- Bitwise has formally filed for an ETF that might observe the worth of Aptos (APT).

- The corporate submitted an S-1 submitting and nonetheless wants a 19b-4 kind for SEC approval.

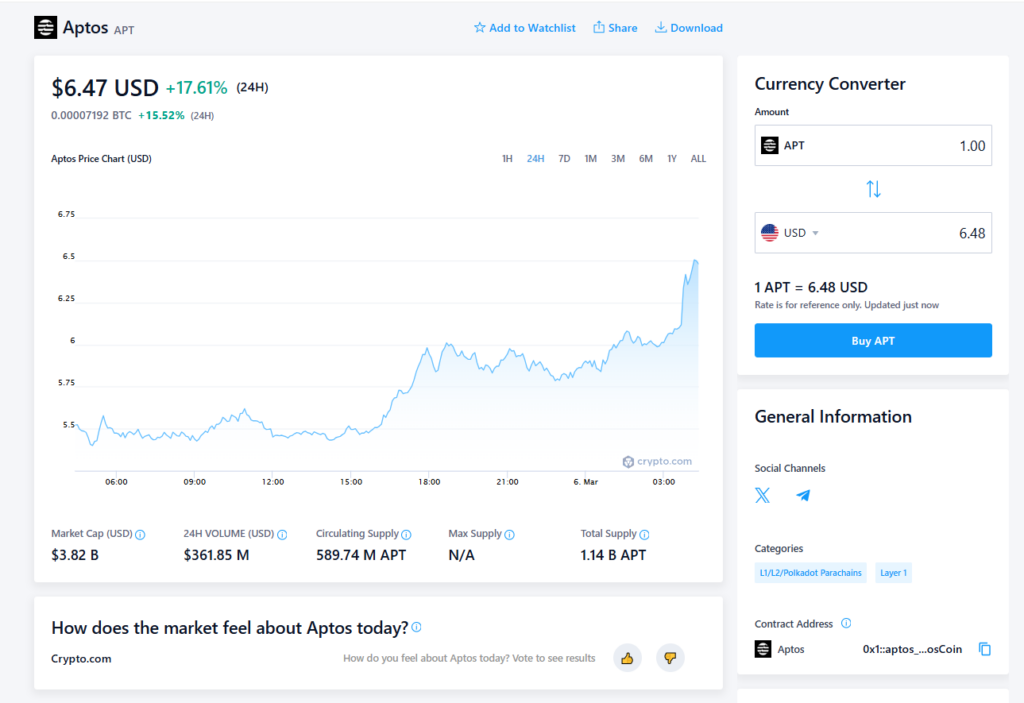

- APT surged 18% to $6.48 following the information, with buyers eyeing potential adoption development.

Bitwise is making strikes—official ones. The asset supervisor has simply filed paperwork for an exchange-traded fund (ETF) that might observe the worth of Aptos (APT), the native token of the Aptos community.

What’s the deal?

Final week, Bitwise dropped a touch by registering a Delaware belief entity for a possible Aptos ETF. Now, it’s placing that plan into movement. On Wednesday, the corporate submitted an S-1 submitting with the Securities and Alternate Fee (SEC), a vital step for launching a brand new safety on a public inventory trade.

APT is a scalable Layer 1 blockchain token constructed on the Transfer programming language, designed for velocity and effectivity. If accredited, the ETF would permit conventional buyers to achieve publicity to Aptos while not having to carry the token instantly.

However there’s yet one more step—Bitwise can even have to file a 19b-4 kind. This submitting alerts a required rule change on the inventory trade planning to listing the ETF, which then forces the SEC to function on a strict timeline for approval or rejection.

crypto.com

Market Response

Following the announcement, APT surged 18% previously 24 hours, climbing to $6.48 at press time. Buyers appear to be betting that this ETF, if accredited, might be a game-changer for Aptos adoption.

Now, all eyes are on the SEC. Will they greenlight one other crypto ETF, or will regulatory hurdles sluggish this one down? Both means, the Aptos group is watching carefully.