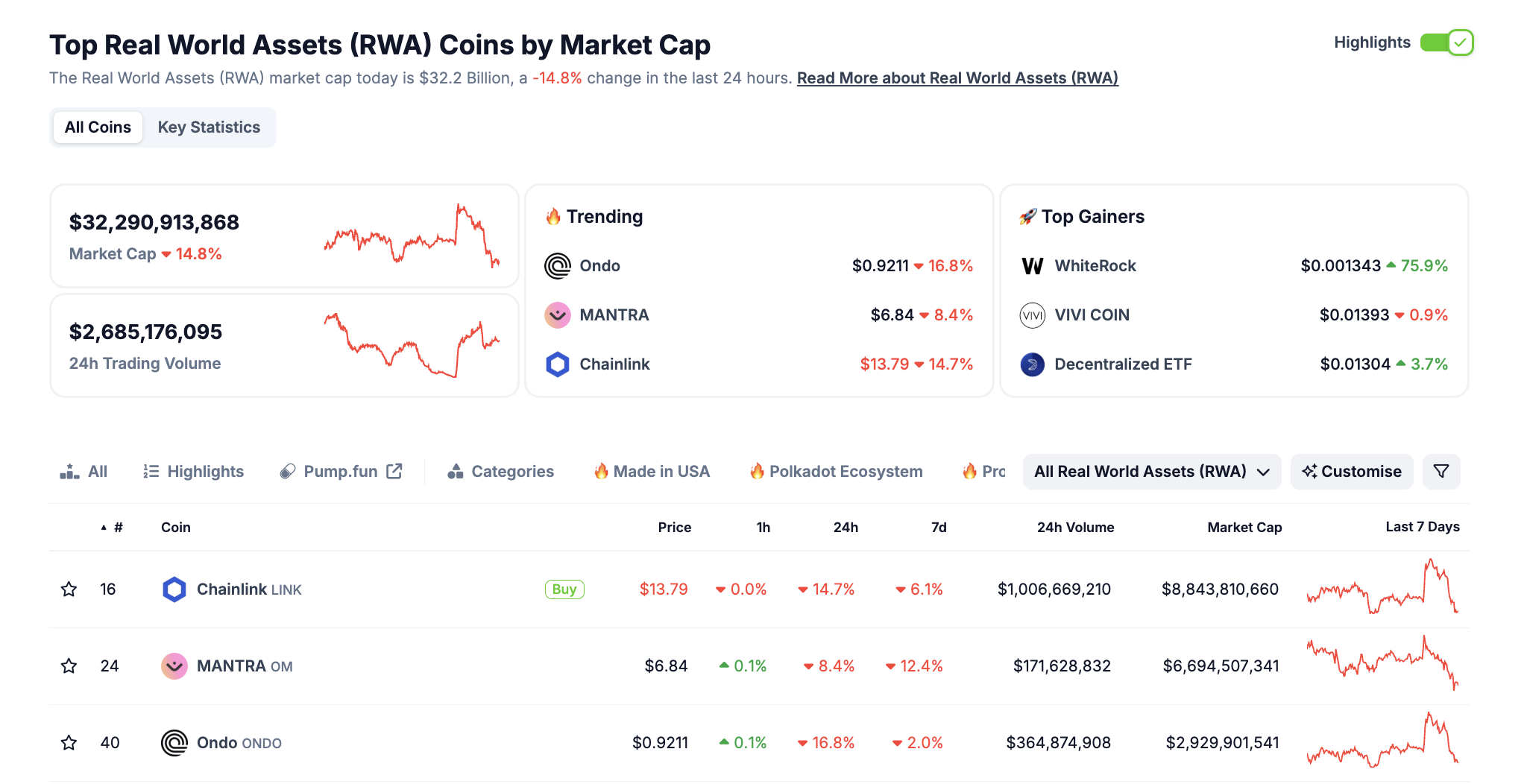

As BeInCrypto has highlighted, Actual-World Asset Tokenization refers back to the strategy of changing bodily or intangible belongings into digital tokens on the blockchain. In accordance with CoinGecko knowledge, as of press time, the market capitalization of RWA-related tasks stands at over $32 billion.

“It’s clear that the world’s largest monetary market infrastructures see an enormous alternative rising from the DLT/Blockchain trade’s skill to attach counterparties round varied types of RWA tokenization,” stated Sergey Nazarov, Co-founder of Chainlink.

