Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

In crypto, wild value swings are regular when insurance policies and new rules are introduced. This market commentary turned evident this week, instantly after US President Donald Trump introduced plans for a strategic crypto reserve that features Ethereum, Solana, ADA, Ripple’s XRP, and naturally, Bitcoin.

Associated Studying

Cryptos’ response was instant, with Ethereum as one of many prime belongings that surged and fell massively inside days. On March 2nd, ETH was buying and selling at $2,191, then climbed to as excessive as $2,542 on March third, earlier than dropping beneath $2,300 on the day’s shut and settling on the $2,050 degree once more the subsequent day.

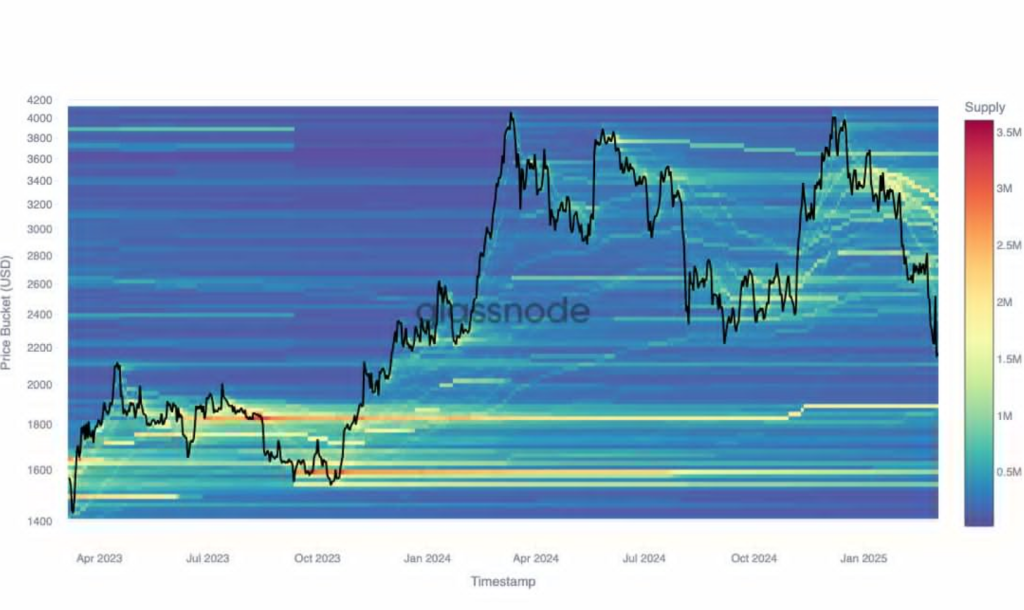

In keeping with Glassnode, the latest crypto value actions unraveled among the key methods of ETH holders.

A Flurry Of Actions Amongst ETH Holders

Glassnode knowledge reveals ETH holders and buyers moved and adjusted their holdings throughout the latest crypto value swings. Based mostly on its three-month evaluation, Ether holders who acquired their tokens at $3,500 adjusted their holdings in February.

#Ethereum buyers actively managed their publicity by way of this unstable interval. After a rally to $2.5K, $ETH retraced to $2.05K – ranges final seen in Nov 2023. Price Foundation Distribution (CBD) reveals how capital rotated throughout value ranges and who took benefit of the dip. 🧵👇 pic.twitter.com/vl6AdghfRO

— glassnode (@glassnode) March 5, 2025

These buyers began their positions at a peak value of $2,500, and remained on their positions when ETH revisited $2,050. Based mostly on Glassnode figures, these buyers personal 1.75 million ETH with a mean acquisition value of $3,200. Which means that their holdings at the moment are down 10% from their entry.

Glassnode additionally shares that on March 1st, buyers purchased 500k ETH at a mean value of $2,200. Nonetheless, this group rapidly redistributed their holdings when ETH’s value hit $2,500.

Ethereum’s latest value motion has revealed a brand new main value resistance at $2,800, the place market merchants accrued 800k tokens. As such, crypto holders and buyers at the moment are this degree if ETH rebounds quickly.

Rising Accumulation Amongst ETH Whales

Market analysts additionally spotlight the rising buying and selling exercise and accumulation amongst crypto wallets. Crypto commentator Ted shared {that a} crypto whale investor just lately purchased 17,855 ETH value roughly $36 million, with a mean value of $2,054.

The whale’s ETH holdings at the moment are valued at $2.5 billion. This transaction validates the present accumulation pattern, suggesting that at the moment’s value is a “purchase alternative”.

Is It Time To Purchase ETH?

At present, ETH is buying and selling between $2,100 and $2,300, which remains to be beneath its Monday value of $3,500. In keeping with a CryptoQuant analyst, Ethereum is more than likely in favorable situation after its latest value swings. The analyst added that Ethereum’s MVRV ratio drops beneath 1, that means the asset is undervalued.

Associated Studying

This degree usually units the tone for a value surge in earlier bull markets. He additionally famous that an rising variety of ETH addresses are shopping for extra tokens. These wallets maintain ETH with out promoting, suggesting that institutional gamers are constructing their holdings.

Nonetheless, the CryptoQuant analyst stays cautious on ETH, declaring that macroeconomic situations can nonetheless sway crypto costs. He then famous the doable impression of tariff measures and financial methods on ETH and altcoin costs.

Featured picture from Reuters, chart from TradingView