Monetary large Franklin Templeton, managing a staggering $1.53 trillion in property, has formally entered the race to launch an XRP exchange-traded fund (ETF).

This transfer locations it alongside corporations like Bitwise, Canary Capital, 21Shares, Grayscale, and WisdomTree, which have already submitted comparable functions.

Regulatory discussions round these proposals are gaining momentum, with the U.S. Securities and Change Fee (SEC) acknowledging the filings from these corporations.

Whereas this recognition is seen as an encouraging step, it stays unsure whether or not the regulator will approve them.

The SEC’s stance on cryptocurrency seems to be shifting, particularly following management adjustments, however the remaining final result is but to be decided. A call on Grayscale’s software is predicted by October 18.

In a separate improvement, Volatility Shares has put ahead its personal distinctive XRP-related ETF proposals, together with a product designed for traders seeking to speculate on a decline within the token’s value.

XRP ETF Race Heats Up, Whereas Solaxy Gives One thing New

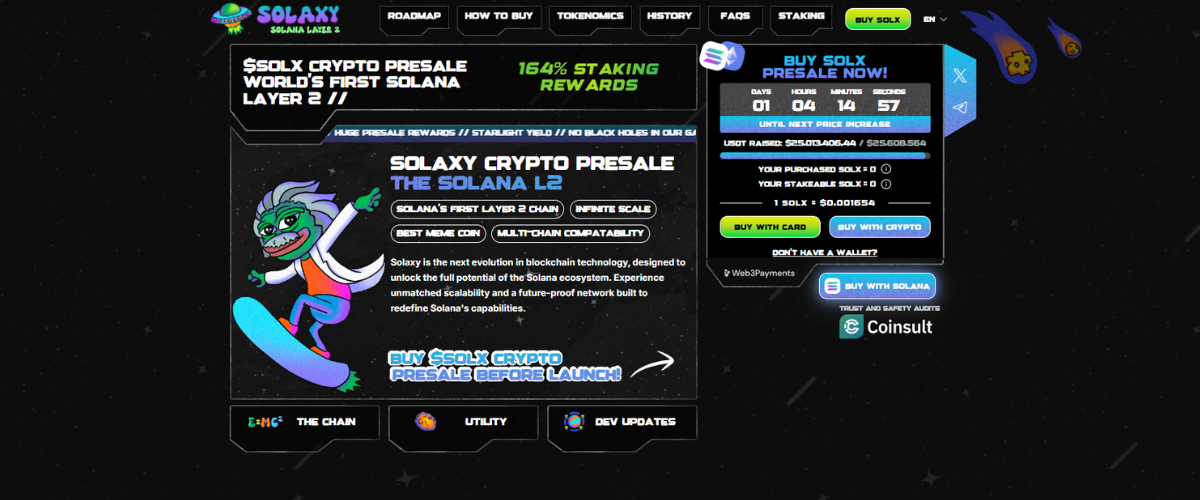

Solaxy ($SOLX) is revolutionizing blockchain know-how by providing the primary Layer-2 answer on Solana. This mission considerably improves pace and reduces transaction charges, fixing community congestion issues.

Solaxy’s superior rollup structure reveals robust potential to optimize transaction speeds and scale back congestion-related inefficiencies on Solana. The mission’s strategy reduces congestion and ensures clean execution, even throughout peak exercise. For merchants, this implies sooner and extra dependable transactions, stopping failed swaps.

Past enhancing transaction effectivity, Solaxy is increasing interoperability between Solana and Ethereum. The $SOLX token capabilities as a multi-chain asset, permitting customers to interact throughout each ecosystems. This offers entry to Ethereum’s liquidity whereas benefiting from Solana’s pace and value effectivity.

Purchase Solaxy Right here