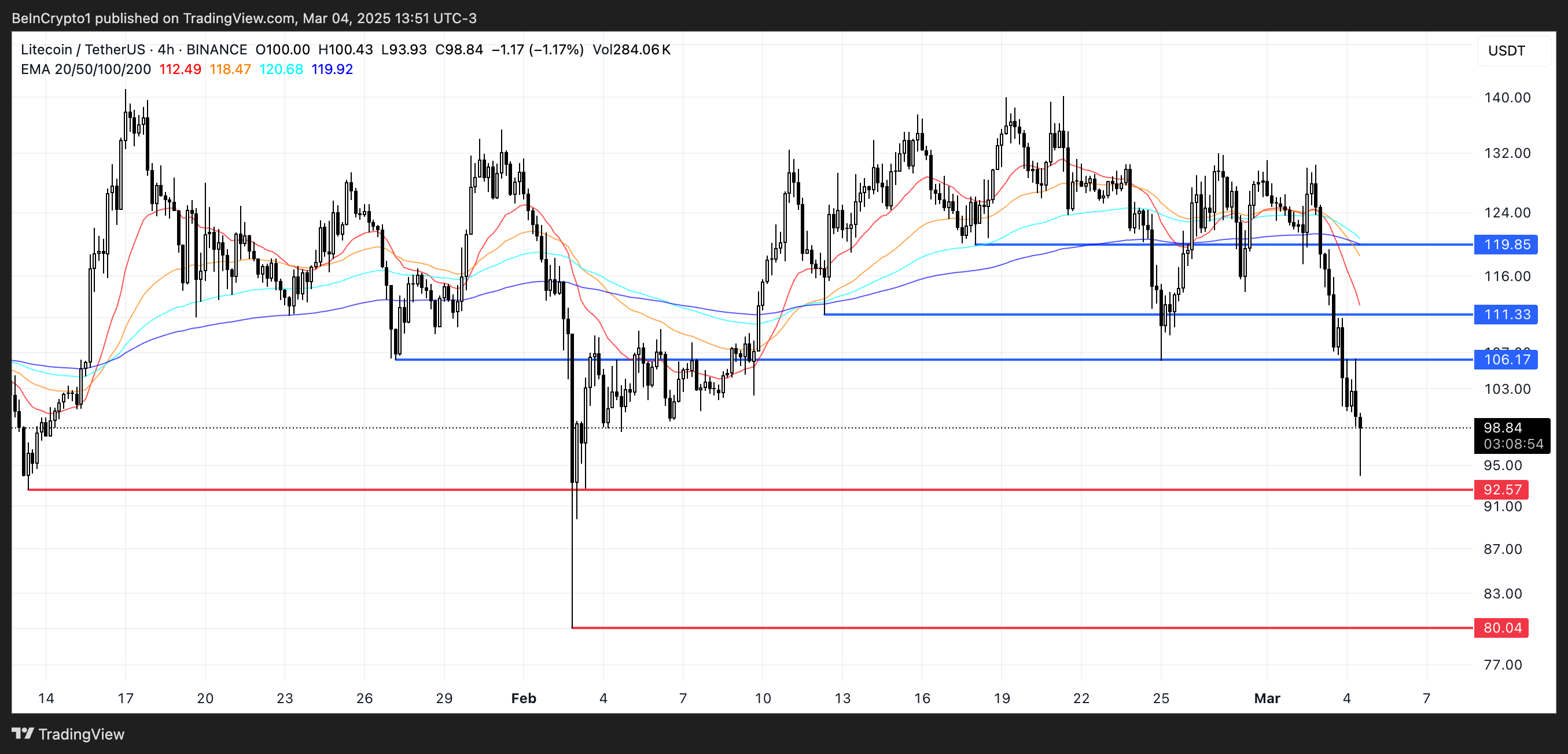

Litecoin (LTC) is down greater than 12% within the final 24 hours, with its value buying and selling round $100 and its market cap dropping to $7.5 billion. The sharp decline comes as promoting strain intensifies, pushing LTC’s RSI into oversold territory and Chaikin Cash Movement (CMF) deeper into detrimental ranges.

If the downtrend continues, LTC might take a look at $92.5 assist and doubtlessly drop to $80, its lowest value since November 2024. Nonetheless, if momentum shifts, LTC might try a restoration, breaking again above $100 and focusing on resistance ranges at $106, $111, and probably $119.

