- Franklin Templeton has filed for a spot XRP ETF, turning into the most important asset supervisor to enter the race.

- Altcoin ETF filings are surging, with VanEck, Grayscale, and Bitwise pushing for Solana, Dogecoin, and HBAR merchandise.

- Institutional demand for Ethereum ETFs is rising, whereas a brand new SEC crypto job pressure might affect future approvals.

Franklin Templeton has formally entered the spot XRP ETF race, submitting an S-1 registration with the U.S. Securities and Trade Fee (SEC) on Tuesday. This makes it the most important asset supervisor to file for an XRP-based exchange-traded fund, marking a significant shift in institutional curiosity beneath crypto-friendly insurance policies from the Trump administration.

The Increasing Altcoin ETF Market

The ETF filings preserve piling up. Simply this week:

- VanEck registered for what seems to be the primary AVAX ETF.

- Grayscale just lately filed for a Polkadot (DOT) ETF.

- Canary Capital registered for an Axelar ETF final week.

- Bitwise and Grayscale filed for Dogecoin and HBAR ETFs, whereas VanEck’s Solana ETF remains to be awaiting SEC motion.

In a separate improvement, the Cboe BZX Trade filed a rule change that might enable staking inside Constancy’s Ethereum ETF, a transfer that might set a precedent for future ETFs incorporating staking rewards.

How Seemingly Are These ETFs to Get Authorised?

Bloomberg analysts predict Litecoin ETFs have a 90% probability of approval, whereas:

- Dogecoin ETFs sit at 75%.

- Solana merchandise at 70%.

- XRP ETFs at 65%.

The SEC accredited spot Bitcoin ETFs in January 2024 and Ethereum ETFs in July, setting the stage for broader altcoin ETF adoption.

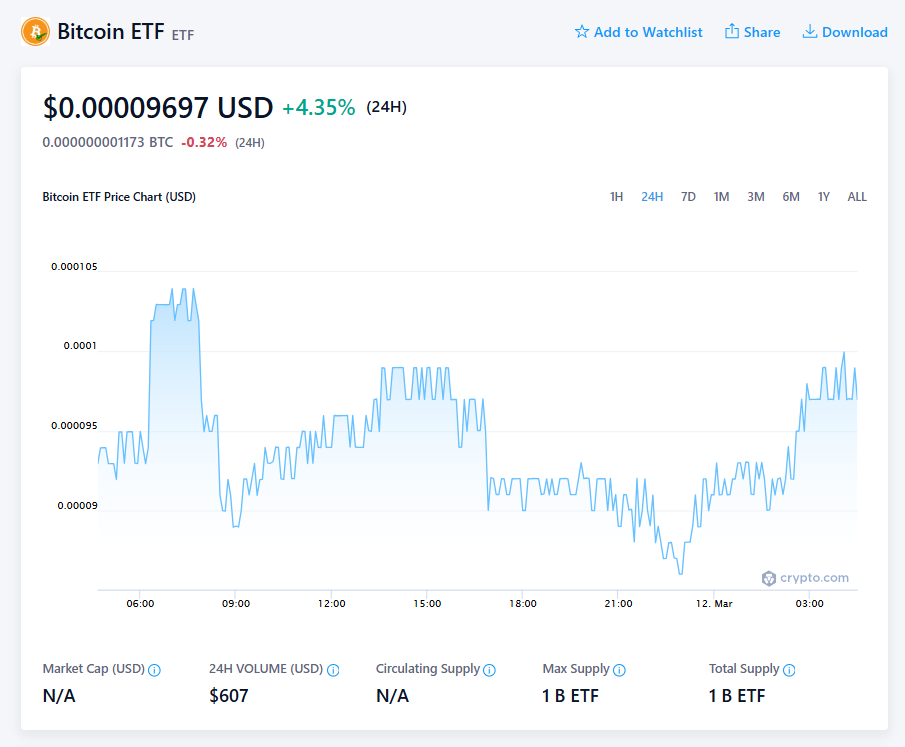

crypto.com

Institutional Curiosity in Crypto ETFs Grows

Institutional demand for spot Ethereum ETFs surged final quarter, with ETH ETF possession rising from 4.8% to 14.5%. In the meantime, spot Bitcoin ETF possession barely declined from 22.3% to 21.5%.

A brand new SEC crypto job pressure, led by Republican SEC Commissioner Hester Peirce, is anticipated to play a key position in figuring out which crypto belongings qualify as securities, probably influencing future ETF approvals.

With institutional cash flowing into altcoin ETFs and new regulatory developments unfolding, the crypto ETF panorama is evolving quick—and XRP, Solana, and Dogecoin might be subsequent in line.