Crypto markets brace for unstable days forward, with key US financial information due for launch this week, beginning Tuesday. These macroeconomic occasions may have an effect on the portfolios of Bitcoin (BTC) holders, making it crucial for buyers to regulate their buying and selling methods.

Financial developments are progressively influencing Bitcoin market sentiment, rising the probability of volatility this week.

US Financial Knowledge With Crypto Implications This Week

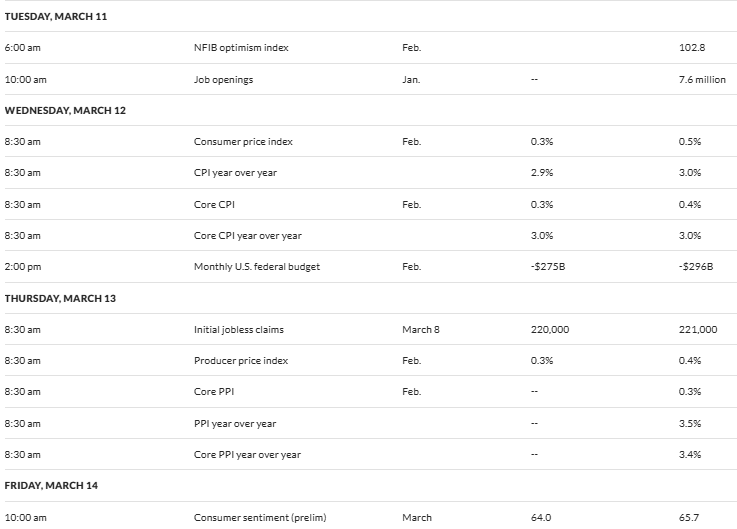

The next macroeconomic information factors may affect Bitcoin sentiment this week.

JOLTS

Beginning the listing of US financial information with crypto implications this week is the discharge of US job openings information on Tuesday, March 11. Generally known as the Job Openings and Labor Turnover Survey (JOLTS), this information level may considerably sway Bitcoin sentiment by offering insights into the well being of the labor market and broader economic system.

If the information signifies a powerful labor market with excessive job openings—say, exceeding the earlier 7.6 million mark—it’d sign persistent financial energy. This might cut back expectations for imminent Federal Reserve (Fed) charge cuts.

Traditionally, a powerful labor market can bolster the US greenback and conventional property like shares, drawing buyers away from riskier property like Bitcoin. This might dampen Bitcoin sentiment, as buyers may understand much less want for a decentralized hedge in opposition to financial easing.

Conversely, if job openings are available in decrease than anticipated, it may heighten recession fears or sign a cooling economic system. Such an end result would immediate hypothesis of Fed intervention by charge cuts. This state of affairs usually boosts Bitcoin’s enchantment as a “digital gold” or haven, doubtlessly driving optimistic sentiment and value momentum amongst crypto lovers.

CPI

The US CPI (Shopper Worth Index) information, set for launch on Wednesday, March 12, may additionally sway Bitcoin sentiment. This information will sign inflation tendencies that affect Fed coverage.

The next-than-expected CPI forecasted at 2.9% in comparison with the earlier 3.0% may recommend persistent inflation. This would cut back hopes for charge cuts and strengthen the greenback, dampening Bitcoin’s enchantment as a hedge. Such an end result may decrease sentiment and costs as buyers favor conventional property.

Alternatively, a softer CPI may gas expectations of looser financial coverage, weakening the greenback and boosting Bitcoin as a danger asset. This may elevate sentiment amongst crypto merchants.

“CPI report on Wednesday – Core Inflation quantity going to return in cool – doubtlessly decrease than most anticipate. BTC will pump,” one person on X said.

Preliminary Jobless Claims

The US Preliminary Jobless Claims information, due Thursday, March 13, may additionally sway Bitcoin sentiment by reflecting labor market energy or weak point.

If claims drop beneath the anticipated 220,000 (following final week’s 221,000), it’d sign a powerful economic system. This might strengthen the greenback and shift buyers’ focus to conventional property like shares. Such an end result would dampen Bitcoin’s enchantment as a danger asset, decreasing sentiment.

In the meantime, higher-than-expected claims may point out financial softening, elevating hopes for Fed charge cuts. This usually boosts Bitcoin as a hedge in opposition to fiat weak point, lifting sentiment and costs.

PPI

The US PPI (Producer Worth Index) information, scheduled for launch on Thursday, March 13, may influence Bitcoin sentiment by revealing wholesale inflation tendencies.

The next-than-expected PPI, forecasted at 0.3% month-over-month, may point out rising producer prices, doubtlessly signaling persistent inflation. This might cut back expectations for Fed charge cuts, strengthening the greenback and pressuring Bitcoin as a danger asset, thus dampening sentiment.

Nonetheless, a decrease PPI may ease inflation fears, enhance rate-cut hopes, and improve Bitcoin’s enchantment as an inflation hedge, lifting sentiment.

“An enormous week for financial information, with JOLTS, CPI & PPI. We may both see some energy and markets claw again a number of the losses of the final couple of weeks, or affirmation there are underlying points and markets proceed to dump,” market analyst Mark Cullen indicated.

Shopper Sentiment

The US Shopper Sentiment Index, due for launch on Friday from the College of Michigan, may considerably affect Bitcoin sentiment by reflecting public confidence within the economic system.

A powerful studying, doubtlessly above the anticipated 64.0 (primarily based on latest tendencies), may recommend optimism about financial stability, bolstering conventional markets and the greenback. This might dampen Bitcoin’s attract as a hedge in opposition to uncertainty, resulting in bearish sentiment amongst crypto buyers, as funds may stream towards equities.

Conversely, a weaker-than-expected determine may sign financial unease, enhancing Bitcoin’s enchantment as a decentralized asset amid fears of inflation or recession. This may enhance bullish sentiment and doubtlessly its value. Given Bitcoin’s sensitivity to macroeconomic cues, this information may sway dealer perceptions sharply.

“The College of Michigan’s shopper sentiment survey can inform us how optimistic individuals really feel in regards to the economic system. This could influence shopper spending, which is a serious driver of financial development,” Pennybois Trades Alert highlighted in a submit.

Disclaimer

In adherence to the Belief Undertaking pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nonetheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any choices primarily based on this content material. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.