Solana (SOL) has confronted vital worth challenges in current weeks, with a notable drawdown that has left it struggling to recuperate.

This decline has triggered considerations out there, additional compounded by a key bearish sign. There’s a rising concern amongst buyers that these elements might result in much more bearishness within the quick time period.

Solana Faces Sturdy Bearishness

Solana’s worth has slipped beneath the realized worth for the primary time in virtually 3 years. The realized worth is a key metric that represents the common worth at which an asset was final moved. When the spot worth falls beneath this, it alerts that the holders of Solana are collectively experiencing internet unrealized losses.

This case is commonly thought of a bearish sign, because it means that buyers are sitting on losses, which can immediate some to promote in an try and keep away from additional declines. Because of this, the potential for panic promoting will increase when the worth trades beneath the realized worth.

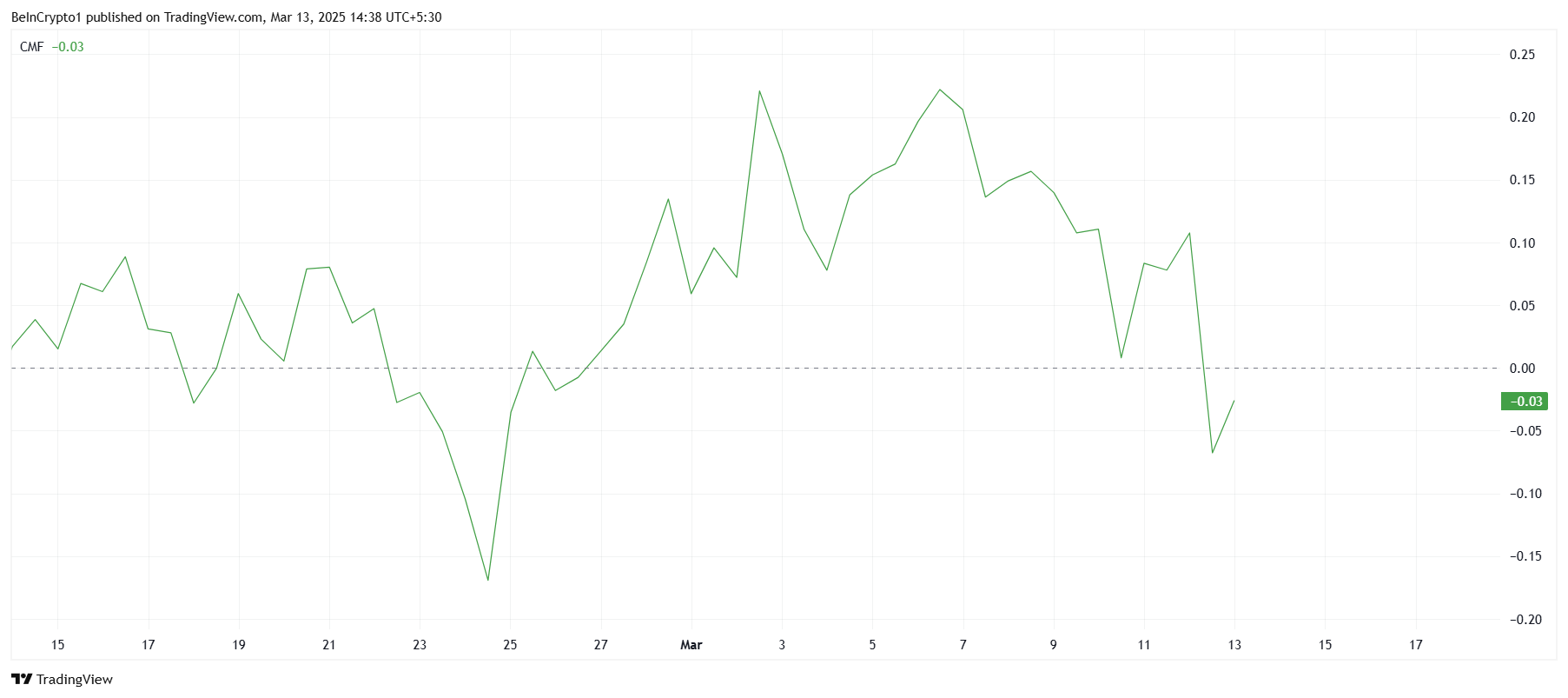

On a broader scale, Solana can also be experiencing weak macro momentum, highlighted by the technical indicators. The Chaikin Cash Move (CMF), which measures the volume-weighted circulation of cash into and out of an asset, has famous a pointy downtick. The CMF is presently beneath the zero line, indicating that outflows are dominating inflows.

Because the CMF stays detrimental, it means that Solana’s worth restoration could possibly be hindered. The dearth of shopping for curiosity and the dominance of promoting exercise are more likely to restrict any vital upward motion.

SOL Value Is Susceptible To A Decline

Solana’s worth has been down practically 30% during the last ten days, and it’s presently buying and selling at $125, slightly below the crucial $126 resistance stage. Regardless of lately bouncing off the assist at $118, the general sentiment and market circumstances counsel that restoration could also be short-lived. The worth stays underneath stress, with additional declines potential if key ranges fail to carry.

If Solana fails to safe $126 as assist, the altcoin might drop again to $118 and even decrease, probably reaching $109. This situation would reinforce the bearish outlook and delay the battle for restoration. With out a robust rally, Solana might face extra losses within the quick time period.

Nevertheless, if Solana manages to breach and flip $126 into assist, it might set off a bounce towards $133, adopted by potential resistance at $143. A profitable breach of $143 would invalidate the present bearish thesis and sign a extra robust restoration. If this happens, Solana might regain a few of the losses it has lately suffered, providing hope for buyers.

Disclaimer

Consistent with the Belief Challenge pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.