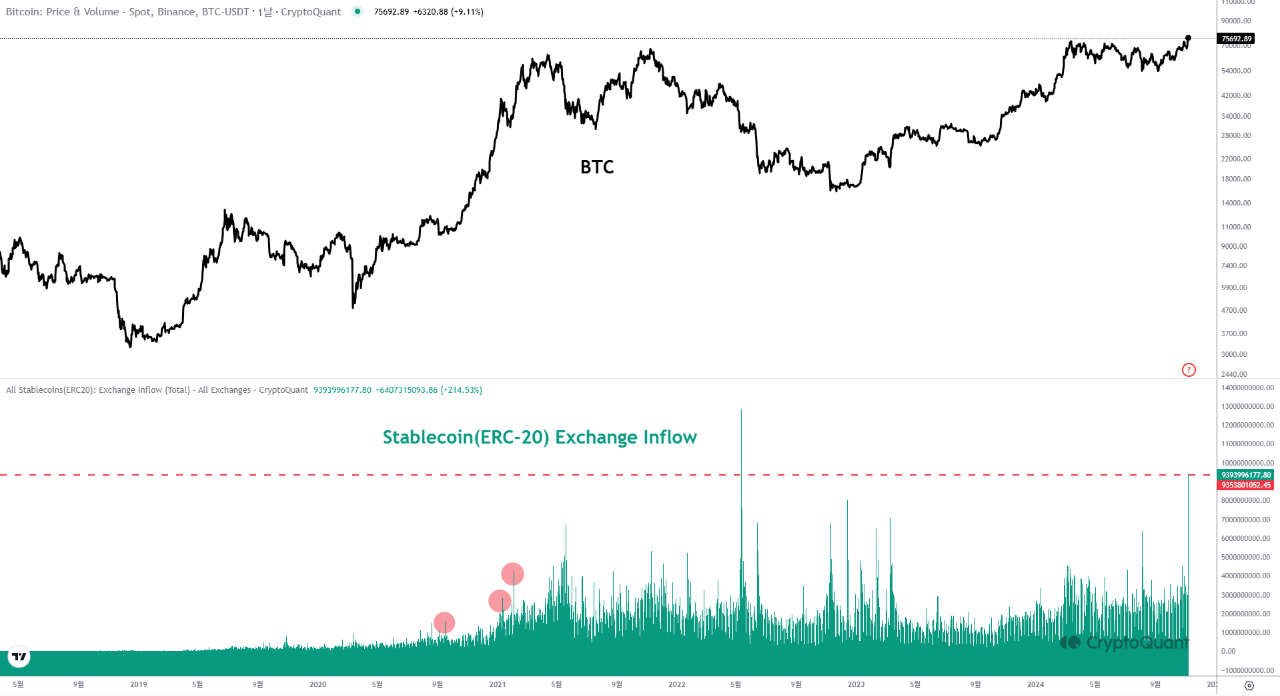

Two main cryptocurrency exchanges, Binance and Coinbase, noticed a whopping $9.3 billion price of stablecoin inflows on the Ethereum community after Republican candidate Donald Trump received the U.S. presidential election.

In response to evaluation from on-chain analytics agency CryptoQuant, out of the $9.3 billion price of ERC-20 stablecoins deposited not these exchanges, $4.3 billion flowed to Binance, whereas $3.4 billion moved to the Nasdaq-listed change Coinbase.

Per the agency’s evaluation, large-scale stablecoin inflows and subsequent upward traits have traditionally “coincided with bullish market rallies.”

The stablecoin inflows come at a time by which spot Bitcoin exchange-traded funds (ETFs) noticed document day by day inflows of $1.38 billion as the value of the flagship cryptocurrency reached a brand new all-time excessive close to the $77,000 mark after Republican candidate Donald Trump received the U.S. presidential elections.

In response to knowledge from Farside, BlackRock’s spot Bitcoin ETF, the iShares Bitcoin Belief (IBIT), accounted for about 81% of the full inflows, bringing in $1.11 billion in internet inflows, far above the runner-up, the Constancy Sensible Origin Bitcoin Fund (FBTC), which noticed $190 million inflows.

The Ark 21 Shares Bitcoin ETF (ARKB) got here in third place, with $17.6 million inflows. No spot Bitcoin ETF noticed outflows on November 7. Information reveals that in whole, spot Bitcoin ETF’s cumulative flows are actually at $25.57 billion.

These document inflows come at a time by which the value of the flagship cryptocurrency rose greater than 9% over the previous week to hit a brand new all-time excessive, fueled by Trump’s victory within the U.S. elections, given his pro-crypto stance.

A Trump victory was broadly anticipated to assist enhance Bitcoin’s value, as the previous U.S. President has expressed sturdy assist for the cryptocurrency sector, that means the regulatory outlook might enhance via the discount of regulatory ambiguity and the appointment of extra crypto-friendly officers to key positions, for instance.

Bitcoin’s value, nonetheless, has been identified to rally after U.S. presidential elections, having seen 90-day returns of 87%, 44%, and 145% after the elections in 2012, 2016, and 2020, respectively.

Featured picture by way of Pixabay.