Bitcoin’s popularity as a hedge in opposition to financial turmoil is fading because it strikes in line with conventional threat belongings.

Since Trump’s return to workplace, almost $1 trillion has vanished from the crypto market, signaling a shift in investor notion.

As soon as seen as digital gold, Bitcoin not mirrors the metallic’s good points. Whereas gold continues to rise, Bitcoin has struggled, with analysts noting a pointy drop in market worth regardless of Trump’s pro-crypto stance.

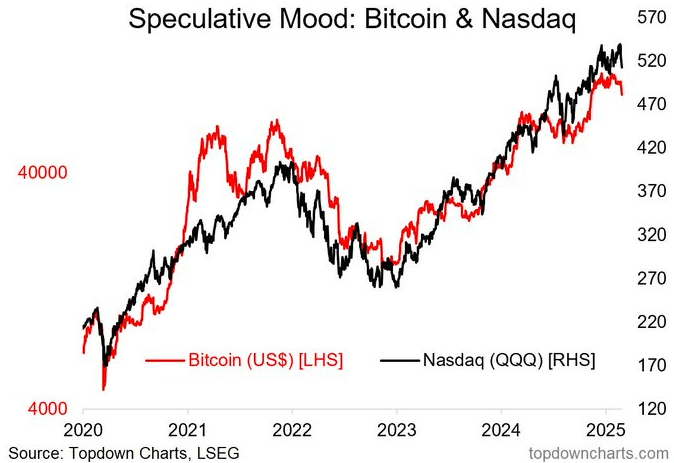

Its growing correlation with conventional markets is a key issue—as soon as impartial, Bitcoin now strikes in sync with the Nasdaq and S&P 500, although this hyperlink has weakened barely in current months.

Liquidity considerations add to the uncertainty. Capital is flowing again into the US greenback, leaving Bitcoin and different cryptocurrencies weak to sudden crashes. ETF holdings have shrunk by $20 billion, and DeFi’s whole locked worth has plunged, reflecting declining confidence in crypto’s stability.

Geopolitical tensions are amplifying market volatility. A rising variety of buyers see commerce wars as the most important risk to threat belongings in 2025, and solely a small fraction nonetheless consider Bitcoin would thrive underneath such situations. In the meantime, volatility indexes are spiking, with analysts warning of continued worth swings.

Regardless of the downturn, some consider Bitcoin may play a job in stabilizing the US financial system. Advocates argue it presents an alternative choice to conventional finance, whereas firms exploring Bitcoin holdings may gas long-term demand.

Even skeptics admit Bitcoin capabilities as digital gold, although its potential to function a real monetary hedge stays unsure. Whether or not it rebounds or continues behaving like a high-risk asset will rely on how buyers adapt to shifting financial situations.