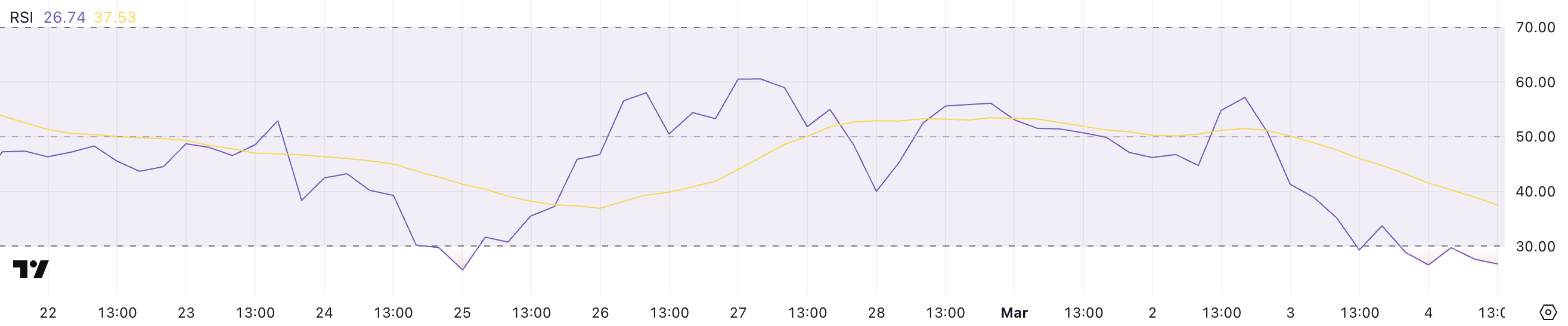

LTC RSI Is At present At Oversold Ranges

Litecoin Relative Power Index (RSI) has dropped to 26.7, a pointy decline from 57.1 simply two days in the past. This steep fall signifies that LTC has entered oversold territory, suggesting intense promoting strain.

Such a speedy drop typically displays panic promoting or a powerful bearish development, leaving LTC weak to additional draw back until patrons step in.

Nonetheless, an RSI this low additionally indicators that the asset could also be nearing a possible short-term reversal, as oversold situations typically result in aid bounces.

RSI is a momentum indicator that ranges from 0 to 100, measuring the power of current value actions. Readings above 70 point out overbought situations, the place property are prone to face promoting strain, whereas readings under 30 recommend oversold situations, the place shopping for alternatives might emerge.

With LTC’s RSI now at 26.7, it’s deep in oversold territory, growing the probabilities of a short-term bounce.

Nonetheless, if bearish momentum persists and RSI continues falling, Litecoin might battle to search out assist and prolong its losses earlier than any restoration try.

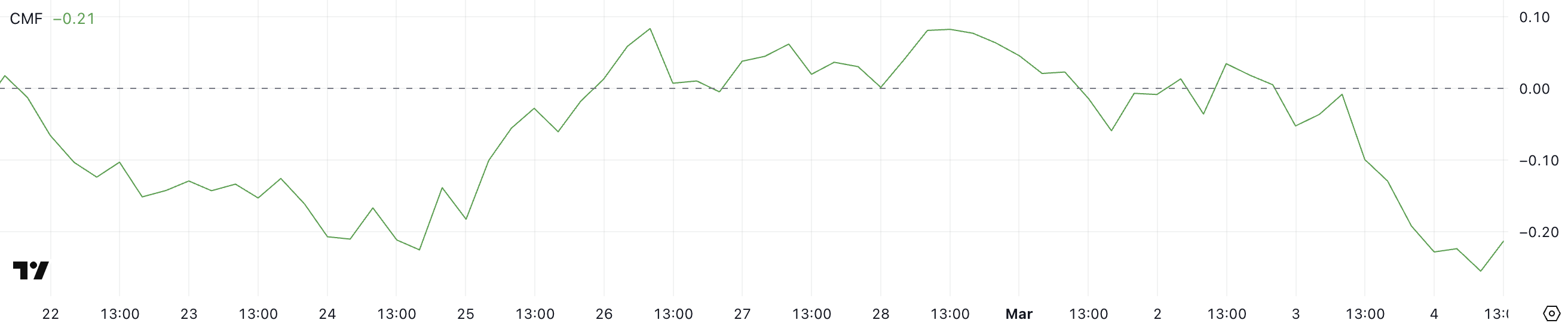

Litecoin CMF Fell Under -0.20

Litecoin’s Chaikin Cash Movement (CMF) is presently at -0.21, down from 0.03 simply two days in the past, indicating a big shift in capital move. Earlier, CMF briefly dropped to -0.26, its lowest degree since mid-February, reinforcing bearish sentiment.

A declining CMF means that promoting strain is growing, with extra capital flowing out of LTC than into it.

This development indicators that traders are pulling liquidity from Litecoin, making it troublesome for the worth to maintain any short-term rebounds.

CMF measures shopping for and promoting strain by analyzing quantity and value actions starting from -1 to 1. Constructive values point out accumulation, that means more cash is flowing into an asset, whereas detrimental values recommend distribution and elevated promoting strain.

With LTC’s CMF now at -0.21, sellers stay in management, and until shopping for quantity returns, LTC might battle to search out assist.

The current drop to -0.26 exhibits that capital outflows are reaching excessive ranges, growing the danger of additional draw back until sentiment shifts.

Will Litecoin Fall Under $90 Quickly?

If Litecoin’s downtrend continues, the worth might take a look at the $92.5 assist degree, a key zone that has beforehand held patrons. If this degree is misplaced, LTC might drop as little as $80, marking its lowest value since November 2024.

With momentum indicators like RSI and CMF exhibiting bearish strain, additional declines stay a risk until patrons step in to defend assist.

Nonetheless, if LTC reverses its development, it might regain momentum and push above $100, with $106 as the primary main resistance degree.

A breakout above this might result in a take a look at of $111, and if bullish momentum strengthens, LTC might rally towards $119.

Disclaimer

In step with the Belief Mission tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.