Alameda Analysis unlocked Solana tokens value practically $23 million as we speak. Regardless of this notable unlock, it barely affected SOL’s underlying value or demand dynamics.

FTX’s reimbursement course of has begun, and the agency unlocked SOL value $1.57 billion. Alameda’s comparatively small unlock exists within the context of bearish market components which might be drastically impacting demand.

How Will Alameda Use Its Unstaked Solana Tokens?

In line with on-chain knowledge from Arkham Intelligence, Alameda Analysis distributed the unstaked SOL to 38 FTX-linked addresses. As a refresher, Alameda was the buying and selling agency linked to the FTX collapse, operated by Caroline Ellison.

“Alameda deal with simply unstaked $23 million SOL to 38 new addresses. An FTX/Alameda staking deal with acquired $22.9 million SOL from a staking deal with unlock and has simply distributed these funds to 37 addresses which have beforehand acquired SOL from this deal with. These addresses presently maintain $178.82 million SOL,” Arkham claimed by way of social media.

Since its downfall, Alameda has moved big quantities of property on a number of events. For instance, Alameda chapter addresses staked $10 million in MATIC tokens in late 2023 and moved Ethereum value $14.75 million in early 2024.

Nonetheless, each these incidents prompted vital value fluctuations within the related property.

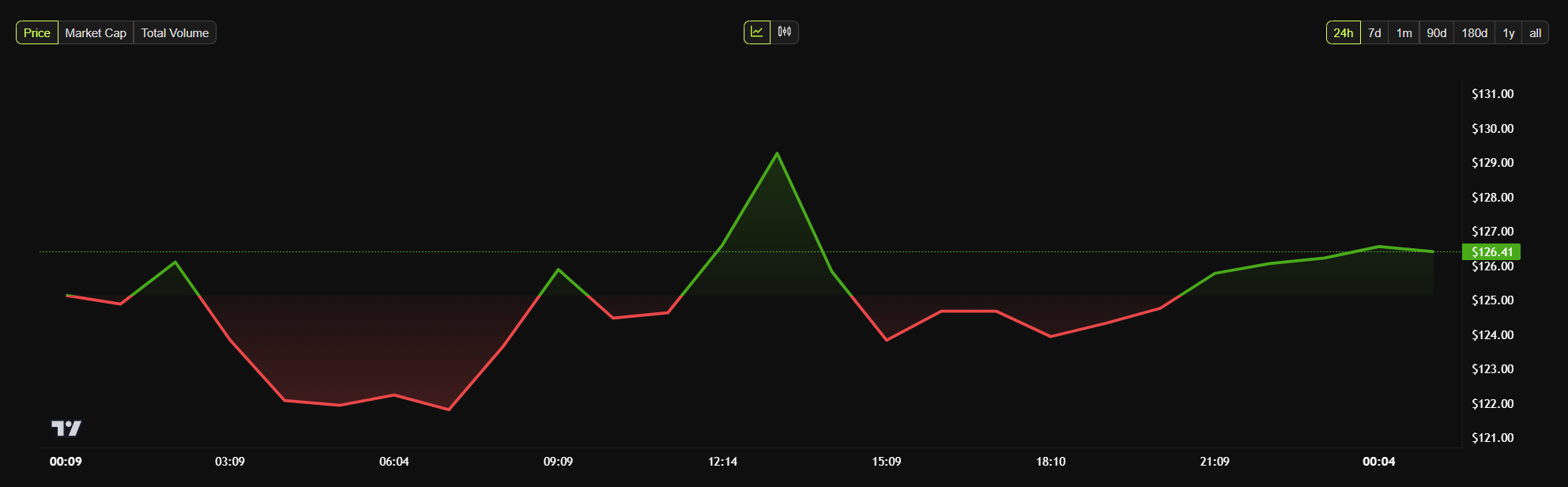

Solana’s value, then again, has barely budged since these Alameda transactions happened. Yesterday, the SEC delayed a number of Solana ETF functions, and this had a barely bearish impression on the altcoin’s value.

Even so, ETH jumped 10% when Alameda moved a provide value $14.75 million. It moved far more SOL as we speak, however this didn’t even trigger the day’s largest value transfer.

Solana declined and spiked in a short while span, however all of this occurred earlier than the announcement. Comparatively, the Alameda unlock had virtually no impact.

Up to now, it isn’t clear what precisely Alameda is planning on doing with these unlocked Solana tokens. Final month, FTX started the primary spherical of creditor repayments, however this will probably be a protracted course of. Earlier this month, FTX additionally unlocked Solana tokens value $1.57 billion.

In different phrases, Alameda could also be planning to make use of these tokens as a part of the FTX reimbursement course of, however that may not change Solana’s demand.

The crypto market is presently in a state of Excessive Concern, and most main property are seeing large outflows. Alameda’s actions are only one drop in a really giant bucket.

Disclaimer

In adherence to the Belief Venture tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.