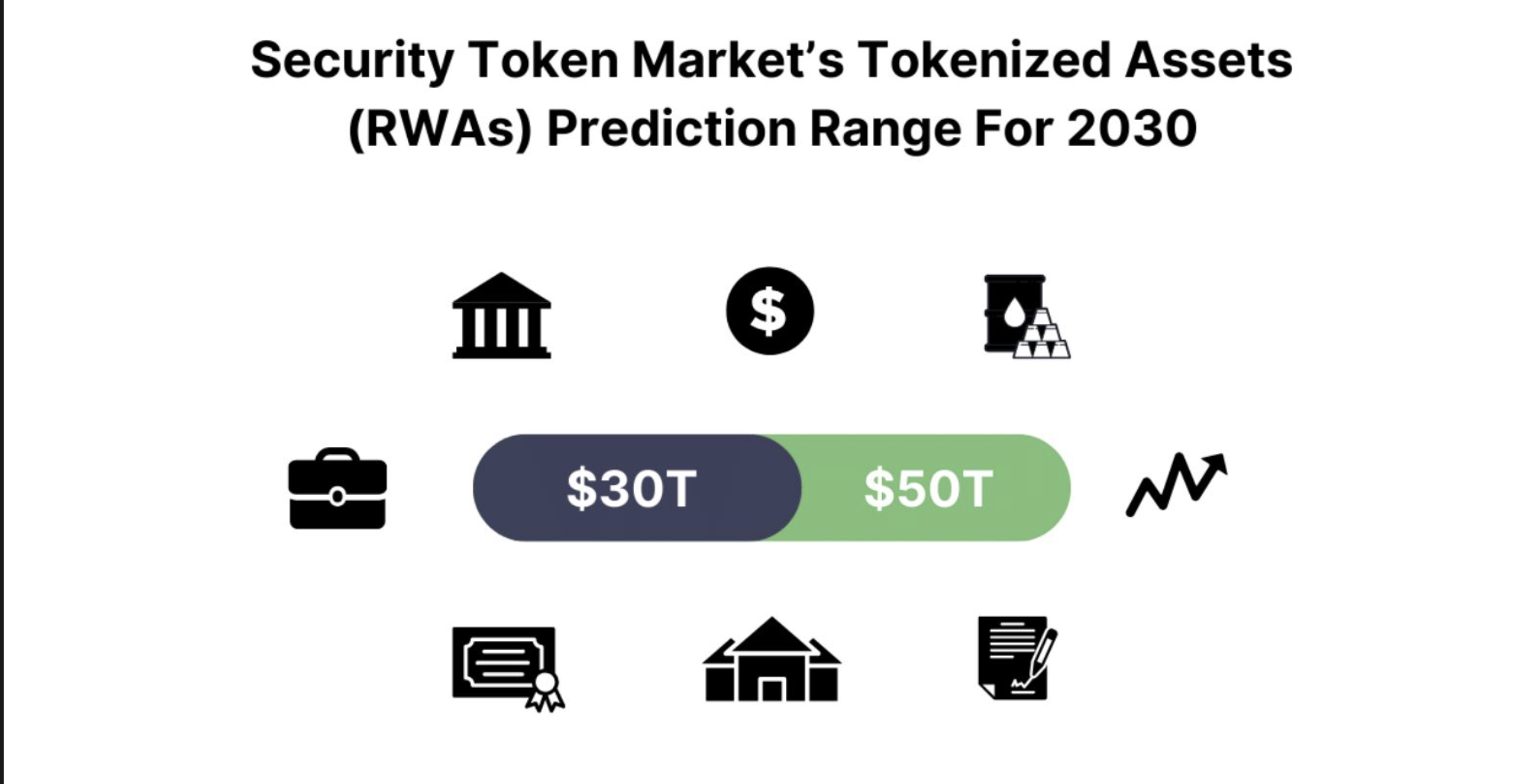

Furthermore, Safety Token Market just lately predicted that the tokenized RWA market may attain $30 trillion by 2030, with main sectors together with securities, actual property, bonds, and gold.

In accordance with the World Mental Property Group (WIPO), the financial worth of Mental Property (IP)—together with copyrights, patents, and emblems—contributes round 38% of worldwide GDP, equal to greater than $30 trillion yearly (based mostly on a worldwide GDP of $80-$100 trillion). The copyright trade alone (music, movie, books) accounts for roughly $5.8 trillion.

Regardless of its large worth, the IP sector stays one of many least liquid asset lessons. Shopping for, licensing, or valuing IP is commonly complicated, time-consuming, and depending on authorized intermediaries. Tokenizing IP may allow extra clear, environment friendly transactions and administration via digital tokens, making this a possible sector that Story Protocol goals to resolve.

Alternatives And Challenges Forward for Story Protocol

Whereas the potential of RWA within the IP sector is plain, Story Protocol nonetheless faces vital challenges in capturing this market. First, Story will not be the one RWA-focused mission.

Rivals like Ondo Finance (Ondo Chain), Centrifuge, and MakerDAO have already established a presence. Story Protocol continues to be comparatively small and only recently launched its mainnet, that means it should display distinctive benefits within the IP area of interest.

Second, tokenizing IP requires authorized recognition from organizations like WIPO and compliance with the Berne Conference. With out overcoming these authorized hurdles, Story Protocol could wrestle to draw main IP holders.

Story Protocol’s transfer to tokenize the copyrights of hit songs aligns with its broader technique to enter the IP sector. Nonetheless, success on this area would require proving its utility and overcoming authorized and market adoption challenges.

Disclaimer

In adherence to the Belief Mission tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nonetheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.