On-chain information exhibits the Bitcoin traders have participated in a large quantity of loss taking because the asset’s worth has gone by way of a crash.

Bitcoin Entity-Adjusted Realized Loss Noticed A Sharp Spike Not too long ago

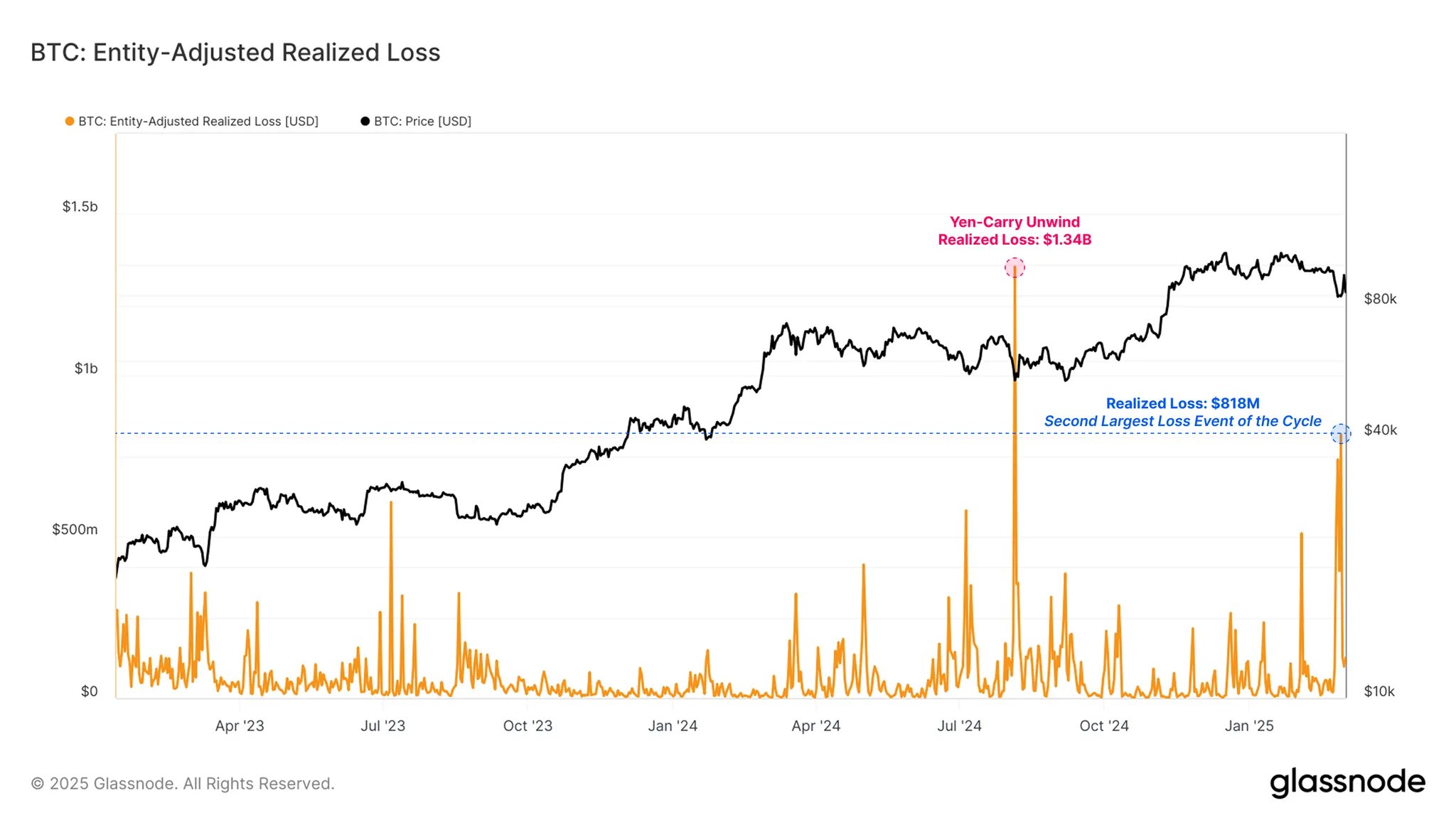

In a brand new publish on X, the on-chain analytics agency Glassnode has talked concerning the newest pattern within the Realized Loss for Bitcoin. The “Realized Loss” right here refers to an indicator that measures the full quantity of loss that the traders are ‘realizing’ by way of their transactions on the community on daily basis.

The metric works by going by way of the switch historical past of every coin being bought on the blockchain to see what worth it was moved at previous to this. If the final promoting worth was greater than the present worth for any token, then that individual coin’s sale will be assumed to be leading to loss realization.

The Realized Loss considers that this loss is the same as the distinction between the 2 costs. On this method, the metric calculates the loss concerned in every transaction after which finds the full sum for the community. A counterpart metric often called the Realized Revenue retains monitor of the transfers of the alternative sort.

Now, right here is the chart shared by Glassnode that exhibits the pattern within the Bitcoin Realized Loss over the past couple of years:

The worth of the indicator seems to have witnessed a pointy spike in latest days | Supply: Glassnode on X

Within the graph, the model of the Realized Loss is the “Entity-Adjusted” one, that means that the metric solely accounts for gross sales occurring between two separate entities, not simply addresses. An entity is a group of wallets that the analytics agency has decided to belong to the identical investor.

Transactions between the addresses of the identical investor don’t actually result in any loss or revenue realization, so it is smart to exclude such strikes from the information of the indicator.

As displayed within the chart, the Bitcoin Entity-Adjusted Realized Loss has noticed a pointy spike lately, implying the traders have made numerous underwater transactions.

This capitulation occasion is of course a results of the bearish volatility that BTC has witnessed lately. In the course of the preliminary crash, the metric’s worth hit a whopping $818 million, which is the second largest loss-taking occasion for the cycle to date.

The one capitulation occasion the place the indicator noticed a bigger peak was through the yen-carry commerce unwind of final yr, the place traders realized a complete of $1.34 billion in losses.

Traditionally, mass selloffs the place traders capitulate have typically led to bottoms for Bitcoin, as tokens are inclined to switch from weak palms to robust ones in these intervals. It now stays to be seen whether or not the spike in Realized Loss would have an analogous impact on the cryptocurrency this time or not.

BTC Worth

On the time of writing, Bitcoin is floating round $90,300, up virtually 7% within the final seven days.

Appears to be like like the worth of the coin has been making restoration from the crash | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, Glassnode.com, chart from TradingView.com